Outline ·

[ Standard ] ·

Linear+

Multiple Signs of Malaysia Property Bubble V20

|

AskarPerang

|

Nov 23 2018, 12:32 AM Nov 23 2018, 12:32 AM

|

|

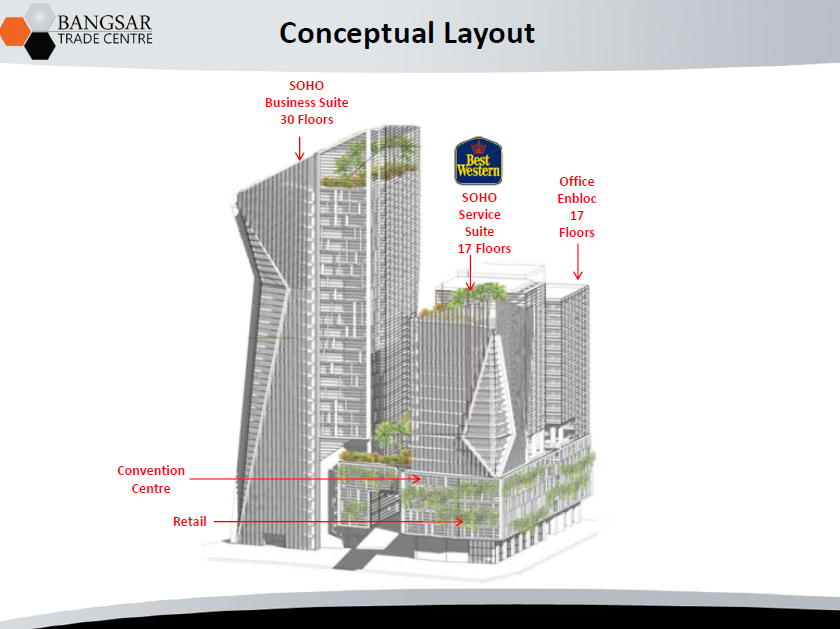

QUOTE(MGM @ Nov 22 2018, 03:36 PM) Any good offer for condo within 5km from University Malaya? Located next to LRT Kerinchi station. E-11-01, Soho Serviced Suites, Bangsar Trade Centre, Reserve price 🔥RM 617,000🔥 1055 sqft Freehold Auction: 29-Nov-2018 (Thu) » Click to show Spoiler - click again to hide... « Anyway the only con I think need to take commercial loan as considered as offices. |

|

|

|

|

|

MGM

|

Nov 23 2018, 01:13 AM Nov 23 2018, 01:13 AM

|

|

QUOTE(AskarPerang @ Nov 23 2018, 12:32 AM) Located next to LRT Kerinchi station. E-11-01, Soho Serviced Suites, Bangsar Trade Centre, Reserve price 🔥RM 617,000🔥 1055 sqft Freehold Auction: 29-Nov-2018 (Thu) » Click to show Spoiler - click again to hide... « Anyway the only con I think need to take commercial loan as considered as offices. Not suitable for own stay as all utilities will be billed in commercial rates. |

|

|

|

|

|

TSicemanfx

|

Nov 23 2018, 01:33 PM Nov 23 2018, 01:33 PM

|

|

QUOTE(AskarPerang @ Nov 23 2018, 01:08 PM) No taker. Below 600k now. Duplex 1018sqft unit. S&P price at 1M.  Almost reach 50% off now. 2-29-18, M-City Ampang, No. 326, Jalan Ampang Reserve price 🔥🔥RM 568,620🔥🔥 Freehold 1018 sqft (duplex) Auction: Dec 18 » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Suarez23

|

Nov 26 2018, 10:41 AM Nov 26 2018, 10:41 AM

|

Getting Started

|

Why hope for property to bubble? I rather hope and wish our economy are booming, everyone can make their money. Every can afford a home. Property bubble means economy are no good, even you think you can buy now...but do you dare to commit when you know economy are bad? Of coz minus those who are cash rich la.

