similar to japan, very low inflation or deflation.

people not breeding due to the high cost of living. furthermore, living with parents

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Apr 27 2017, 03:55 PM Apr 27 2017, 03:55 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

similar to japan, very low inflation or deflation.

people not breeding due to the high cost of living. furthermore, living with parents |

|

|

|

|

|

Apr 30 2017, 03:08 AM Apr 30 2017, 03:08 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

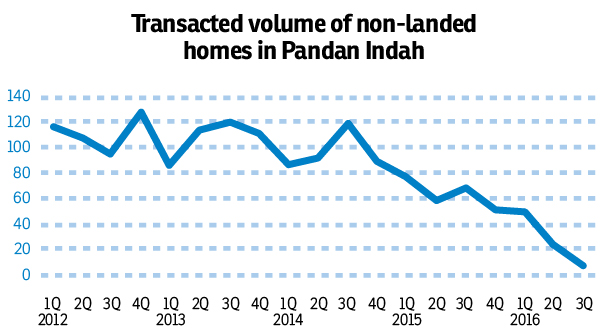

Compared with the main sub-sectors, the residential sub-sector registered a drop of 13.9% and 10.7% in transaction volume and value last year compared with the previous year, respectively.

http://www.theedgeproperty.com.my/content/...rms-market-2016 This was in tandem with the overall market performance for 2016 as property transactions nationwide declined for the second consecutive year with 320,425 transactions worth RM145.51 billion, indicating a 11.5% decrease in volume and 3% dip in total value of transactions from the year before. http://www.theedgeproperty.com.my/content/...ming-areas-2016 Unless market sentiment change, down trend is expected to continue. |

|

|

May 2 2017, 10:58 AM May 2 2017, 10:58 AM

|

Junior Member

352 posts Joined: Mar 2009 |

Wow! So now both value and number of transaction is going down? UUU nightmare??

QUOTE(icemanfx @ Apr 30 2017, 03:08 AM) Compared with the main sub-sectors, the residential sub-sector registered a drop of 13.9% and 10.7% in transaction volume and value last year compared with the previous year, respectively. http://www.theedgeproperty.com.my/content/...rms-market-2016 This was in tandem with the overall market performance for 2016 as property transactions nationwide declined for the second consecutive year with 320,425 transactions worth RM145.51 billion, indicating a 11.5% decrease in volume and 3% dip in total value of transactions from the year before. http://www.theedgeproperty.com.my/content/...ming-areas-2016 Unless market sentiment change, down trend is expected to continue. |

|

|

May 2 2017, 05:18 PM May 2 2017, 05:18 PM

|

Senior Member

600 posts Joined: Jun 2014 |

bearbearwong how r u ?

|

|

|

May 3 2017, 11:21 AM May 3 2017, 11:21 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

KUALA LUMPUR: A property expert has rejected the view that property prices in Malaysia have bottomed out.

Speaking to FMT, chartered surveyor Ernest Chong said he foresaw prices dropping for another two to three years. He was responding to comments made recently by Sarkunan Subramaniam, the managing director of property consultancy firm Knight Frank. Subramaniam said in a press interview that the property market had now “seriously bottomed out” and that the market was expected to recover by the end of the year. But Cheong said property prices could drop more deeply than they did during the 1997/1998 Asian Financial Crisis. “The cost of living then was still manageable,” he said. “People weren’t struggling as much as they’re doing now and could even afford to save money. It was the banks that were struggling. He noted that during that financial crisis, residential property values dropped by 36% while commercial property values dropped by 43.9%. He acknowledged that this was more than the 25% to 30% drop in prices of some properties in today’s market. However, he added: “I believe the percentage prices of properties will drop to levels which are even lower than during the Asian Financial Crisis due to the reduction in consumers’ purchasing power, stagnant salaries, the current economic climate, the goods and services tax and, of course, the oversupply of properties.” He said he couldn’t say for sure when prices would finally bottom out, but expected them to go lower than the 1997/1998 levels by the middle of 2018. He said speculators who bought properties between 2010 to 2014 were likely to be the hardest hit. “So if you are looking for a home, I would say wait till next year. But be sure to evaluate your financial capabilities. If you can afford a loan, then it might be a good time to buy a home. “But if you’re in no hurry, it would be better to wait till 2019 or 2020. By then, if prices haven’t bottomed out, they would have reached very low levels.” http://www.freemalaysiatoday.com/category/...ch-rock-bottom/ bbb, uuu! |

|

|

May 3 2017, 11:33 AM May 3 2017, 11:33 AM

Show posts by this member only | IPv6 | Post

#366

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

State (developed state or not)

