KL Freehold.

1010sqft.

Reserve price at 307,800 only.

More than 50% off the S&P price of 646,200

Refer: https://www.summerfield.com.my/wp-content/u...-05-05-2017.pdf

Multiple Signs of Malaysia Property Bubble V20

|

|

Jun 21 2023, 12:45 AM Jun 21 2023, 12:45 AM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

Another mouth watering lelong unit from here.

KL Freehold. 1010sqft. Reserve price at 307,800 only. More than 50% off the S&P price of 646,200 Refer: https://www.summerfield.com.my/wp-content/u...-05-05-2017.pdf  |

|

|

|

|

|

Jun 21 2023, 01:32 AM Jun 21 2023, 01:32 AM

Show posts by this member only | IPv6 | Post

#4162

|

Junior Member

242 posts Joined: Feb 2019 |

QUOTE(tlc7 @ May 16 2023, 12:04 AM) Interesting thread... What bubble? Yup I don't think a property bubble will happen especially in prime areas ie KL and Klang Valley with the Freehold Title I see people buying the fxxxwoodz at RM 900+ psf 🤣 Is like pricing for year 2050 Eventually all prices will increase with less land, higher water level, but the question how much farther future pricing are you willing to pay right now. The year 2050? 2100? Plus many foreigners invest in Malaysia to stay for retirement years |

|

|

Jun 21 2023, 01:52 AM Jun 21 2023, 01:52 AM

Show posts by this member only | IPv6 | Post

#4163

|

Junior Member

30 posts Joined: Feb 2023 |

QUOTE(AskarPerang @ Jun 21 2023, 12:45 AM) Another mouth watering lelong unit from here. the commercial below aren’t really doing good only shop facing Jln Kuching are doing so so, while inside mostly empty, meanwhile for the residential , expensive maintenance fee and everything not so well maintain sigH…..KL Freehold. 1010sqft. Reserve price at 307,800 only. More than 50% off the S&P price of 646,200 Refer: https://www.summerfield.com.my/wp-content/u...-05-05-2017.pdf  it was good in the beginning then start to go bad |

|

|

Jul 11 2023, 07:51 AM Jul 11 2023, 07:51 AM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

QUOTE(AskarPerang @ Jun 21 2023, 12:45 AM) Another mouth watering lelong unit from here. Unit sold at reserve price 307,800. KL Freehold. 1010sqft. Reserve price at 307,800 only. More than 50% off the S&P price of 646,200 Refer: https://www.summerfield.com.my/wp-content/u...-05-05-2017.pdf  Single bidder won unchallenged. What a great catch. Not sure why no other buyer interested at this pricing.  |

|

|

Jul 11 2023, 08:20 AM Jul 11 2023, 08:20 AM

|

Junior Member

436 posts Joined: Dec 2021 |

|

|

|

Jul 11 2023, 12:50 PM Jul 11 2023, 12:50 PM

Show posts by this member only | IPv6 | Post

#4166

|

Junior Member

664 posts Joined: Jun 2017 |

Property auction market sees 20% rise in listings after OPR hikes

https://www.freemalaysiatoday.com/category/...fter-opr-hikes/ |

|

|

|

|

|

Jul 22 2023, 12:04 AM Jul 22 2023, 12:04 AM

Show posts by this member only | IPv6 | Post

#4167

|

All Stars

21,457 posts Joined: Jul 2012 |

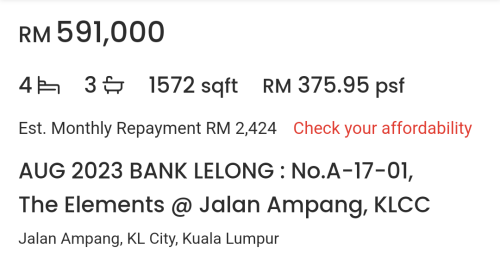

QUOTE(Mr Gray @ Jul 21 2023, 11:41 PM) Another lelong unit, several rounds already. A-17-01 1572sqft (biggest unit in elements) now RM591k. I'm guessing it will go down even further. Such a far cry from 1 million ringgit price tag when it was launched. https://www.propertyguru.com.my/property-li...ie-low-38317731  QUOTE(taurean @ Jul 21 2023, 11:48 PM) A lot of housing price is dropping now. and population in Malaysia is not increasing as much as last time. Aging population is increasing also. I wonder if residential property's price will go up in long term as the supply will surpass demand in long term. Malaysia population growth rate could be referred from link below. https://www.dosm.gov.my/portal-main/release...s-malaysia-2022 Sihambodoh liked this post

|

|

|

Jul 22 2023, 12:46 AM Jul 22 2023, 12:46 AM

|

Senior Member

926 posts Joined: Aug 2013 |

QUOTE(icemanfx @ Jul 22 2023, 12:04 AM) Can't imagine the pain for the house owner. Less than 10 years, price already dropped 30-40% like that High rise in Klang valley is just a money pit. oversupply everywhere This post has been edited by Mr Gray: Jul 22 2023, 12:47 AM ceo684 liked this post

|

|

|

Jul 22 2023, 08:20 PM Jul 22 2023, 08:20 PM

Show posts by this member only | IPv6 | Post

#4169

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Jul 25 2023, 06:47 PM Jul 25 2023, 06:47 PM

