QUOTE(besiegetank @ Oct 9 2017, 11:09 PM)

Is there anyway to change the username? It is so hard to remember their assigned username for my eunitrust account...

You can try using a password manager. I am using Lastpass.Maybank eGIA-i 3.45% p.a., Rojak of SA + FD + MMF

|

|

Oct 9 2017, 11:38 PM Oct 9 2017, 11:38 PM

|

All Stars

24,380 posts Joined: Feb 2011 |

|

|

|

|

|

|

Oct 16 2017, 04:06 PM Oct 16 2017, 04:06 PM

|

Junior Member

629 posts Joined: Nov 2011 |

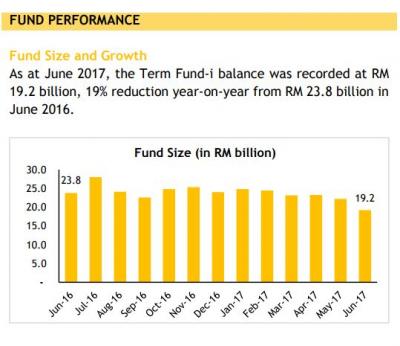

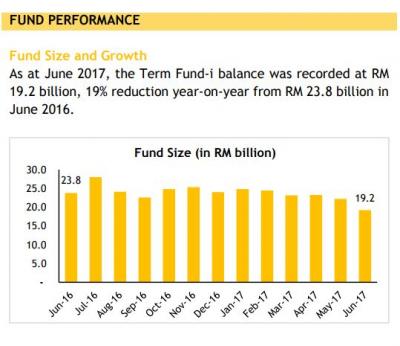

Since the change of the GIA, the fund size drop nearly 2-3 Billion on June compare to May

http://www.maybank2u.com.my/WebBank/IA_Fun...e_TF_2017Q2.pdf |

|

|

Oct 16 2017, 09:36 PM Oct 16 2017, 09:36 PM

|

All Stars

23,688 posts Joined: Aug 2007 From: Outer Space |

will drop more. coz only got withdrawal.

|

|

|

Oct 17 2017, 12:04 AM Oct 17 2017, 12:04 AM

Show posts by this member only | IPv6 | Post

#1404

|

|

Staff

72,826 posts Joined: Sep 2005 From: KUL |

QUOTE(ytan053 @ Oct 7 2017, 06:17 PM) wont know upon withdrawal. only will know the rate on the following month when the rate is disclosed on philip page / dividend credited into ur account I hope by then I will know how to calculate. So the interest is not really daily interest. Assuming if I withdraw everything today, I may not get a single cent of interest since I didn't withdraw on 1st? I just tried redeeming 2000 units for some quick payments and I got RM 1k. Assuming if I only have RM1k and i have withdrew now, so I won't get any interest right? |

|

|

Oct 17 2017, 08:44 AM Oct 17 2017, 08:44 AM

Show posts by this member only | IPv6 | Post

#1405

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(akping_1 @ Oct 16 2017, 04:06 PM) Since the change of the GIA, the fund size drop nearly 2-3 Billion on June compare to May They are surprisingly honest about this, cant wait to see Q3 report

http://www.maybank2u.com.my/WebBank/IA_Fun...e_TF_2017Q2.pdf |

|

|

Oct 17 2017, 08:46 AM Oct 17 2017, 08:46 AM

|

Senior Member

2,232 posts Joined: May 2006 From: Petaling Jaya |

I'm waiting for mine to mature next month and will withdraw all.

|

|

|

|

|

|

Oct 17 2017, 10:14 AM Oct 17 2017, 10:14 AM

Show posts by this member only | IPv6 | Post

#1407

|

Senior Member

664 posts Joined: Jun 2009 |

that's year to year. how about month to month? and they should have known this before they implement watever they are doing now.

|

|

|

Oct 17 2017, 10:22 AM Oct 17 2017, 10:22 AM

|

Junior Member

629 posts Joined: Nov 2011 |

|

|

|

Oct 17 2017, 10:23 AM Oct 17 2017, 10:23 AM

|

Junior Member

565 posts Joined: Mar 2014 |

QUOTE(fruitie @ Oct 17 2017, 12:04 AM) I hope by then I will know how to calculate. Interest is still calculated on daily.So the interest is not really daily interest. Assuming if I withdraw everything today, I may not get a single cent of interest since I didn't withdraw on 1st? I just tried redeeming 2000 units for some quick payments and I got RM 1k. Assuming if I only have RM1k and i have withdrew now, so I won't get any interest right? In a month, interest on your each placement is calculated from the day you buy the unit to 1st of the following month. For sale of unit, you minus the interest from the day of your selling date (always refer/ check back to the transaction date on PMMMF*) to the 1st of the following month. Even though you have withdraw everything today, you still earn the interest you get for your earlier placement until end of the month (because they also deduct you interest for sale of unit from the day you sell the unit until end of the month). *I have encountered selling of units after 6:00pm and the transaction date was considered as the following date. |

