what about Pucheong?

Landed properties prices only goes up

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Aug 15 2023, 05:37 PM Aug 15 2023, 05:37 PM

Show posts by this member only | IPv6 | Post

#4181

|

Senior Member

1,053 posts Joined: Mar 2006 From: Stop monitoring =) |

what about Pucheong?

Landed properties prices only goes up |

|

|

|

|

|

Aug 15 2023, 11:55 PM Aug 15 2023, 11:55 PM

Show posts by this member only | IPv6 | Post

#4182

|

Junior Member

192 posts Joined: Feb 2022 |

|

|

|

Aug 29 2023, 07:40 AM Aug 29 2023, 07:40 AM

Show posts by this member only | IPv6 | Post

#4183

|

Senior Member

2,365 posts Joined: Aug 2008 |

Found someone who is same gang as TS, non stop claim bubble and been renting for over 15 years in Singapore

This post has been edited by A.B.D.: Aug 29 2023, 07:42 AM |

|

|

Aug 29 2023, 08:15 AM Aug 29 2023, 08:15 AM

Show posts by this member only | IPv6 | Post

#4184

|

Junior Member

717 posts Joined: Nov 2012 |

|

|

|

Aug 29 2023, 01:43 PM Aug 29 2023, 01:43 PM

Show posts by this member only | IPv6 | Post

#4185

|

Junior Member

88 posts Joined: Dec 2021 |

|

|

|

Aug 31 2023, 06:56 PM Aug 31 2023, 06:56 PM

Show posts by this member only | IPv6 | Post

#4186

|

Junior Member

763 posts Joined: Jan 2003 |

Up for updates and comments.

|

|

|

|

|

|

Sep 1 2023, 10:13 AM Sep 1 2023, 10:13 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Sep 15 2023, 11:02 AM Sep 15 2023, 11:02 AM