Show posts by this member only | IPv6 | Post

#4170

|

Senior Member

1,057 posts Joined: Jan 2003 |

QUOTE(AskarPerang @ Jul 11 2023, 07:51 AM) Unit sold at reserve price 307,800. Single bidder won unchallenged. What a great catch. Not sure why no other buyer interested at this pricing.  QUOTE(Sihambodoh @ Jul 11 2023, 08:20 AM) Maybe because laca?Btw the link to the auction website, can share? Appreciated.. |

|

|

Jul 26 2023, 10:48 AM Jul 26 2023, 10:48 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(nihility @ Jul 26 2023, 09:49 AM) The last property boom post 2010~2012, a lot of business entities joined the band wagon & become superstar developers overnight. All these "part time" developers need to exit the market. That is the sign market is looking for. When that sign appear, you know the property sector almost bottoming. Most foreign poorperly investors are underwater.Another one will be macro policy making. Unless the government release the tap to allow foreign to buy / own < 1mil property , Malaysia will not see the property sector boom. The 1st time house buyer got so many choices, the market have filtered out that targeted group with WIP / Selangorku. When they can buy WIP/ Selangorku, who else wanna buy the unit you bought? QUOTE(gu~wak_zhai @ Jul 26 2023, 10:15 AM) |

|

|

Jul 26 2023, 10:52 AM Jul 26 2023, 10:52 AM

|

Junior Member

149 posts Joined: Dec 2022 |

QUOTE(Azury36 @ Jun 21 2023, 01:32 AM) Yup I don't think a property bubble will happen especially in prime areas ie KL and Klang Valley with the Freehold Title u must listen to /Kxpert la, is V20 d and still going strong.Plus many foreigners invest in Malaysia to stay for retirement years kidmad liked this post

|

|

|

Jul 26 2023, 10:57 AM Jul 26 2023, 10:57 AM

|

Senior Member

1,037 posts Joined: Jul 2009 |

i bought an apartment in puchong at 100k during V1, market value is 350k now V20. QUOTE(Gen000 @ Jul 26 2023, 10:52 AM) kidmad liked this post

|

|

|

|

|

|

Jul 26 2023, 10:58 AM Jul 26 2023, 10:58 AM

|

Junior Member

149 posts Joined: Dec 2022 |

QUOTE(mroys@lyn @ Jul 26 2023, 10:57 AM) that why must trust /Kxpert .... without them, what to laugh about? |

|

|

Jul 26 2023, 11:00 AM Jul 26 2023, 11:00 AM

|

Senior Member

1,596 posts Joined: Sep 2021 |

|

|

|

Jul 26 2023, 03:56 PM Jul 26 2023, 03:56 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(nihility @ Jul 26 2023, 11:00 AM) Still possible if policy maker decided to open up the tap. Our properties still the cheapest within the S.E.A region. Until that happen, I don't see any turning around soon. Investors buy for potential profit not because price is the cheapest. As most PRC and sg poorperly investors are underwater, doubt many of their friends and relatives will buy.KV poorperly is not the only investment opportunity available. There are many more liquid assets outside. |

|

|

Jul 26 2023, 04:20 PM Jul 26 2023, 04:20 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

Jul 27 2023, 01:53 PM Jul 27 2023, 01:53 PM

|

Junior Member

916 posts Joined: Sep 2016 |

|

|

|

Jul 28 2023, 08:40 AM Jul 28 2023, 08:40 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(AskarPerang @ Jul 28 2023, 08:04 AM) Another lelong unit sold yesterday. Size 1001 sqft, sold at reserve price 495K. Single bidder won unchallenged. Seems like a very good catch as smaller size unit sold at above 500K++ before this. Wow.  Lelong record at The Pano: 1. A-18-07, 829sqft, sold at 534K. 2. A-09-07, 829sqft, sold at 530K. 3. A-16-01, 807sqft, sold at 510K. 4. B-07-09, 829sqft, unit call off, owner managed to save the unit. 5. B-11-09, 807sqft, sold at 524K. 6. A-10-06, 692sqft, sold at 384K. 7. B-10-06, 979sqft, reserve price 518,400, unknown sold price. 8. B-06-03, 1001sqft, sold at 495K. Still active unit: 1. A-18-02, 688sqft, reserve price 364,500. Auction later today. 2. A-17-01, 807sqft, no bidder at 516K. 3. B-18-10, 807sqft, reserve price 585K. 4. A-13A-3A, 1001sqft, reserve price 870K. 5. B-25-09, 1388sqft, reserve price 1.04M. |

|

|

Aug 15 2023, 05:15 PM Aug 15 2023, 05:15 PM

|

Junior Member

192 posts Joined: Feb 2022 |

Anyone realized landed house in Klang valley continue to climb? from 1H2022 to 1H2023

700k become 850k 900k become 1.2M |

| Change to: |  0.0354sec 0.0354sec

1.19 1.19

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 04:29 AM |