Outline ·

[ Standard ] ·

Linear+

Fundsupermart.com v14, Happy 牛(bull!) Year

|

dasecret

|

Jun 1 2016, 03:30 PM Jun 1 2016, 03:30 PM

|

|

QUOTE(river.sand @ Jun 1 2016, 03:15 PM) I am confused how bond fund's platform fee works  Anyone care to explain? RHB Asian Total Asian FundInitial Cost - 1,500 Current Cost - 1,499.42 ( down 0.58) Platform Fee Sell: Units Sold - 0.93 Sale Price - 0.6049 Amount - 0.56NAV on the day platform fee was charged: 1453.33 0.05% of that is 0.73See https://www.fundsupermart.com.my/main/faq/1...atform-Fee-8467Under HOW DO I CALCULATE THE BOND FUND PLATFORM FEE THAT I NEED TO PAY? "The bond fund platform fee is accrued daily and deducted based on the account holdings on a quarterly basis." |

|

|

|

|

|

SUSyklooi

|

Jun 2 2016, 08:50 AM Jun 2 2016, 08:50 AM

|

|

my same portfolio had a good erection last month after a prolonged refractory.  portfolio up + 3% in a month. hope you guys are better too.... Attached thumbnail(s)

|

|

|

|

|

|

wil-i-am

|

Jun 2 2016, 08:58 AM Jun 2 2016, 08:58 AM

|

|

QUOTE(yklooi @ Jun 2 2016, 08:50 AM)  my same portfolio had a good erection last month after a prolonged refractory.  portfolio up + 3% in a month. hope you guys are better too.... Can u sustain d gud erection?  |

|

|

|

|

|

SUSyklooi

|

Jun 2 2016, 09:04 AM Jun 2 2016, 09:04 AM

|

|

QUOTE(wil-i-am @ Jun 2 2016, 08:58 AM) Can u sustain d gud erection?  I hope can ..... with YELLEN just hinted of a good time for a hike I already high.... if she acted and showed her moves this month ....  |

|

|

|

|

|

SUSDavid83

|

Jun 2 2016, 09:38 AM Jun 2 2016, 09:38 AM

|

|

My portfolio also same:

Apr ROI: 0.4% ---> May ROI: 6.0%

Apr IRR: 0.1% ---> May IRR: 1.8%

Partial reason could be due to weaken MYR 3.91XX (Apr 30th) to 4.10XX (May 31st).

This post has been edited by David83: Jun 2 2016, 09:40 AM

|

|

|

|

|

|

xuzen

|

Jun 2 2016, 10:20 AM Jun 2 2016, 10:20 AM

|

|

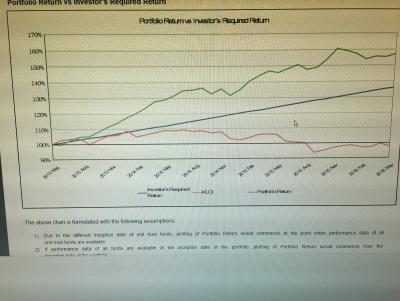

QUOTE(David83 @ Jun 2 2016, 09:38 AM) My portfolio also same: Apr ROI: 0.4% ---> May ROI: 6.0% Apr IRR: 0.1% ---> May IRR: 1.8% Partial reason could be due to weaken MYR 3.91XX (Apr 30th) to 4.10XX (May 31st). May the odds ever be in your favour! Below is my "syiok-sendiri" portfolio aka Algozen's recommended portfolio. Xuzen. p/s Looks like it beat the heluva KLCI. NB: The investors desired return is set at 12% p.a. This post has been edited by xuzen: Jun 2 2016, 10:25 AM Attached thumbnail(s)

|

|

|

|

|

|

SUSDavid83

|

Jun 2 2016, 10:24 AM Jun 2 2016, 10:24 AM

|

|

QUOTE(xuzen @ Jun 2 2016, 10:20 AM) Mr crystal ball, why are you attaching that graph to me? |