Location Property class (luxury or peasant property) Forecasting property price drop as a whole without really specifying the above 3 important criteria is laughable. Whilst demands for luxury property has shown huge drop, demand for peasant property around RM300k-400k is in hot demand, price drop? Keep dreaming. |

|

|

|

|

|

May 3 2017, 11:37 AM May 3 2017, 11:37 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(iGamer @ May 3 2017, 11:33 AM) State (developed state or not) When luxury property price dropped near peasants property price, peasants property price will be dropped but at lower rate/amount.Location Property class (luxury or peasant property) Forecasting property price drop as a whole without really specifying the above 3 important criteria is laughable. Whilst demands for luxury property has shown huge drop, demand for peasant property around RM300k-400k is in hot demand, price drop? Keep dreaming. |

|

|

May 3 2017, 11:39 AM May 3 2017, 11:39 AM

Show posts by this member only | IPv6 | Post

#368

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

|

|

|

May 3 2017, 11:53 AM May 3 2017, 11:53 AM

|

All Stars

21,457 posts Joined: Jul 2012 |

|

|

|

May 3 2017, 11:59 AM May 3 2017, 11:59 AM

Show posts by this member only | IPv6 | Post

#370

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(icemanfx @ May 3 2017, 11:53 AM) Yes difficult to truly classify. That's why I wrote "truly luxury" properties in my previous comment, many fake small size properties disguised as luxury product to sell at higher price.... The location would be another important price factor for such borderline properties. |

|

|

May 4 2017, 12:19 AM May 4 2017, 12:19 AM

|

Junior Member

352 posts Joined: Mar 2009 |

Wow! 259k for an auction property sold from around 224k before construction!

http://auctions.com.my/pah/list-details-cu...25288&Key=94008 This post has been edited by axisresidence17: May 4 2017, 12:22 AM |

|

|

May 4 2017, 01:09 PM May 4 2017, 01:09 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(wild_card_my @ May 2 2017, 04:13 AM) Im not into props, but I have a client who bought Cyberia Town Apartment, 2k sqft for RM350k Is that the right price? The owner was desperate, but I think he scored a deal. As usual, I don't really keep up with property news because there are so many that I process to care. But this one though... RM180/sqft. Built by MK Land (blacklisted by some banks), title is just about to be transferred. He got special exception though, he got to transfer the title directly to him. QUOTE(wild_card_my @ May 4 2017, 12:20 PM) |

|

|

May 4 2017, 01:13 PM May 4 2017, 01:13 PM

|

Senior Member

600 posts Joined: Jun 2014 |

QUOTE(axisresidence17 @ May 4 2017, 12:19 AM) Wow! 259k for an auction property sold from around 224k before construction! Dude that is reserve price ...not incur maintenance fees , assessment which buyer usually need to pay for lelong property ..http://auctions.com.my/pah/list-details-cu...25288&Key=94008 |

|

|

|

|

|

May 4 2017, 02:44 PM May 4 2017, 02:44 PM

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

QUOTE(Jliew168 @ May 4 2017, 01:13 PM) Dude that is reserve price ...not incur maintenance fees , assessment which buyer usually need to pay for lelong property .. you see the reserve value is not to the nearest thousand. This is not first time went to the auction hall.the previous reserve price should be 288k. If anyone went during the previous auction, confirm will be the winner at 288k. I donno if 288k is good value or not. |

|

|

May 4 2017, 02:52 PM May 4 2017, 02:52 PM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

May 5 2017, 08:53 AM May 5 2017, 08:53 AM

|

Junior Member

352 posts Joined: Mar 2009 |

QUOTE(kurtkob78 @ May 4 2017, 02:44 PM) you see the reserve value is not to the nearest thousand. This is not first time went to the auction hall. 259k is quite near to the ori dev price thoughthe previous reserve price should be 288k. If anyone went during the previous auction, confirm will be the winner at 288k. I donno if 288k is good value or not. |

|

|

May 7 2017, 11:16 PM May 7 2017, 11:16 PM

|

All Stars

21,457 posts Joined: Jul 2012 |

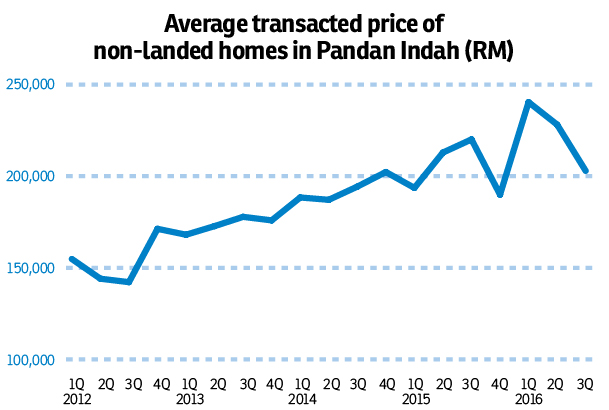

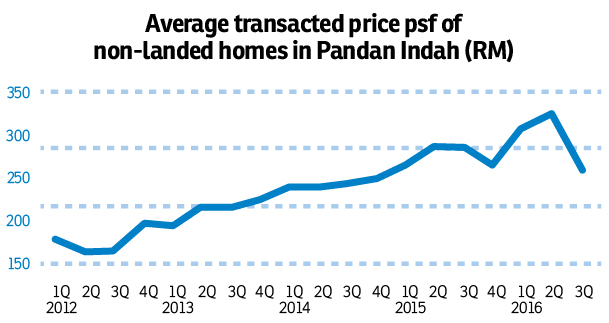

http://www.theedgeproperty.com.my/content/...e-earners-dwell QUOTE(iGamer @ May 3 2017, 11:33 AM) State (developed state or not) igamer Your dream may have been fulfilled.Location Property class (luxury or peasant property) Forecasting property price drop as a whole without really specifying the above 3 important criteria is laughable. Whilst demands for luxury property has shown huge drop, demand for peasant property around RM300k-400k is in hot demand, price drop? Keep dreaming. Unless pandan indah is exception, believe property in other areas in kv are having similar fate. This post has been edited by icemanfx: May 7 2017, 11:40 PM |

|

|

May 8 2017, 10:44 AM May 8 2017, 10:44 AM

|

Senior Member

6,562 posts Joined: Jan 2003 From: Kuala Lumpur |

As a broker who handles multiple cases each day for the past 7 years (I was a banker too)... house price have definitely droppped in many areas.. it used to be that getting the MV to match the selling price was almost impossible unless I beg beg beg hahaha...

now the MV is actually HIGHER than the selling price. GOod luck guys, you keep on buying and selling ya. hehe |

|

|

May 8 2017, 10:53 AM May 8 2017, 10:53 AM

|

Senior Member

700 posts Joined: Nov 2009 |

QUOTE(iGamer @ May 3 2017, 11:39 AM) Peasant property are mostly small size, no way any true luxury property would go down to peasant price range given the larger size. It will still drop due to domino effect. First, luxury prop drop then the price will be similar to some of those more expensive mid end properties, then this will cause mid end properties prices to drop and then it will trickle down to those peasant properties. Of course, peasant properties will be the last to drop. QUOTE(Jliew168 @ May 4 2017, 01:13 PM) Dude that is reserve price ...not incur maintenance fees , assessment which buyer usually need to pay for lelong property .. Check d terms and conditions, some lelong units the previous outstanding maintenance fee will be absorbed by the bank. |

|

|

May 8 2017, 11:18 AM May 8 2017, 11:18 AM

|

Junior Member

288 posts Joined: Jan 2013 |

QUOTE(wild_card_my @ May 8 2017, 10:44 AM) As a broker who handles multiple cases each day for the past 7 years (I was a banker too)... house price have definitely droppped in many areas.. it used to be that getting the MV to match the selling price was almost impossible unless I beg beg beg hahaha... Do you mean during hot time, you were begging the banks to give the required MV to match the selling price?now the MV is actually HIGHER than the selling price. GOod luck guys, you keep on buying and selling ya. hehe |

| Change to: |  0.0343sec 0.0343sec

0.54 0.54

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 08:23 AM |