Show posts by this member only | IPv6 | Post

#4188

|

All Stars

21,457 posts Joined: Jul 2012 |

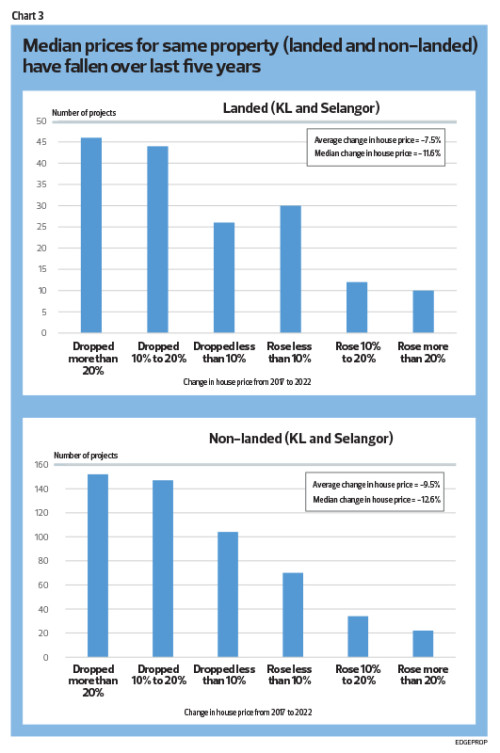

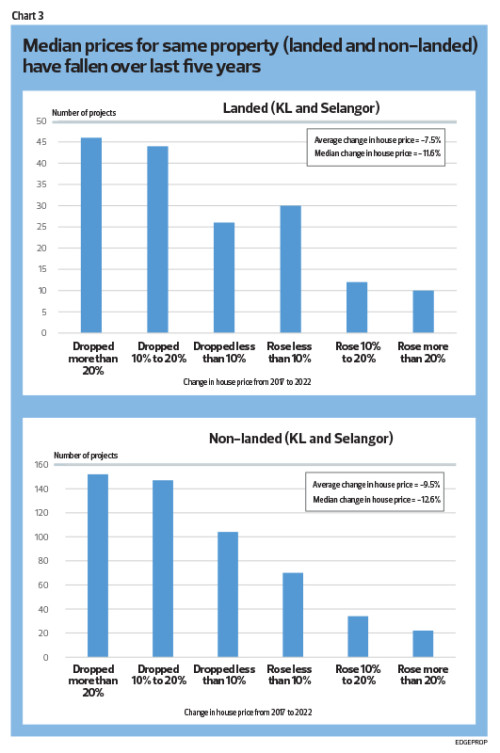

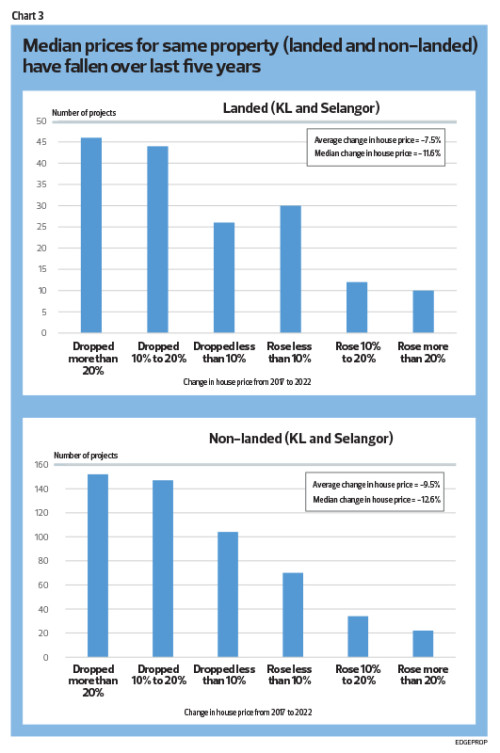

https://www.edgeprop.my/content/1906097/mal...less-affordable in the last 5 years, most poorperly are under water. |

|

|

Sep 15 2023, 11:05 AM Sep 15 2023, 11:05 AM

|

Junior Member

200 posts Joined: Oct 2009 From: Kuala Lumpur, Selangor |

Don't care if location like Rawang or Semenyih have big bubble burst, Prime area like PJ and SJ still expensive af

|

|

|

Sep 15 2023, 12:11 PM Sep 15 2023, 12:11 PM

Show posts by this member only | IPv6 | Post

#4190

|

Junior Member

436 posts Joined: Dec 2021 |

QUOTE(icemanfx @ Sep 15 2023, 11:02 AM)  https://www.edgeprop.my/content/1906097/mal...less-affordable in the last 5 years, most poorperly are under water. |

|

|

Sep 18 2023, 07:15 AM Sep 18 2023, 07:15 AM

Show posts by this member only | IPv6 | Post

#4191

|

Senior Member

1,057 posts Joined: Jan 2003 |

QUOTE(icemanfx @ Sep 15 2023, 11:02 AM)  https://www.edgeprop.my/content/1906097/mal...less-affordable in the last 5 years, most poorperly are under water. QUOTE(Sihambodoh @ Sep 15 2023, 12:11 PM) I believe that’s a good chance this will happen(or has already began), I believe the boom of local market was mostly due to spill over effect from China’s real estate boom… Sihambodoh liked this post

|

|

|

Sep 24 2023, 03:55 PM Sep 24 2023, 03:55 PM

Show posts by this member only | IPv6 | Post

#4192

|

Junior Member

763 posts Joined: Jan 2003 |

Diu Nia seng, waiting until neck also long for prices to crash.

Really wtf some ppl can wait 10 years. Like tat sure rich man so much discipline. |

|

|

Sep 24 2023, 04:10 PM Sep 24 2023, 04:10 PM

|

Senior Member

2,193 posts Joined: Feb 2012 |

Auction market seems quite hot and prices quite low.

|

|

|

|

|

|

Sep 25 2023, 10:45 AM Sep 25 2023, 10:45 AM

|

Junior Member

192 posts Joined: Feb 2022 |

Looking and BNM policy, most likely they will make MYR like LIRA to inflate everything. Include property price Condo price going down? not likely, price stagnant? Yes Landed? Definitely a min 20% increase in 5 years time NightFelix and Momo33 liked this post

