Prices dropping like flies!

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Dec 14 2018, 11:46 AM Dec 14 2018, 11:46 AM

Return to original view | Post

#1

|

All Stars

12,269 posts Joined: Oct 2010 |

Prices dropping like flies!

|

|

|

|

|

|

May 29 2019, 11:38 AM May 29 2019, 11:38 AM

Return to original view | Post

#2

|

All Stars

12,269 posts Joined: Oct 2010 |

QUOTE(AskarPerang @ May 26 2019, 10:09 PM) The Elements @ Jalan Ampang, KL address. 5km to KLCC. Launching price back in 2012, refer sales chart below:  Now you can get lelong unit at below 700k. Not 1 unit. But 3 units available. All around same pricing. S&P price from 1.2M++. Almost 50% off you can get today. KLCC facing unit (same floor unit) more expensive by 93k!!! Now ended up block without any view. » Click to show Spoiler - click again to hide... « » Click to show Spoiler - click again to hide... « |

|

|

Jun 21 2019, 03:44 PM Jun 21 2019, 03:44 PM

Return to original view | Post

#3

|

All Stars

12,269 posts Joined: Oct 2010 |

Looking like the rubber is hitting the road very soon!

|

|

|

Jul 5 2019, 11:07 AM Jul 5 2019, 11:07 AM

Return to original view | Post

#4

|

All Stars

12,269 posts Joined: Oct 2010 |

|

|

|

Jul 5 2019, 11:22 AM Jul 5 2019, 11:22 AM

Return to original view | Post

#5

|

All Stars

12,269 posts Joined: Oct 2010 |

|

|

|

Jun 21 2020, 01:45 PM Jun 21 2020, 01:45 PM

Return to original view | IPv6 | Post

#6

|

All Stars

12,269 posts Joined: Oct 2010 |

|

|

|

|

|

|

Feb 22 2021, 09:05 AM Feb 22 2021, 09:05 AM

Return to original view | IPv6 | Post

#7

|

All Stars

12,269 posts Joined: Oct 2010 |

|

|

|

Feb 22 2021, 12:15 PM Feb 22 2021, 12:15 PM

Return to original view | IPv6 | Post

#8

|

All Stars

12,269 posts Joined: Oct 2010 |

QUOTE(icemanfx @ Feb 22 2021, 11:03 AM) Yes, according to a investment bank wealth reports. Think it may be due to the middle income trap which has happened 10 years? back.for reasons, household debts in this country is among the highest in the region. The middle income then has become the lower income now. Sad country. |

|

|

Mar 31 2021, 03:58 PM Mar 31 2021, 03:58 PM

Return to original view | IPv6 | Post

#9

|

All Stars

12,269 posts Joined: Oct 2010 |

So cheap now.

|

|

|

Jan 18 2022, 10:27 AM Jan 18 2022, 10:27 AM

Return to original view | IPv6 | Post

#10

|

All Stars

12,269 posts Joined: Oct 2010 |

|

|

|

Jan 18 2022, 11:26 AM Jan 18 2022, 11:26 AM

Return to original view | IPv6 | Post

#11

|

All Stars

12,269 posts Joined: Oct 2010 |

QUOTE(Cavatzu @ Jan 18 2022, 11:23 AM) I’m not saying all KLCC property are the same. There was a lot of leverage here to bargain since this property is facing the kampung baru mrt and u can complain about noise etc. Ultimately, the rent is just used to pay for management fees which for these types of units are like 50c psf or more. The KLCC property market collapse with oil in 2016. Many expats had to leave and vacate the properties there when the jobs evaporated with the oil market. It is probably picking up again with the rising oil and gas prices.After 2 years of vacancy, most owners will just hire the bullet and take what they can get. It’s truly a buyer’s/tenant’s market. |

