QUOTE(AIYH @ Nov 9 2016, 08:18 AM)

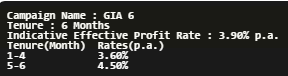

risk is not a problem, but given it is not protected, fixed income do provide better returns then GIA for now (unless they raise OPR until fixed income return dont look attractive, then thats another story

)

You are using ASX fp to park short term fund?

QUOTE(epie @ Nov 9 2016, 08:28 AM)

what is ur opinion about the risk involve?

i am confident with maybank and i think the risk is really small to none

Same here. If maybank kaput. Malaysia economy also kaput.

QUOTE(vincabby @ Nov 9 2016, 08:41 AM)

this is how i handle my funds. i put them all in maybank2u savers with 2.xx% per annum with a balance of more than 2.5k. make gia-i for two months.

in your case, still doable. put in gia-i for two weeks, reap the rewards, take it all out and rinse and repeat every month. no penalty for taking it out early if that is what you are worrying.

Keep in mind that below RM2k you won't get anything from M2savers. Interest for >=RM2k is only 2.15%

Nov 8 2016, 05:04 PM

Nov 8 2016, 05:04 PM

Quote

Quote

0.0237sec

0.0237sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled