QUOTE(ikanbilis @ Jul 15 2022, 12:44 PM)

CASA never credited with the interest. The interest is added on to the principal which is renewed for another year.

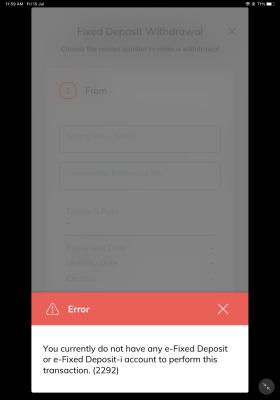

One month before maturity i asked if they could change the instruction to withdraw the principal+interest to CASA. They say cannot but i could withdraw all on maturity date. Unfortunately this has not been the case and my money has stuck there for more than a week.

So it is just an auto-renew principal and interest for another year at lower board rate.

Sorry, but cannot change instruction once made original instruction at any bank.

The best thing you can do now, is to premature withdrawal for the renewed eFD as quick as you can since you did not withdraw on 7.7.2022 or 8.7.2022. I don't think BNM complaint will help, since you do not understand how this FD instruction thingy works for all banks. You will not get any new interest for the renewed FD since it is now a premature withdrawal. But still it is better if you take out the money and then place at a better interest rate somewhere.

The general advice is ALWAYS credit principal and any interest into a designated CASA account automatically on maturity if checked first that you are allowed to set this instruction on placement of FD.

In the past, when there was no FD promo business, it was the general assumption that auto-renewal was usually a good convenient idea for those who do not hop from bank to bank. The savyy FD promo investor should be aware of banking history/tactic and reasoning behind this, and discard obsolete and no longer relevant advice/teaching/practice to avoid interest loss. As always, we must adapt to changing situation and change our way of thinking and operational ways appropriately.

For your info, some banks do not have automatic withdrawal on maturity instruction, and you always have to be mindful when the Maturity Date is due.

But HL eFD now does have option for full withdrawal to your CASA on maturity. However, another sometimes overlooked aspect is the condition of the CASA at maturity date. To prevent this fiasco/avoidable problem the general advice is that one needs to regularly keep alive any relevant CASA accounts at set dates.

This post has been edited by oldkiasu: Jul 15 2022, 03:03 PM

Jul 14 2022, 06:29 PM

Jul 14 2022, 06:29 PM

Quote

Quote

0.0324sec

0.0324sec

0.58

0.58

6 queries

6 queries

GZIP Disabled

GZIP Disabled