Just swipe MUVI.. 2x points better than 1.. Im trying to use AMEX whenever its accepted and MUVI if they do not accept

Credit Cards Maybank 2 Cards Premier V2, Fastest Air Miles Conversion

Credit Cards Maybank 2 Cards Premier V2, Fastest Air Miles Conversion

|

|

Mar 26 2019, 11:38 AM Mar 26 2019, 11:38 AM

Show posts by this member only | IPv6 | Post

#4501

|

|

Staff

5,054 posts Joined: Aug 2008 |

Just swipe MUVI.. 2x points better than 1.. Im trying to use AMEX whenever its accepted and MUVI if they do not accept

|

|

|

|

|

|

Mar 26 2019, 11:49 AM Mar 26 2019, 11:49 AM

|

|

Staff

72,841 posts Joined: Sep 2005 From: KUL |

QUOTE(tarvalslain87 @ Mar 26 2019, 11:38 AM) Just swipe MUVI.. 2x points better than 1.. Im trying to use AMEX whenever its accepted and MUVI if they do not accept That's what I thought as well. No more better cards. Suddenly I feel lack of cards. However, I'm also thinking to get waiver for both my SCB WM and Citibank PM, so I will swipe RM 1k-2k there to show I am using their cards though my usage was less than RM 200 for both cards last year and got AF waiver. I don't think I will have such luck anymore this year. Will do that when their AF date is approaching. So, can keep MUVI aside for a while. |

|

|

Mar 26 2019, 11:54 AM Mar 26 2019, 11:54 AM

Show posts by this member only | IPv6 | Post

#4503

|

Junior Member

206 posts Joined: Jan 2013 |

Base on my spending experience using m2c for the past 3 months, not many merchant accept amex. Even some rolex ad does not accept amex. Its like 90% spending on visa vs 10% amex. Hope there will be more merchant accepts amex 😅

|

|

|

Mar 26 2019, 11:54 AM Mar 26 2019, 11:54 AM

|

|

Staff

5,054 posts Joined: Aug 2008 |

QUOTE(fruitie @ Mar 26 2019, 11:49 AM) That's what I thought as well. No more better cards. Suddenly I feel lack of cards. I wanna cancel my Citi PM card but for local unlimited lounge access seems quite good. Just have to ask them to waive the AF this year since I moved to M2P for miles collection However, I'm also thinking to get waiver for both my SCB WM and Citibank PM, so I will swipe RM 1k-2k there to show I am using their cards though my usage was less than RM 200 for both cards last year and got AF waiver. I don't think I will have such luck anymore this year. Will do that when their AF date is approaching. So, can keep MUVI aside for a while. |

|

|

Mar 26 2019, 11:56 AM Mar 26 2019, 11:56 AM

|

|

Staff

72,841 posts Joined: Sep 2005 From: KUL |

QUOTE(rivetindigo @ Mar 26 2019, 11:54 AM) Base on my spending experience using m2c for the past 3 months, not many merchant accept amex. Even some rolex ad does not accept amex. Its like 90% spending on visa vs 10% amex. Hope there will be more merchant accepts amex 😅 My AmEx is mainly for GrabPay and now Boost as well. QUOTE(tarvalslain87 @ Mar 26 2019, 11:54 AM) I wanna cancel my Citi PM card but for local unlimited lounge access seems quite good. Just have to ask them to waive the AF this year since I moved to M2P for miles collection For PPL, I will prefer my SCB WM. This post has been edited by fruitie: Mar 26 2019, 11:56 AM |

|

|

Mar 26 2019, 01:15 PM Mar 26 2019, 01:15 PM

|

Junior Member

503 posts Joined: Nov 2006 |

Hello guys. Just got my Amex Reserve and Visa Infinite a couple of weeks ago. I tried to link the Amex to my paypal and grab account but they reject? Anyone can advise why?