|

|

Jun 13 2022, 04:17 PM Jun 13 2022, 04:17 PM

Return to original view | IPv6 | Post

#12

|

All Stars

12,269 posts Joined: Oct 2010 |

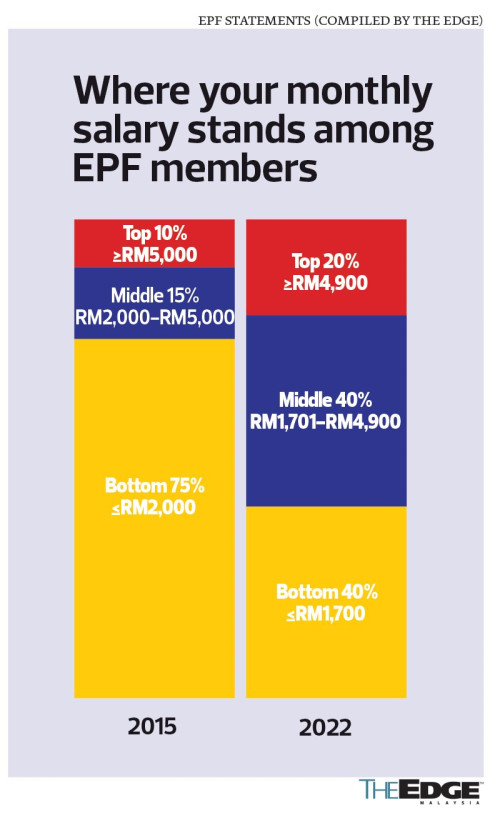

QUOTE(icemanfx @ Jun 13 2022, 04:16 PM)  https://www.theedgemarkets.com/article/stat...pfs-t20-members malehsians are poorer than most expected. Rm must be very valuable! |

|

|

Jul 18 2024, 09:21 AM Jul 18 2024, 09:21 AM

Return to original view | Post

#13

|

All Stars

12,269 posts Joined: Oct 2010 |

It seems Lots of condo going down in prices. cawan liked this post

|

|

|

|

|

|

Jul 1 2025, 05:29 AM Jul 1 2025, 05:29 AM

Return to original view | IPv6 | Post

#14

|

All Stars

12,269 posts Joined: Oct 2010 |

Condo is a lousy investment in bolihland.

|

|

|

Jul 1 2025, 07:07 AM Jul 1 2025, 07:07 AM

Return to original view | Post

#15

|

All Stars

12,269 posts Joined: Oct 2010 |

QUOTE(LDP @ Jul 1 2025, 07:05 AM) I do agree with that, but ppl keep on telling me, they are flipping it like hamburger, each time flip, 200K - 300K in pocket....must be nonsense Maybe 10 years ago at the start of the bubble, you can flip to FOMOs.Nowadays a low/med cost housing flat may bring better returns than condos IMO. |

|

|

Jul 28 2025, 09:26 AM Jul 28 2025, 09:26 AM

Return to original view | Post

#16

|

All Stars

12,269 posts Joined: Oct 2010 |

QUOTE(Phoenix_KL @ Jul 27 2025, 11:01 AM) A sharp drop that tells it all To illustrate the gravity of this issue, consider a mixed development in Kota Damansara. Launched in 2016 with an average pricing of RM750 per sq ft (psf), units in this development are now reselling for as low as RM268 psf since their handover in 2020. This represents a staggering plunge of up to 64% in value in one of the Klang Valley’s more prominent and desirable addresses. How does such a dramatic devaluation occur? The answer lies behind the scenes, obscured by a web of undisclosed rebates, inflated loan approvals and pricing tactics designed to mask the real transaction value. Alarmingly, this is not an isolated incident. This deceptive pattern is increasingly spreading across the broader Malaysian property market, turning a blind eye to genuine market fundamentals. What initially began as seemingly well-intentioned tools to enhance affordability such as rebates, cashbacks and zero-entry packages have gradually mutated into a pervasive mechanism that profoundly distorts the market. The playbook for this distortion is alarmingly simple yet highly effective: https://www.starproperty.my/news/malaysia-s...-up-call/132580 |

|

|

Jul 28 2025, 10:57 AM Jul 28 2025, 10:57 AM

Return to original view | Post

#17

|

All Stars

12,269 posts Joined: Oct 2010 |

|

| Change to: |  0.1391sec 0.1391sec

0.74 0.74

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 10:07 PM |