|

|

|

Sep 26 2023, 02:58 PM Sep 26 2023, 02:58 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(30624770 @ Sep 26 2023, 11:40 AM) Here is a list of condominiums and serviced apartments in Malaysia that have benefited from high property value growth in the past 10 years. 4.5% pa compounded for 10 years is about 55%.Properties with highest Capital Appreciation in Kuala Lumpur 1. Jamnah View Condominium, Bukit Damansara Capital Appreciation: 94.4% Median PSF in 2012: RM738 Median PSF in 2022: RM1,435 2. Antah Tower, Jalan Kuching Capital Appreciation: 87.3% Median PSF in 2012: RM252 Median PSF in 2022: RM472 3. Le Chateau 2, Seputeh Capital Appreciation: 80.2% Median PSF in 2012: RM192 Median PSF in 2022: RM346 4. Villa OUG Condominium, Taman Yarl, Jalan Klang Lama Capital Appreciation: 69.3% Median PSF in 2012: RM264 Median PSF in 2022: RM447 5. Bukit Winner (Winner Heights), Taman Desa Petaling Capital Appreciation: 58.3% Median PSF in 2012: RM180 Median PSF in 2022: RM285 Properties with highest Capital Growth in Selangor 1. Villaria, Bukit Antarabangsa, Ampang Capital Appreciation: 112.60% Median PSF in 2012: RM127 Median PSF in 2022: RM270 2. Regency Condominium, Klang Capital Appreciation: 99.30% Median PSF in 2012: RM136 Median PSF in 2022: RM271 3. Casa Mila Tower, Selayang Capital Appreciation: 79.60% Median PSF in 2012: RM186 Median PSF in 2022: RM334 4. Menara Indah, Ampang Capital Appreciation: 67.10% Median PSF in 2012: RM216 Median PSF in 2022: RM361 5. Sri Permata , Shah Alam Capital Appreciation: 61.30% Median PSF in 2012: RM204 Median PSF in 2022: RM329 Properties with highest Capital Growth in Penang 1. Arena Residence @ The Arena , Bayan Baru Capital Appreciation: 61.80% Median PSF in 2012: RM327 Median PSF in 2022: RM529 2. Desa Golf, Bukit Jambul Capital Appreciation: 50.1% Median PSF in 2012: RM349 Median PSF in 2022: RM524 3. Seaview Garden, Mount Pleasure, Batu Ferringhi Capital Appreciation: 49.4% Median PSF in 2012: RM255 Median PSF in 2022: RM381 4. SkyHome, Tanjong Tokong Capital Appreciation: 49.4% Median PSF in 2012: RM397 Median PSF in 2022: RM593 5. Central Park, Green Lane, Bukit Lanchang Capital Appreciation: 48.6% Median PSF in 2012: RM331 Median PSF in 2022: RM492 Properties with highest Capital Growth in Johor 1. Octville Condominium, Masai Capital Appreciation: 335.7% Median PSF in 2012: RM56 Median PSF in 2022: RM244 2. Jentayu Residensi, Tampoi, Johor Bahru Capital Appreciation: 39.8.% Median PSF in 2012: RM274 Median PSF in 2022: RM383 3. Pelita Indah Condominium, Johor Bahru Capital Appreciation: 39.6.% Median PSF in 2012: RM144 Median PSF in 2022: RM201 4. Akademik Suite , Tebrau Capital Appreciation: 32.7.% Median PSF in 2012: RM254 Median PSF in 2022: RM337 5. Datin Halimah Condominium, Tampoi Capital Appreciation: 25.5.% Median PSF in 2012: RM220 Median PSF in 2022: RM276. https://www.iproperty.com.my/property-insig...Ugoxu-ms6qJl58_ This post has been edited by icemanfx: Sep 26 2023, 03:06 PM |

|

|

Sep 29 2023, 12:16 AM Sep 29 2023, 12:16 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(kidmad @ Sep 28 2023, 07:24 PM) Underwater i also get to sell la.. koi Kinrara bought in 2014 430k when I kahwin.. 2018 sold without lost 465k. QUOTE(mini orchard @ Sep 28 2023, 08:29 PM) QUOTE(kidmad @ Sep 28 2023, 09:51 PM) |

|

|

Oct 3 2023, 08:34 PM Oct 3 2023, 08:34 PM

|

Junior Member

111 posts Joined: May 2011 |

|

|

|

Oct 4 2023, 12:44 AM Oct 4 2023, 12:44 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(Sihambodoh @ Oct 3 2023, 10:12 AM) I have more friends having negative equity on their property than positive. Like you, they too thought that property price can only go up. QUOTE(Donchay @ Oct 3 2023, 11:51 PM) |

|

|

Oct 10 2023, 12:29 PM Oct 10 2023, 12:29 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Oct 11 2023, 04:55 AM Oct 11 2023, 04:55 AM

|

Junior Member

916 posts Joined: Sep 2016 |

|

| Change to: |  0.0425sec 0.0425sec

0.70 0.70

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 11:40 PM |