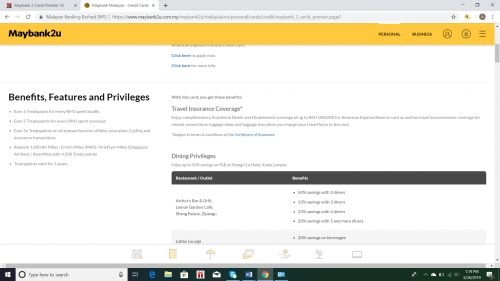

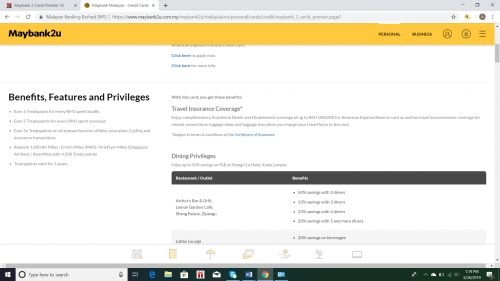

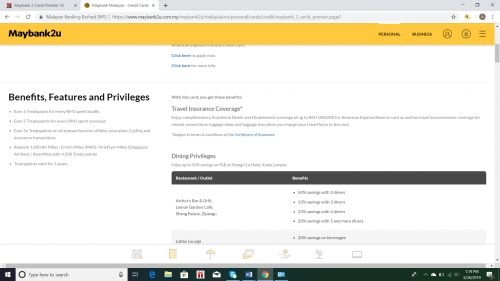

Also after reading this forum, many state that using the Visa card would not get 5 Treatpoints. However when I check the details online, it says that using Visa will also get 5x TP. Which is correct? This post has been edited by cynthusc: Mar 26 2019, 01:26 PM |

|

|

|

|

|

Mar 26 2019, 01:28 PM Mar 26 2019, 01:28 PM

|

Senior Member

3,033 posts Joined: May 2011 |

QUOTE(fruitie @ Mar 26 2019, 10:30 AM) Which card? BP? I purposely keep the quota for this weekend's match. So, it has no effect whether I reload to BP or pay straight to the merchant, still 2x. Or did I misunderstand anything else? If you buy 25k worth of big items. U only get 50k tp. If u r targeting vouchers. Every 500 get 1 ringgit worth of vouchers. Your 50k tp only get you RM100 worth of cash voucher. It equivalent to 0.4% cash back for that spending. In reality it is lesser than 0.4% as the cash voucher (eg Giant voucher) that you use will not qualify for grocery cash back. So, if you can get another cash back card that can offer you at least 0.4% cb, it is definately better than using the MUVI swiping on non match day.I already maxed out all my cash back cards, so I really have nothing else left. |

|

|

Mar 26 2019, 01:42 PM Mar 26 2019, 01:42 PM

|

Junior Member

134 posts Joined: Mar 2013 |

QUOTE(Tigerr @ Mar 26 2019, 01:28 PM) If you buy 25k worth of big items. U only get 50k tp. If u r targeting vouchers. Every 500 get 1 ringgit worth of vouchers. Your 50k tp only get you RM100 worth of cash voucher. It equivalent to 0.4% cash back for that spending. In reality it is lesser than 0.4% as the cash voucher (eg Giant voucher) that you use will not qualify for grocery cash back. So, if you can get another cash back card that can offer you at least 0.4% cb, it is definately better than using the MUVI swiping on non match day. But if you convert 50k TP to 11k Miles, that's worth more than RM100. |

|

|

Mar 26 2019, 01:46 PM Mar 26 2019, 01:46 PM

Show posts by this member only | IPv6 | Post

#4509

|

|

Staff

5,054 posts Joined: Aug 2008 |

QUOTE(cynthusc @ Mar 26 2019, 01:15 PM) Hello guys. Just got my Amex Reserve and Visa Infinite a couple of weeks ago. I tried to link the Amex to my paypal and grab account but they reject? Anyone can advise why? My Grab has no issue linking with my AMEX. Its my primary method for topup for Grab. Also after reading this forum, many state that using the Visa card would not get 5 Treatpoints. However when I check the details online, it says that using Visa will also get 5x TP. Which is correct? AMEX will get 5 tps everyday while VI is 2 tps per RM1 spent locally (5 tps for overseas). If you have the MU VI then its 5 tps when MU wins a match |

