ABOUT two weeks ago, a group of about 80 property club members saw licensed auctioneer Warrick Singh.

They were seeking solutions as to what they can do with their property purchases which they took vacant possession a few years ago.

Aged between 28 and 42, most of them have two or three property units purchased in 2011 and they were given possession of the property in 2014 or 2015.Many of them, according to Warrick, have never heard about the property cycle or property clock.

“They bought the properties based on what they were taught about the good debt versus bad debt principle, that buying properties is a good debt,” says Warrick.

They are disgruntled now because they are unable to rent out the units to meet the monthly mortgage payments and they do not want to sell at a loss, although some have done so. They are also unhappy they have to pay for the monthly management charges and sinking fund.

Warrick says their gross salaries were “between RM5,000 and RM10,000 or dual income”.

“They were seeking a solution but I had no solution.

.....

Warrick believes we are currently at 7 o’clock (of the property cycle clock), while the Institute for Democracy and Economic Affairs (Ideas) senior fellow and economist Dr Carmelo Ferlito is of the view we are currently between 3 and 6 o’ clock.

Not surprised by the rising overhang, he says: “Prices will probably start to go down a little but we cannot hope for all these overhang units to be absorbed in the short term.”

He is of the view that a property crisis is approaching. The situation will be more critical at the beginning of next year, he says.

.....

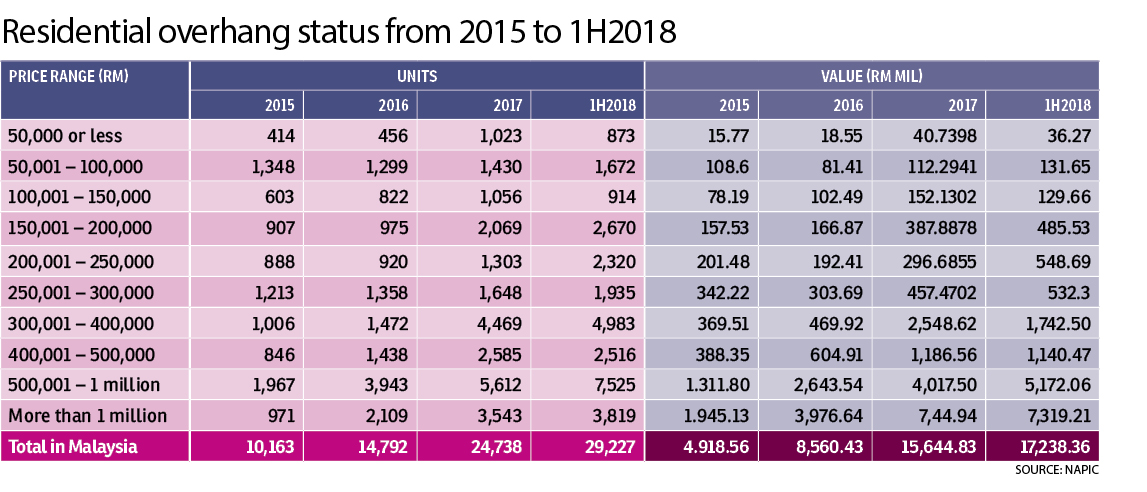

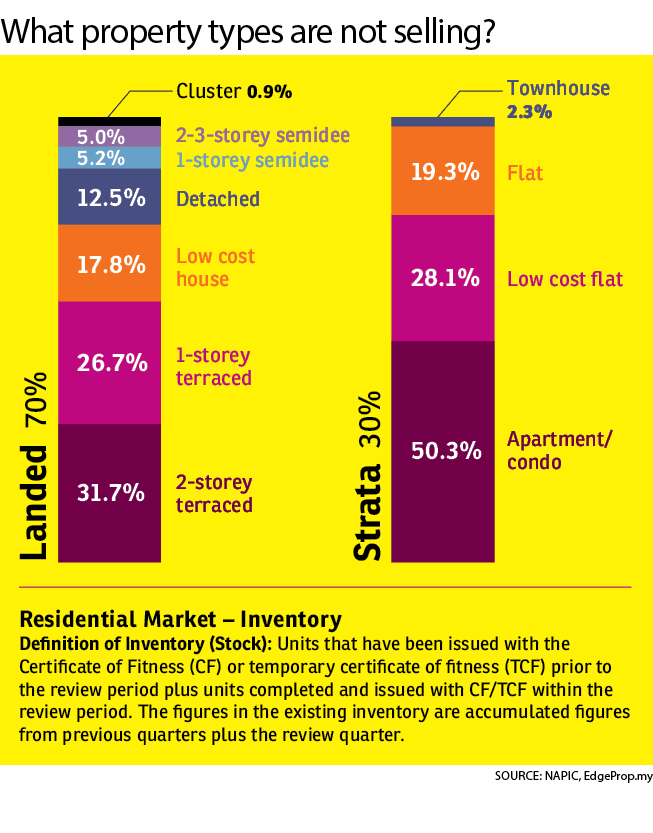

According to the National Property Information Centre’s (Napic) Property Overhang Report for the second quarter 2018, Malaysia has an overhang of 29,227 units, valued at RM17.24bil as at June 30, 2018.

The above overhang figures exclude serviced apartments and small offices home offices (SoHos), which are built on commercial titled land. If this segment is included, the overhang volume and value would rise considerably.

Napic defines an overhang as unsold units nine months after completion. Valuation & Property Services department director general Nordin Daharom says the rising number of overhang units is one of two pertinent issues – the other being the commercial space vacancy, both retail and office space.

Read more at

https://www.thestar.com.my/business/busines...33sGzVPwezP4.99This post has been edited by icemanfx: Oct 21 2018, 02:17 PM

Oct 11 2018, 02:42 AM

Oct 11 2018, 02:42 AM

Quote

Quote

0.0273sec

0.0273sec

0.53

0.53

6 queries

6 queries

GZIP Disabled

GZIP Disabled