|

|

Oct 17 2017, 10:32 AM Oct 17 2017, 10:32 AM

Show posts by this member only | IPv6 | Post

#1410

|

Senior Member

664 posts Joined: Jun 2009 |

|

|

|

Oct 17 2017, 10:45 AM Oct 17 2017, 10:45 AM

|

|

Staff

72,826 posts Joined: Sep 2005 From: KUL |

QUOTE(ytan053 @ Oct 17 2017, 10:23 AM) Interest is still calculated on daily. I see. So, in another word, though I put in RM 1000 = 2000 units, when I sell that time it will be more than 2000 units ya?In a month, interest on your each placement is calculated from the day you buy the unit to 1st of the following month. For sale of unit, you minus the interest from the day of your selling date (always refer/ check back to the transaction date on PMMMF*) to the 1st of the following month. Even though you have withdraw everything today, you still earn the interest you get for your earlier placement until end of the month (because they also deduct you interest for sale of unit from the day you sell the unit until end of the month). *I have encountered selling of units after 6:00pm and the transaction date was considered as the following date. |

|

|

Oct 17 2017, 10:46 AM Oct 17 2017, 10:46 AM

|

Senior Member

1,361 posts Joined: May 2006 |

QUOTE(ytan053 @ Oct 17 2017, 10:23 AM) Interest is still calculated on daily. looks complicated.In a month, interest on your each placement is calculated from the day you buy the unit to 1st of the following month. For sale of unit, you minus the interest from the day of your selling date (always refer/ check back to the transaction date on PMMMF*) to the 1st of the following month. Even though you have withdraw everything today, you still earn the interest you get for your earlier placement until end of the month (because they also deduct you interest for sale of unit from the day you sell the unit until end of the month). *I have encountered selling of units after 6:00pm and the transaction date was considered as the following date. |

|

|

Oct 17 2017, 03:32 PM Oct 17 2017, 03:32 PM

|

All Stars

65,317 posts Joined: Jan 2003 |

QUOTE(ytan053 @ Oct 17 2017, 10:23 AM) Interest is still calculated on daily. In a month, interest on your each placement is calculated from the day you buy the unit to 1st of the following month. For sale of unit, you minus the interest from the day of your selling date (always refer/ check back to the transaction date on PMMMF*) to the 1st of the following month. Even though you have withdraw everything today, you still earn the interest you get for your earlier placement until end of the month (because they also deduct you interest for sale of unit from the day you sell the unit until end of the month). *I have encountered selling of units after 6:00pm and the transaction date was considered as the following date. QUOTE(sendohz @ Oct 17 2017, 10:46 AM) this is more like the "advance charging/cycle forward" billing model i guess can be illustrated below...  |

|

|

|

|

|

Oct 17 2017, 03:39 PM Oct 17 2017, 03:39 PM

|

Senior Member

1,361 posts Joined: May 2006 |

|

|

|

Oct 17 2017, 10:50 PM Oct 17 2017, 10:50 PM

|

Junior Member

217 posts Joined: Oct 2015 |

uob change e account Rates

Revision of eAccount Interest Rates (effective 19 October 2017) Above / Melebihi RM50,000 3.60% http://www1.uob.com.my/personal/announcement.page |

|

|

Oct 17 2017, 11:55 PM Oct 17 2017, 11:55 PM

|

Junior Member

565 posts Joined: Mar 2014 |

|

|

|

Oct 18 2017, 12:01 AM Oct 18 2017, 12:01 AM

Show posts by this member only | IPv6 | Post

#1417

|

|

Staff

72,826 posts Joined: Sep 2005 From: KUL |

|

|

|

Oct 18 2017, 04:20 PM Oct 18 2017, 04:20 PM

|

Senior Member

853 posts Joined: Jan 2003 |

QUOTE(poor man @ Oct 17 2017, 10:50 PM) uob change e account Rates Thanks for this. Good news!Revision of eAccount Interest Rates (effective 19 October 2017) Above / Melebihi RM50,000 3.60% http://www1.uob.com.my/personal/announcement.page Even better than Gia 60m at 3.55% |

|

|

Oct 18 2017, 04:31 PM Oct 18 2017, 04:31 PM

|

Junior Member

507 posts Joined: Jun 2015 |

QUOTE(poor man @ Oct 17 2017, 10:50 PM) uob change e account Rates Revision of eAccount Interest Rates (effective 19 October 2017) Above / Melebihi RM50,000 3.60% http://www1.uob.com.my/personal/announcement.page QUOTE(lookie @ Oct 18 2017, 04:20 PM) Great news indeed. |

|

|

Oct 18 2017, 05:19 PM Oct 18 2017, 05:19 PM

|

All Stars

24,380 posts Joined: Feb 2011 |

fruitie, any idea when I try to submit my IC, it gave me a "500 - Internal server error". How to go about it?

|

| Change to: |  0.0309sec 0.0309sec

0.84 0.84

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 12:20 AM |