|

|

Mar 26 2019, 01:46 PM Mar 26 2019, 01:46 PM

|

Senior Member

2,680 posts Joined: Dec 2010 |

QUOTE(Tigerr @ Mar 26 2019, 01:28 PM) So, if you can get another cash back card that can offer you at least 0.4% cb, it is definately better than using the MUVI swiping on non match day. Good analysis, but I think fruitie has run out of CB cards for this month. Both of us used to focus on CB before getting M2P and I know her card inventory is very similar to mine.Thankfully I still have BP balance from Soton (and Arsenal, which was a wasted gamble) for tomorrow's Lazada sale. Since getting M2P I've changed my spending habits slightly to spend at places which accept Amex. Can hit about 30:70 ratio for Amex:MUVI spending. Never ever going to redeem vouchers again and instead use for KF miles. |

|

|

Mar 26 2019, 01:47 PM Mar 26 2019, 01:47 PM

|

|

Staff

72,841 posts Joined: Sep 2005 From: KUL |

QUOTE(cynthusc @ Mar 26 2019, 01:15 PM) Hello guys. Just got my Amex Reserve and Visa Infinite a couple of weeks ago. I tried to link the Amex to my paypal and grab account but they reject? Anyone can advise why? You will need to call CS to turn on your online transactions feature. Also after reading this forum, many state that using the Visa card would not get 5 Treatpoints. However when I check the details online, it says that using Visa will also get 5x TP. Which is correct? QUOTE(Tigerr @ Mar 26 2019, 01:28 PM) If you buy 25k worth of big items. U only get 50k tp. If u r targeting vouchers. Every 500 get 1 ringgit worth of vouchers. Your 50k tp only get you RM100 worth of cash voucher. It equivalent to 0.4% cash back for that spending. In reality it is lesser than 0.4% as the cash voucher (eg Giant voucher) that you use will not qualify for grocery cash back. So, if you can get another cash back card that can offer you at least 0.4% cb, it is definately better than using the MUVI swiping on non match day. Not targeting for vouchers obviously. I already maxed out my PBB VS, QMC, SCB JOP, LFC and MBB FCB VS for BP. Not forgetting AmEx Plat for other usage and UOB YOLO for bills. No intention to add more cards as I'm trying to consolidate and remove some lowly utilized cards. Nevertheless, if I use for MUVI and AR, usually for airmiles purpose. |

|

|

Mar 26 2019, 01:48 PM Mar 26 2019, 01:48 PM

Show posts by this member only | IPv6 | Post

#4512

|

|

Staff

5,054 posts Joined: Aug 2008 |

QUOTE(Tigerr @ Mar 26 2019, 01:28 PM) If you buy 25k worth of big items. U only get 50k tp. If u r targeting vouchers. Every 500 get 1 ringgit worth of vouchers. Your 50k tp only get you RM100 worth of cash voucher. It equivalent to 0.4% cash back for that spending. In reality it is lesser than 0.4% as the cash voucher (eg Giant voucher) that you use will not qualify for grocery cash back. So, if you can get another cash back card that can offer you at least 0.4% cb, it is definately better than using the MUVI swiping on non match day. Im sure majority here are converting all of our tps to miles instead of vouchers |

|

|

Mar 26 2019, 01:50 PM Mar 26 2019, 01:50 PM

|

Senior Member

2,680 posts Joined: Dec 2010 |

QUOTE(fruitie @ Mar 26 2019, 01:47 PM) Not targeting for vouchers obviously. I already maxed out my PBB VS, QMC, SCB JOP, LFC and MBB FCB VS for BP. Not forgetting AmEx Plat for other usage and UOB YOLO for bills. No intention to add more cards as I'm trying to consolidate and remove some lowly utilized cards. Nevertheless, if I use for MUVI and AR, usually for airmiles purpose. Haha I was right. We have almost identical CC usage strategy. |

|

|

|

|

|

Mar 26 2019, 01:50 PM Mar 26 2019, 01:50 PM

Show posts by this member only | IPv6 | Post

#4514

|

Senior Member

1,745 posts Joined: Jul 2015 |

Unless u spend too little , or swimming in miles...