|

|

|

|

|

xuzen

|

Jun 2 2016, 10:26 AM Jun 2 2016, 10:26 AM

|

|

QUOTE(David83 @ Jun 2 2016, 10:24 AM) Mr crystal ball, why are you attaching that graph to me? No particular reason! Just wanna show whose balls are bigger, that's all....    |

|

|

|

|

|

SUSDavid83

|

Jun 2 2016, 10:28 AM Jun 2 2016, 10:28 AM

|

|

QUOTE(xuzen @ Jun 2 2016, 10:26 AM) I'm not bragging but I think the main contributor is also forex. I don't touch my portfolio for months. This post has been edited by David83: Jun 2 2016, 10:28 AM |

|

|

|

|

|

xuzen

|

Jun 2 2016, 10:32 AM Jun 2 2016, 10:32 AM

|

|

QUOTE(David83 @ Jun 2 2016, 10:28 AM) I'm not bragging but I think the main contributor is also forex. I don't touch my portfolio for months. Forex ke, itu ke, ini ke... a win is still a win. Bravo! Xuzen |

|

|

|

|

|

Ramjade

|

Jun 2 2016, 10:58 AM Jun 2 2016, 10:58 AM

|

|

xuzen I thought you said don't focus on one country specifically. The fund should be mixed. Then how come you are buying the manuallife USA? That's just focusing on one country specifically. Just a question. Hope you don't mind answering.

|

|

|

|

|

|

xuzen

|

Jun 2 2016, 11:11 AM Jun 2 2016, 11:11 AM

|

|

QUOTE(Ramjade @ Jun 2 2016, 10:58 AM) xuzen I thought you said don't focus on one country specifically. The fund should be mixed. Then how come you are buying the manuallife USA? That's just focusing on one country specifically. Just a question. Hope you don't mind answering. Apa yang awak membebel nih? Sejak bila gua hanya beli UTF Uncle Sam aje? |

|

|

|

|

|

wil-i-am

|

Jun 2 2016, 11:30 AM Jun 2 2016, 11:30 AM

|

|

QUOTE(xuzen @ Jun 2 2016, 10:26 AM) V will know whose ball is bigger when Euro 2016 start on 10/6  |

|

|

|

|

|

wil-i-am

|

Jun 2 2016, 12:00 PM Jun 2 2016, 12:00 PM

|

|

FSM Fund Choice: AmAsia Pacific REITs-Class B (MYR) [June 2016] https://www.fundsupermart.com.my/main/resea...June-2016--7153 |

|

|

|

|

|

river.sand

|

Jun 2 2016, 05:07 PM Jun 2 2016, 05:07 PM

|

|

QUOTE(xuzen @ Jun 2 2016, 10:20 AM) May the odds ever be in your favour! Below is my "syiok-sendiri" portfolio aka Algozen's recommended portfolio. Xuzen. p/s Looks like it beat the heluva KLCI. NB: The investors desired return is set at 12% p.a. I also invest in Bursa, and I beat KLCI in the last few years. But seriously, KLCI is not a good benchmark. Why? Because KLCI's components stocks are big caps which don't grow fast. Dividends may be good, but they are not counted towards the index. |

|

|

|

|

|

kimyee73

|

Jun 2 2016, 05:38 PM Jun 2 2016, 05:38 PM

|

|

Below is my Main portfolio May performance based on 31/5/16 NAV | | | | Mar | Apr | May | | Overall | | IRR | 5.36% | 6.81% | 8.95% | | Top 3 Funds | % of Port | | | | | | AmPrecious Metal | 8.6% | IRR | 50.15% | 74.73% | 54.2% | | EI Small Caps | 4.4% | IRR | 20.87% | 19% | 19.23% | | RHB Small Cap Opp | 2.7% | IRR | 13.53% | 8.62% | 7.56% | | Bottom 3 Eq Funds | % Port | | | | | | RHB Smart Treasure | 2.4% | ROI | -3.56% | -5.51% | -5.48% | | TA Small Cap | 1.2% | ROI | -5.28% | -6.53% | -6.06% | | AMB Ethical | 4.5% | IRR | -4.1% | -5.67% | -6.13% |

