Outline ·

[ Standard ] ·

Linear+

Multiple Signs of Malaysia Property Bubble V20

|

iGamer

|

May 3 2017, 11:33 AM May 3 2017, 11:33 AM

|

|

State (developed state or not)

Location

Property class (luxury or peasant property)

Forecasting property price drop as a whole without really specifying the above 3 important criteria is laughable.

Whilst demands for luxury property has shown huge drop, demand for peasant property around RM300k-400k is in hot demand, price drop? Keep dreaming.

|

|

|

|

|

|

iGamer

|

May 3 2017, 11:39 AM May 3 2017, 11:39 AM

|

|

QUOTE(icemanfx @ May 3 2017, 11:37 AM) When luxury property price dropped near peasants property price, peasants property price will be dropped but at lower rate/amount. Peasant property are mostly small size, no way any true luxury property would go down to peasant price range given the larger size. |

|

|

|

|

|

iGamer

|

May 3 2017, 11:59 AM May 3 2017, 11:59 AM

|

|

QUOTE(icemanfx @ May 3 2017, 11:53 AM) how do you classify soho, xoho, studio size? luxury or peasant? Yes difficult to truly classify. That's why I wrote "truly luxury" properties in my previous comment, many fake small size properties disguised as luxury product to sell at higher price....  The location would be another important price factor for such borderline properties. |

|

|

|

|

|

iGamer

|

Jul 4 2017, 10:50 AM Jul 4 2017, 10:50 AM

|

|

QUOTE(icemanfx @ Jul 4 2017, 10:41 AM) If unker need not make money, they would prefer to spend time at kopitium instead of working. Singapore home prices fell in the quarter ended June, extending the drop in property values to a record 15th quarter as most measures to cool the market remain in place despite a slight easing in March. https://www.bloomberg.com/news/articles/201...h-curbs-to-stayAs seen in singapore, property price drop won't have adverse effect on aggregate economy. Price drop =/= bubble burst Only huge free fall is bubble burst lah, minor price fall is merely market adjustment. |

|

|

|

|

|

iGamer

|

Jul 4 2017, 11:04 AM Jul 4 2017, 11:04 AM

|

|

QUOTE(icemanfx @ Jul 4 2017, 10:53 AM) Property is illiquid, unlike commodities or stocks, price takes years to bottom. Then it's just shrinking bubble, not bubble burst, shrinking bubble could be the result of central bank cooling off the market from developing into a potential bubble.......... The impact is very different, such gradual price drop does not adversely impact the economy too much. In case of true bubble burst, the whole market sentiment suddenly panic and price free fall, deeply impacting the overall economy and other business. |

|

|

|

|

|

iGamer

|

Jul 20 2017, 11:01 PM Jul 20 2017, 11:01 PM

|

|

QUOTE(aaron1717 @ Jul 20 2017, 09:27 AM) i understand your point bro... but this thread is talking mostly about investors point of view.... for own stayers... whatever happen to the property market now... your house wont get rampas away anyway.... it will only impact those who owned few properties for appreciation and rental... and yea.... developers still very bullish about cyberjaya.... its not bad for own stay.... for investment or rental play.... just too much.... and some ppl just like to use those old, nearer to Cyber city center properties to compare against the potential appreciation of the new ones....   I think not true, from what I know, when HK prop bubble burst, banks will demand loan taker to cover the the difference when house market value fall below the outstanding loan amount, if can't top up the difference, bank will rampas your prop.  This post has been edited by iGamer: Jul 20 2017, 11:02 PM This post has been edited by iGamer: Jul 20 2017, 11:02 PM |

|

|

|

|

|

iGamer

|

Jul 21 2017, 11:02 AM Jul 21 2017, 11:02 AM

|

|

QUOTE(icemanfx @ Jul 21 2017, 10:17 AM) When ifrs 9 kicked in on 1st january 2018, banks will unlikely to offer 90% margin of finance, play along with developer on cash back/rebate, interest rate is likely to rise and foreclosure process could be expedite. Financial reporting standards to affect banking operation? Shouldn't actual operation under Central Bank governance?  |

|

|

|

|

|

iGamer

|

Jun 5 2018, 04:27 PM Jun 5 2018, 04:27 PM

|

|

QUOTE(icemanfx @ Jun 5 2018, 04:14 PM) According to statistics from the Employee Provident Fund (EPF) shows that 92 percent of the people who contributed regularly to their EPF retirement fund are earning less than US$1,500 or RM6,000 a month. Those bought over priced property to flip are in for a long haul. So far merely tiny bubble burst only, no giant bubble burst yet.  HK after giant bubble burst also recover with even higher prices.  |