|

|

|

Mar 26 2019, 01:58 PM Mar 26 2019, 01:58 PM

|

|

Staff

72,841 posts Joined: Sep 2005 From: KUL |

QUOTE(lilsunflower @ Mar 26 2019, 01:46 PM) Good analysis, but I think fruitie has run out of CB cards for this month. Both of us used to focus on CB before getting M2P and I know her card inventory is very similar to mine. Thankfully I still have BP balance from Soton (and Arsenal, which was a wasted gamble) for tomorrow's Lazada sale. Since getting M2P I've changed my spending habits slightly to spend at places which accept Amex. Can hit about 30:70 ratio for Amex:MUVI spending. Never ever going to redeem vouchers again and instead use for KF miles. QUOTE(lilsunflower @ Mar 26 2019, 01:50 PM) Yeah, this month's expenses suddenly shot up a lot and I suddenly realised I didn't have enough CB cards. |

|

|

Mar 26 2019, 03:41 PM Mar 26 2019, 03:41 PM

|

Junior Member

503 posts Joined: Nov 2006 |

QUOTE(fruitie @ Mar 26 2019, 01:47 PM) You will need to call CS to turn on your online transactions feature. No wonder! I was thinking why cannot link.Not targeting for vouchers obviously. I already maxed out my PBB VS, QMC, SCB JOP, LFC and MBB FCB VS for BP. Not forgetting AmEx Plat for other usage and UOB YOLO for bills. No intention to add more cards as I'm trying to consolidate and remove some lowly utilized cards. Nevertheless, if I use for MUVI and AR, usually for airmiles purpose. Thanks. Will call CS. |

|

|

Mar 26 2019, 03:53 PM Mar 26 2019, 03:53 PM

|

Junior Member

283 posts Joined: Mar 2015 |

|

|

|

Mar 26 2019, 04:11 PM Mar 26 2019, 04:11 PM

|

All Stars

12,291 posts Joined: Aug 2006 |

QUOTE(vrek @ Mar 26 2019, 03:53 PM) Cheques are useful for: Cheque number is useful for tracking payments and accounts reconciliation. Online transfers can be problematic as some banks don't list details....1. Moving large amount of money (ie RM200K) - place FD, pay downpayment, etc 2. Some Chinese school still oldschool - accepts cheque payment only |

|

|

Mar 26 2019, 04:19 PM Mar 26 2019, 04:19 PM

|

Senior Member

1,516 posts Joined: Oct 2005 |

QUOTE(fruitie @ Mar 26 2019, 11:49 AM) That's what I thought as well. No more better cards. Suddenly I feel lack of cards. haha... I feel you... that's what I been through when I started move into this.... struggling between CT PM... hahaHowever, I'm also thinking to get waiver for both my SCB WM and Citibank PM, so I will swipe RM 1k-2k there to show I am using their cards though my usage was less than RM 200 for both cards last year and got AF waiver. I don't think I will have such luck anymore this year. Will do that when their AF date is approaching. So, can keep MUVI aside for a while. QUOTE(rivetindigo @ Mar 26 2019, 11:54 AM) Base on my spending experience using m2c for the past 3 months, not many merchant accept amex. Even some rolex ad does not accept amex. Its like 90% spending on visa vs 10% amex. Hope there will be more merchant accepts amex 😅 but now Boost, Favepay, Grabpay is more around the market, easier to spend with amex... hehe...btw, which are those rolex AD you mean? |

|

|

Mar 26 2019, 05:34 PM Mar 26 2019, 05:34 PM

Show posts by this member only | IPv6 | Post

#4520

|

Junior Member

206 posts Joined: Jan 2013 |

QUOTE(ProxMatoR @ Mar 26 2019, 04:19 PM) haha... I feel you... that's what I been through when I started move into this.... struggling between CT PM... haha Yes...i do use boost, less on grabpay and fave...but now Boost, Favepay, Grabpay is more around the market, easier to spend with amex... hehe... btw, which are those rolex AD you mean? The rolex ad is at klcc, but i found one that accept amex at gardens. This post has been edited by rivetindigo: Mar 26 2019, 05:35 PM |

| Change to: |  0.0194sec 0.0194sec

0.83 0.83

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 12:29 AM |