|

|

|

|

|

|

SUSyklooi

|

Jun 2 2016, 05:48 PM Jun 2 2016, 05:48 PM

|

|

QUOTE(kimyee73 @ Jun 2 2016, 05:38 PM) Below is my Main portfolio May performance based on 31/5/16 NAV | Overall | | IRR | 5.36% | 6.81% | 8.95% | MOM UP 2.1% IRR

| Top 3 Funds | % of Port | | | | | | AmPrecious Metal | 8.6% | IRR | 50.15% | 74.73% | 54.2% | MOM drops 20% IRR

| EI Small Caps | 4.4% | IRR | 20.87% | 19% | 19.23% | MOM drops 0.23% IRR

| RHB Small Cap Opp | 2.7% | IRR | 13.53% | 8.62% | 7.56% | MOM drops 0.9% IRR| Bottom 3 Eq Funds | % Port | | | | | | RHB Smart Treasure | 2.4% | ROI | -3.56% | -5.51% | -5.48% | | TA Small Cap | 1.2% | ROI | -5.28% | -6.53% | -6.06% | | AMB Ethical | 4.5% | IRR | -4.1% | -5.67% | -6.13% |

just envy your IRR performance  btw,....M-O-M irr performance of your funds does not moves a lot....but how come the IRR of yr portfolio moved up 2.1% IRR?  |

|

|

|

|

|

kimyee73

|

Jun 2 2016, 05:59 PM Jun 2 2016, 05:59 PM

|

|

QUOTE(yklooi @ Jun 2 2016, 05:48 PM) just envy your IRR performance  btw,....M-O-M irr performance of your funds does not moves a lot....but how come the IRR of yr portfolio moved up 2.1% IRR?  Because what you see are just 6 of my funds, many of my other funds moved up as well such as Ponzi 2.0 from -9.81% to -3.42%, CIMB Greater China from -4.56% to 5.78%, RHB ATR from -1.25% to 4.61%, RHB EMBF from 1.7% to 7.07%, Libra Leisure from 0.42% to 7.54% and Manulife India from -6.93% to 0.72%. These form 35% of my portfolio size. |

|

|

|

|

|

SUSyklooi

|

Jun 2 2016, 06:02 PM Jun 2 2016, 06:02 PM

|

|

QUOTE(kimyee73 @ Jun 2 2016, 05:59 PM) Because what you see are just 6 of my funds, many of my other funds moved up as well such as Ponzi 2.0 from -9.81% to -3.42%, CIMB Greater China from -4.56% to 5.78%, RHB ATR from -1.25% to 4.61%, RHB EMBF from 1.7% to 7.07%, Libra Leisure from 0.42% to 7.54% and Manulife India from -6.93% to 0.72%. These form 35% of my portfolio size.  BAD of me....missed that in that case....    for you.... |

|

|

|

|

|

TakoC

|

Jun 2 2016, 07:27 PM Jun 2 2016, 07:27 PM

|

|

QUOTE(kimyee73 @ Jun 2 2016, 05:38 PM) Below is my Main portfolio May performance based on 31/5/16 NAV | | | | Mar | Apr | May | | Overall | | IRR | 5.36% | 6.81% | 8.95% | | Top 3 Funds | % of Port | | | | | | AmPrecious Metal | 8.6% | IRR | 50.15% | 74.73% | 54.2% | | EI Small Caps | 4.4% | IRR | 20.87% | 19% | 19.23% | | RHB Small Cap Opp | 2.7% | IRR | 13.53% | 8.62% | 7.56% | | Bottom 3 Eq Funds | % Port | | | | | | RHB Smart Treasure | 2.4% | ROI | -3.56% | -5.51% | -5.48% | | TA Small Cap | 1.2% | ROI | -5.28% | -6.53% | -6.06% | | AMB Ethical | 4.5% | IRR | -4.1% | -5.67% | -6.13% |

How long have you hold your EI Small Cap? |

|

|

|

|

Jun 1 2016, 03:30 PM

Jun 1 2016, 03:30 PM

Quote

Quote

0.0398sec

0.0398sec

0.30

0.30

6 queries

6 queries

GZIP Disabled

GZIP Disabled