QUOTE(Kaka23 @ Oct 29 2016, 04:04 PM)

Come and join me.why not?FundSuperMart v16 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v16 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Oct 29 2016, 08:43 PM Oct 29 2016, 08:43 PM

|

Senior Member

2,679 posts Joined: Oct 2014 |

|

|

|

|

|

|

Oct 29 2016, 08:45 PM Oct 29 2016, 08:45 PM

|

Senior Member

3,813 posts Joined: Feb 2012 |

|

|

|

Oct 29 2016, 08:57 PM Oct 29 2016, 08:57 PM

|

All Stars

33,633 posts Joined: May 2008 |

QUOTE(xuzen @ Oct 29 2016, 05:40 PM) The NAV for TAGTF on 10/10/2016 is MYR 0.7335 per unit. The unit split happened on 11/10/2016. The NAV for TAGTF on 11/10/2016 that is post unit split became MYR 0.6092 Haha it is a day of maths. If one has 10,000 units originally his NAV would be 10,000 x 0.7335 = MYR 7,335.00 ====> (A) Due to unit split of 1 units per 5, he will get 10,000/5 = 2,000 new units. The total units then became 10,000 + 2,000 = 12,000 units. The new NAV becomes 12,000 x 0.6092 = MYR 7,310.40.====> (B) Now take a look at the NAV (A) & (B). From this do you see that the actual value is lebih-kurang sama aje! Although you will say the NAV has dropped, but for someone who is actually holding the unit prior to the units split; it does not seem that way. Hence, do not be deluded that it is cheap or otherwise. The NAV drop is engineered by the UTMC, it is not due to actual drop in its underlying asset price. In another word, the drop in NAV is a manipulation by the UTF management company. Xuzen p/s (IMPORTANT NOTE): Actual cheap or otherwise is not determine by the NAV face value per se. Look to its underlying asset to determine. In the absence of knowing the actual underlying asset, then look at the fund benchmark for guidance. I would like to show my calculation too. Actually 5 units get 1 unit is equivalent to (1 + 1/5)= 1.2 times increase in units. If original nav is .7335, then new nav is .7335/1.2 = .61125. But the price became .6092, there was indeed a drop of nav on that day. |

|

|

Oct 29 2016, 09:11 PM Oct 29 2016, 09:11 PM

|

Senior Member

5,322 posts Joined: Oct 2009 |

Thanks a lot for all your generous opinions. I've also read the thread's first page and everything is consistent. I guess I'll put in another 30% of my basket of eggs into TA GT.

However, on my other question, does anyone have any opinion? i.e., I already have 30% of total investments in RHB AIF, but seeing from the good future progress of Asia ex Japan market, Ponzi 2 seems like a good buy too. My concern is just that whether I am concentrating too much together in terms of geographical sector, ie. AIF and Ponzi 2 having similar geographical exposures. @Ramjade I have also considered your opinion of whether I am going to increase my Malaysian UT exposure. Let's say in this event, I am not considering Malaysia, is it still wise to go Ponzi 2? Or diversify in other funds? Feedback appreciated. |

|

|

Oct 29 2016, 10:32 PM Oct 29 2016, 10:32 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

Hasn't read the past few pages... seems to be going in circles again

Anyway, got this off our in-house UTC Sharing is caring so here you go, play around and have fun! http://iportfolio.com.my/snapshot It's somewhat similar to FSM's portfolio simulator, but has more info on downside risk, and has almost all the funds available in Msia. Doesn't work with ASB VP funds since I think they don't publish fund price daily |

|

|

Oct 29 2016, 11:09 PM Oct 29 2016, 11:09 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

deleted...double post

This post has been edited by AIYH: Oct 29 2016, 11:11 PM |

|

|

|

|

|

Oct 29 2016, 11:09 PM Oct 29 2016, 11:09 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

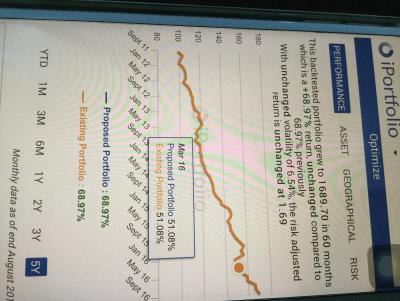

QUOTE(dasecret @ Oct 29 2016, 10:32 PM) Hasn't read the past few pages... seems to be going in circles again Dafaq did I just ... ??? Anyway, got this off our in-house UTC Sharing is caring so here you go, play around and have fun! http://iportfolio.com.my/snapshot It's somewhat similar to FSM's portfolio simulator, but has more info on downside risk, and has almost all the funds available in Msia. Doesn't work with ASB VP funds since I think they don't publish fund price daily This post has been edited by AIYH: Oct 29 2016, 11:11 PM Attached thumbnail(s)

|

|

|

Oct 29 2016, 11:14 PM Oct 29 2016, 11:14 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Oct 29 2016, 11:31 PM Oct 29 2016, 11:31 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(dasecret @ Oct 29 2016, 11:14 PM) These lo, is there any bug eh? Don't tell me it has the same limitation of 10 funds in a portfolio like morningstar, more than that it goes hairwayer (how does it spell dy?) ? This post has been edited by AIYH: Oct 29 2016, 11:41 PM |

|

|

Oct 29 2016, 11:34 PM Oct 29 2016, 11:34 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

Algozen™'s portfolio back tested five years.