|

|

|

|

|

|

Jliew168

|

Nov 26 2018, 10:52 AM Nov 26 2018, 10:52 AM

|

|

QUOTE(icemanfx @ Nov 23 2018, 01:33 PM) Wow, do u have auction details? |

|

|

|

|

|

Jliew168

|

Nov 26 2018, 10:55 AM Nov 26 2018, 10:55 AM

|

|

Bearbearwong mana u? This thread is dieing without u

|

|

|

|

|

|

MGM

|

Nov 26 2018, 11:26 AM Nov 26 2018, 11:26 AM

|

|

QUOTE(Suarez23 @ Nov 26 2018, 10:41 AM) Why hope for property to bubble? I rather hope and wish our economy are booming, everyone can make their money. Every can afford a home. Property bubble means economy are no good, even you think you can buy now...but do you dare to commit when you know economy are bad? Of coz minus those who are cash rich la. Must have cycle lah, up down up down, not healthy to keep going up. |

|

|

|

|

|

doppatroll

|

Nov 26 2018, 11:42 AM Nov 26 2018, 11:42 AM

|

|

thanks to LGE....now RGPT tax stays after 5 years

|

|

|

|

|

|

TSicemanfx

|

Nov 26 2018, 01:28 PM Nov 26 2018, 01:28 PM

|

|

QUOTE(Suarez23 @ Nov 26 2018, 10:41 AM) Why hope for property to bubble? I rather hope and wish our economy are booming, everyone can make their money. Every can afford a home. Property bubble means economy are no good, even you think you can buy now...but do you dare to commit when you know economy are bad? Of coz minus those who are cash rich la. Property bubble formed in 2011-2016. As income didn't rise faster and higher than property price, property price become un-affordable to most; hence, disposable income/consumers spending drop when more properties are vped. QUOTE(Jliew168 @ Nov 26 2018, 10:55 AM) Bearbearwong mana u? This thread is dieing without u Where are your bbb/uuu kaki? we need them to give inspiration to property investors. |

|

|

|

|

|

Jliew168

|

Nov 26 2018, 01:44 PM Nov 26 2018, 01:44 PM

|

|

QUOTE(icemanfx @ Nov 26 2018, 01:28 PM) Property bubble formed in 2011-2016. As income didn't rise faster and higher than property price, property price become un-affordable to most; hence, disposable income/consumers spending drop when more properties are vped. Where are your bbb/uuu kaki? we need them to give inspiration to property investors. We need people like bearbearwong to kick start |

|

|

|

|

|

eXTaTine

|

Nov 26 2018, 01:55 PM Nov 26 2018, 01:55 PM

|

|

QUOTE(Jliew168 @ Nov 26 2018, 01:44 PM) We need people like bearbearwong to kick start Himself say DDD then he buy a landed in a shit location, so now he no sound already? So far, those affected mostly the props in bad locations, prime ones still relatively unaffected? |

|

|

|

|

|

bearbearwong

|

Nov 26 2018, 10:45 PM Nov 26 2018, 10:45 PM

|

|

QUOTE(Jliew168 @ Nov 26 2018, 10:55 AM) Bearbearwong mana u? This thread is dieing without u thread dying, haihh the prop market is gging undergoing correction |

|

|

|

|

|

Jliew168

|

Nov 26 2018, 11:54 PM Nov 26 2018, 11:54 PM

|

|

QUOTE(bearbearwong @ Nov 26 2018, 10:45 PM) thread dying, haihh the prop market is gging undergoing correction Price is cheap... Good to buy now icemanfx ngam mou |

|

|

|

|

|

TSicemanfx

|

Nov 27 2018, 12:10 AM Nov 27 2018, 12:10 AM

|

|

QUOTE(Jliew168 @ Nov 26 2018, 11:54 PM) Price is cheap... Good to buy now icemanfx ngam mou Buy when blood is knee deep on the floor. As property overhang is still increasing, believe we have yet to see the bottom. |

|

|

|

|

|

scorptim

|

Nov 27 2018, 12:17 AM Nov 27 2018, 12:17 AM

|

|

QUOTE(icemanfx @ Nov 27 2018, 12:10 AM) Buy when blood is knee deep on the floor. As property overhang is still increasing, believe we have yet to see the bottom. How much lower until the bottom bro? It’s end 2018 already, max one or 2 years more downtrend. Historically always been a 5 year (more or less) downtrend. |

|

|

|

|

|

TSicemanfx

|

Nov 27 2018, 12:22 AM Nov 27 2018, 12:22 AM

|

|

QUOTE(scorptim @ Nov 27 2018, 12:17 AM) How much lower until the bottom bro? It’s end 2018 already, max one or 2 years more downtrend. Historically always been a 5 year (more or less) downtrend. In 2008 u.s subprime crisis, house price took about 6 years to bottom. Given foreclosure process is slower and longer here, expect house price to take longer than 6 years to bottom. House price is unlikely to upturn until overhang is reduced substantially. And overhang is expected to increase in next few years. |

|

|

|

|

|

TSicemanfx

|

Nov 27 2018, 10:38 AM Nov 27 2018, 10:38 AM

|

|

QUOTE(Jliew168 @ Nov 26 2018, 01:44 PM) We need people like bearbearwong to kick start QUOTE(bearbearwong @ Nov 26 2018, 10:45 PM) thread dying, haihh the prop market is gging undergoing correction believe it is a consensus; debate would be one sided on property market performance moving forward or in last few years. it is about time for those name calling uuu/bbb to apologize to bbw for the ordeal e.g called up his office/family members, posted his photo/love story, etc. whats goes around comes around; believe those did personal attacked are financially suffering. there is opportunity in every crisis, believe more money could be made during crisis than during bull run. This post has been edited by icemanfx: Nov 27 2018, 10:49 AM |

|

|

|

|

|

Suarez23

|

Nov 27 2018, 12:10 PM Nov 27 2018, 12:10 PM

|

Getting Started

|

QUOTE(icemanfx @ Nov 26 2018, 01:28 PM) Property bubble formed in 2011-2016. As income didn't rise faster and higher than property price, property price become un-affordable to most; hence, disposable income/consumers spending drop when more properties are vped. Where are your bbb/uuu kaki? we need them to give inspiration to property investors. That what i said....When our economy is good, salary will be high and all houses are affordable to everyone. If you have no money, even property is below 100k you also will say high. Like i said, if economy is bad will you dare to commit buying a property or not? You might lose a job, if you do business you might not get your payment in time. So back to square one, property price low but economy no good. So your blood knee low price, how low you want it to be? Price back to the 80s or 90s?? Or 50s...60s? There are times in early 2000 1U houses sub sale are selling 400-500k. Property bubble during that time 1U price down around 330k-400k. I know this because my sister neighbour that time wanted to sell 380K. My sis ask me to buy, but that me no money and just started my career. My sister bought only below 200k. In other words first hand owner are still making decent money. Actually there are many affordable houses in KV, many still can afford to buy their first home. Hope for better economy, better malaysia la, currency strong than HO SEH already...you have look at it in a different perspective.    |

|

|

|

|

|

TSicemanfx

|

Nov 27 2018, 12:45 PM Nov 27 2018, 12:45 PM

|

|

QUOTE(Suarez23 @ Nov 27 2018, 12:10 PM) That what i said....When our economy is good, salary will be high and all houses are affordable to everyone. If you have no money, even property is below 100k you also will say high. Like i said, if economy is bad will you dare to commit buying a property or not? You might lose a job, if you do business you might not get your payment in time. So back to square one, property price low but economy no good. So your blood knee low price, how low you want it to be? Price back to the 80s or 90s?? Or 50s...60s? There are times in early 2000 1U houses sub sale are selling 400-500k. Property bubble during that time 1U price down around 330k-400k. I know this because my sister neighbour that time wanted to sell 380K. My sis ask me to buy, but that me no money and just started my career. My sister bought only below 200k. In other words first hand owner are still making decent money. Actually there are many affordable houses in KV, many still can afford to buy their first home. Hope for better economy, better malaysia la, currency strong than HO SEH already...you have look at it in a different perspective.     Cost of doing business in malaysia is expensive due to indirect taxes (e.g levy, etc), inefficiency and leakages, companies couldn't afford to pay high wages. it will take a few years for current gomen to make changes. until changes is made, economy and wages is unlikely to improve significantly. most bought property with bank loan, high house price mean higher bank loan, more is spent on loan interest and repayment, less on disposable income. |

|

|

|

|

|

kurtkob78

|

Nov 27 2018, 03:45 PM Nov 27 2018, 03:45 PM

|

|

i dont see any catalyst that can improve the property market but notice the opposite are happening.

look at the corporations now. some start to consider downsizing

still alot of property overhang

Now can find many good value discounted properties especially in auctions

|

|

|

|

|

Nov 23 2018, 12:32 AM

Nov 23 2018, 12:32 AM

Quote

Quote

0.0331sec

0.0331sec

0.84

0.84

6 queries

6 queries

GZIP Disabled

GZIP Disabled