|

|

|

|

|

iGamer

|

Jun 5 2018, 04:42 PM Jun 5 2018, 04:42 PM

|

|

QUOTE(icemanfx @ Jun 5 2018, 04:39 PM) Property is illiquid, price takes years to bottom and currently is only the beginning. A few years ago, no uuu/bbb would expect this from developer. But if true bubble burst the price should fall sharply, like what happen in HK and US. |

|

|

|

|

|

iGamer

|

Jun 5 2018, 04:48 PM Jun 5 2018, 04:48 PM

|

|

QUOTE(icemanfx @ Jun 5 2018, 04:46 PM) Most bought property with loan, incurring bank interest daily. Price remain stagnant mean losing on bank interest incurred. Foreclosure in this country could take up to 2 years from npl, price drop is a lot slower than in the u.s. or h.k. HK scenario the banks already went after the borrower when the market value dip below the loan amount, even when the borrower manage to service their installments. |

|

|

|

|

|

iGamer

|

Jul 5 2019, 11:14 AM Jul 5 2019, 11:14 AM

|

|

Low rental yield, but I thought most ppl treat it as additional side income while waiting for the main capital appreciation of the prop over longer term.

|

|

|

|

|

|

iGamer

|

Aug 10 2021, 05:17 PM Aug 10 2021, 05:17 PM

|

|

QUOTE(swanlover @ Aug 10 2021, 05:10 PM) Tons of online gurus will advise you to buy prop as much as possible to hedge against shit...lolx If really buy ok what, but most ppl is borrow, prop belong to bank…  |

|

|

|

|

|

iGamer

|

Jan 15 2022, 06:50 PM Jan 15 2022, 06:50 PM

|

|

QUOTE(Kylow @ Jan 15 2022, 04:50 PM) I been seeing this thread pop up every now and then since I joined lowyat but still havent burst Hope no ktards wait for the burst to buy their first prop  |

|

|

|

|

|

iGamer

|

Jan 15 2022, 06:53 PM Jan 15 2022, 06:53 PM

|

|

QUOTE(icemanfx @ Jan 15 2022, 04:52 PM) Wait til extended loan moratorium end. EPF account 2 kan ada?  |

|

|

|

|

|

iGamer

|

Jun 13 2022, 04:30 PM Jun 13 2022, 04:30 PM

|

|

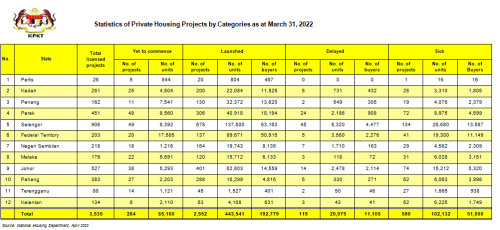

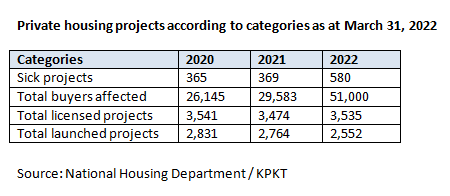

QUOTE(icemanfx @ Jun 13 2022, 04:20 PM)   With 580 sick projects against 2,552 launched projects, it also indicated that nearly 23% of house buyers’ fates were determined by those errant developers According to the government’s statistics, as of March 31, 2022, the number of “sick” private housing projects rose to 580, comprising 102,132 units, which affected a total of 51,000 house buyers compared to 365 sick projects comprising 48,826 units affecting a total of 26,145 buyers in March 31, 2020 (Table 1). This represents a 58.9% increase in the number of ailing projects and a 95% rise among affected buyers within the two years. A “sick housing project” is defined by the Housing and Local Government Ministry (KPKT)’s portal as one that has been delayed by more than 30% compared to its scheduled progress or one whose sale and purchase agreement (SPA) has lapsed. https://www.edgeprop.my/content/1902793/ris...ds-housing-woesSeem like many prop flippers...... |

|

|

|

|

|

iGamer

|

Mar 14 2024, 04:37 PM Mar 14 2024, 04:37 PM

|

|

Prop bubble bila pop?

|

|

|

|

|

May 3 2017, 11:33 AM

May 3 2017, 11:33 AM

Quote

Quote

0.1480sec

0.1480sec

0.67

0.67

7 queries

7 queries

GZIP Disabled

GZIP Disabled