I only have four UTF in my port coz Algozen™ does not do Pokemon Go, "Gotta catch em' all". The portfolio has a volatility of 6.54% , and in sixty mths of backtesting, there are 46 mths with positive return which means 77% of the time, it is a winner. This post has been edited by xuzen: Oct 29 2016, 11:44 PM Attached thumbnail(s)

|

|

|

Oct 29 2016, 11:42 PM Oct 29 2016, 11:42 PM

|

Junior Member

200 posts Joined: Mar 2015 |

|

|

|

Oct 29 2016, 11:52 PM Oct 29 2016, 11:52 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

|

|

|

Oct 30 2016, 06:56 AM Oct 30 2016, 06:56 AM

|

All Stars

24,354 posts Joined: Feb 2011 |

QUOTE(botakbin @ Oct 29 2016, 09:11 PM) @Ramjade I have also considered your opinion of whether I am going to increase my Malaysian UT exposure. Let's say in this event, I am not considering Malaysia, is it still wise to go Ponzi 2? Or diversify in other funds? Ponzi 2 only holds 1.56% in Malaysia which in my opinion is too insignificant. Well is up to you. Anyway I have 1 month experience only la Feedback appreciated. |

|

|

|

|

|

Oct 30 2016, 10:11 AM Oct 30 2016, 10:11 AM

|

Senior Member

2,679 posts Joined: Oct 2014 |

|

|

|

Oct 30 2016, 10:31 AM Oct 30 2016, 10:31 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

Simple Asset Allocation test - also good, no need no stress/pick gila nor crystal balls

1. Equities, Developed Market: CIMB Global Titans 17% . 2. Equities, Emerging Market: Eastspring Global Emerging Markets 17% . 3. Equities, Real Estate AmAsia Pacific REITs 33% . 4. Fixed Income, Bond (can also be represented by EPF) Libra AsnitaBond 22% . 5. Fixed Income, Money Market (can also be represented by Flexi Mortgage) RHB Cash Management 2 11% http://iportfolio.com.my/snapshot?cntp=5&f...22000&readp4=TZ PS: a. Purposely simplified. IMHO if want to spend more effort / time - might as well get into direct stocks/properties to be worth the effort b. Simple alternatives shared too Coz it's holistic right? not in vacuum eg. I wont have $ in +Libra Asnita coz i've enough % EPF +RHB Cash Management coz i've enough in prepaid Flexi Mortgage +took all CIMB Global Tit.s out to fully fund my direct investments via US Exchanges, thus $0 too in CIMB Global Tit.s This post has been edited by wongmunkeong: Oct 30 2016, 10:49 AM |

|

|

Oct 30 2016, 10:33 AM Oct 30 2016, 10:33 AM

|

Senior Member

2,679 posts Joined: Oct 2014 |

QUOTE(wongmunkeong @ Oct 30 2016, 10:31 AM) Simple Asset Allocation test - also good, no need no stress/pick gila nor crystal balls Boss,1. Equities, Developed Market: CIMB Global Titans 17% . 2. Equities, Emerging Market: Eastspring Global Emerging Markets 17% . 3. Equities, Real Estate AmAsia Pacific REITs 33% . 4. Fixed Income, Bond (can also be represented by EPF) Libra AsnitaBond 22% . 5. Fixed Income, Money Market (can also be represented by Flexi Mortgage) RHB Cash Management 2 11% http://iportfolio.com.my/snapshot?cntp=5&f...22000&readp4=TZ No KGF or EISCF? |

|

|

Oct 30 2016, 10:43 AM Oct 30 2016, 10:43 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

Oct 30 2016, 12:10 PM Oct 30 2016, 12:10 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

My portfolio is classified as aggressive and I only have two asset class..... equities and bond. Super simple hor!

Xuzen P/s Is the optimise portfolio function rosak or not? I click on it, my current port and optimised portfolio results are the same wan... This post has been edited by xuzen: Oct 30 2016, 12:12 PM |

|

|

Oct 30 2016, 12:12 PM Oct 30 2016, 12:12 PM

|

All Stars

48,448 posts Joined: Sep 2014 From: REality |

|

|

|

Oct 30 2016, 12:16 PM Oct 30 2016, 12:16 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(kswee @ Oct 29 2016, 07:07 PM) What Fund invest in education and universities? Education = Paramount, Sunway, MasterskillFast food processing? chemical plant or any associate with chemical? Fast Food = KFC, QSR, BFood, QL Chemical = CCM Xuzen P/s Stop playing stock market since 2009, still can remember the counter, not bad hor! This post has been edited by xuzen: Oct 30 2016, 12:17 PM |

|

Topic ClosedOptions

|

| Change to: |  0.1677sec 0.1677sec

0.42 0.42

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 01:15 AM |