QUOTE(Leroi2x @ Nov 13 2018, 07:05 PM)

Thank you bro ,i already get the debit card

If so , then i will proceed to open the islamic 360 via online as change the debit card link to islamic account as primary

QUOTE(alexanderclz @ Nov 13 2018, 07:06 PM)

can open islamic account online if already have pre-existing conventional one?

QUOTE(Leroi2x @ Nov 13 2018, 10:20 PM)

i also wan ask , ask i login try to open account it only show conv 360 account which i been already have

need to walk in branch again? is abit hassle ...

QUOTE(MilesAndMore @ Nov 13 2018, 11:51 PM)

I attempted to help my mom to open an OCBC 360 Account for her online this morning but was unable to proceed as she had no existing savings or current account with OCBC Bank which is needed to fund the initial deposit at point of creation of the new OCBC 360 Account. So I guess she will still have to walk-in to OCBC Bank to open her account.

By the way, for OCBC 360 Account, only the conventional OCBC 360 Account is shown on her online banking. Can’t see the OCBC Al-Amin 360 Account-i.

I was able to see the option to open Islamic account before, I don't remember when exactly but I don't think it is this year though. The funny thing though was I need to select Al-Amin branch and not able to use my existing branch. However, when I checked again today, I can only see the option to open conventional accounts, no more Islamic ones. So, I am not sure if OCBC makes some changes to this. If that is the case, I think the account can only be opened at the branch. Do check with customer service first though on this.

QUOTE(bee993 @ Nov 14 2018, 05:25 AM)

I juz login and now the fund transfer is able to use my 360 acc without me doin anything.

And about ur post now i am little confused bout linking debit card and credit card thing.tried to search for the option but ntg available.

Before i open this 360 i got ocbc credit card already.

Now i could just easily spend rm500 using this card and fulfill the last requirement for 4.1% but u mentioned need to link debit and cc to this acc somehow concerned me unable to get the full 4.1%

Perform 3 ifbt and deposit also done.

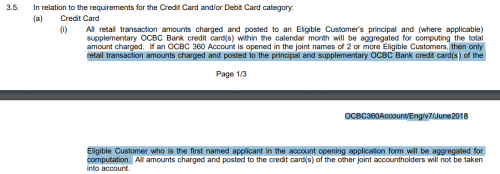

For OCBC 360 account, using your credit card will get the bonus for spending category, no need to link anything. For OCBC 360 Account-i only need to link the debit card. The linking needs to be done by bank staff.

Nov 13 2018, 07:05 PM

Nov 13 2018, 07:05 PM

Quote

Quote

0.0286sec

0.0286sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled