QUOTE(Ramjade @ Apr 1 2021, 04:42 PM)

FSM SG is only good for SG stocks. Nothing else. Do not use their platform to buy unit trust or overseas stocks unless you like to give them free money.

Yes, even their "managed portfolio" sucksFundsupermart Singapore, Let's have a separate thread

|

|

Apr 2 2021, 02:00 PM Apr 2 2021, 02:00 PM

Show posts by this member only | IPv6 | Post

#801

|

Senior Member

2,337 posts Joined: Oct 2014 |

|

|

|

|

|

|

Apr 3 2021, 09:19 AM Apr 3 2021, 09:19 AM

Show posts by this member only | IPv6 | Post

#802

|

All Stars

24,333 posts Joined: Feb 2011 |

|

|

|

Dec 2 2021, 02:22 PM Dec 2 2021, 02:22 PM

|

Junior Member

692 posts Joined: Nov 2021 |

Thanks to a kind poster from FSM Msia thread I am now in FSM Spore thread.

The latest promotion is very attractive. Any takers? secure.fundsupermart.com/fsm/article/view/rcms243720/announcement-invest-in-bite-sized-unit-trusts-with-reduced-minimum-initial-investment |

|

|

Dec 2 2021, 04:35 PM Dec 2 2021, 04:35 PM

Show posts by this member only | IPv6 | Post

#804

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(sgh @ Dec 2 2021, 02:22 PM) Thanks to a kind poster from FSM Msia thread I am now in FSM Spore thread. Don't bother with FSM SG unless you like to give free money to FSM SG. They have quarterly platform fees.The latest promotion is very attractive. Any takers? secure.fundsupermart.com/fsm/article/view/rcms243720/announcement-invest-in-bite-sized-unit-trusts-with-reduced-minimum-initial-investment |

|

|

Dec 3 2021, 11:32 AM Dec 3 2021, 11:32 AM

|

All Stars

10,340 posts Joined: Jan 2003 |

|

|

|

Dec 3 2021, 12:14 PM Dec 3 2021, 12:14 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(Ramjade @ Dec 2 2021, 04:35 PM) Don't bother with FSM SG unless you like to give free money to FSM SG. They have quarterly platform fees. Hi as WhitE LighteR point out I am from Spore. All investment platform charges fees else how they survive? Regarding your concern of platform fees my reasoning is below.FSM Spore impose 0% sales charge which means you put X dollars all of them go into buying units. With sales charge you actually put (X - sales charge) dollars so you get lesser units. Since it is quarterly, if your fund perform good before the quarterly time is triggered, the fund profits can cover the platform fees. The new promotion means with 100 I can buy more new funds but take note to sell it is still mostly min holding 1000 which means you can't sell that 100 partially unless you sell all totally. The 100 low capital means I can risk to put into much more riskier funds and hope to get higher returns which previously I dare not as lose is lose 1000 instead of 100. Imagine 1000 can buy up to 10 funds each 100 (of cuz I not doing that in reality it is just for illustration). |

|

|

|

|

|

Dec 3 2021, 02:16 PM Dec 3 2021, 02:16 PM

Show posts by this member only | IPv6 | Post

#807

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(sgh @ Dec 3 2021, 12:14 PM) Hi as WhitE LighteR point out I am from Spore. All investment platform charges fees else how they survive? Regarding your concern of platform fees my reasoning is below. Wrong. Dollardex and poems got no quarterly platform fees.FSM Spore impose 0% sales charge which means you put X dollars all of them go into buying units. With sales charge you actually put (X - sales charge) dollars so you get lesser units. Since it is quarterly, if your fund perform good before the quarterly time is triggered, the fund profits can cover the platform fees. The new promotion means with 100 I can buy more new funds but take note to sell it is still mostly min holding 1000 which means you can't sell that 100 partially unless you sell all totally. The 100 low capital means I can risk to put into much more riskier funds and hope to get higher returns which previously I dare not as lose is lose 1000 instead of 100. Imagine 1000 can buy up to 10 funds each 100 (of cuz I not doing that in reality it is just for illustration). So said as I said if you like paying fees and giving away free money, by all means use FSM sg for uni trust. If you are Singaporean or eorkig in sg with some local address, I will recommend dollardex. Poems is for Malaysian ehi don't have sg address, not working or studying in sg.pick wheicher you want. If you still want to pick FSM cause you can buy smaller funds, by all means go ahead. Just heads up you will be paying more over the long term Vs usih dollardex or Poems. This post has been edited by Ramjade: Dec 3 2021, 02:19 PM |

|

|

Dec 3 2021, 03:30 PM Dec 3 2021, 03:30 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(Ramjade @ Dec 3 2021, 02:16 PM) Wrong. Dollardex and poems got no quarterly platform fees. Hi I do have dollarDex acct and why I choose FSM was too confidential to discuss here. Basically their online platform workflow has some "flaw". But that was in year 2000 and now I check it is under Aviva maybe they have improved. I also have a POEMS acct but that is primarily a ETF/stocks platform more than UT and their UT features are quite limited in year 2000 but now I check they are quite comprehensive on UT now.So said as I said if you like paying fees and giving away free money, by all means use FSM sg for uni trust. If you are Singaporean or eorkig in sg with some local address, I will recommend dollardex. Poems is for Malaysian ehi don't have sg address, not working or studying in sg.pick wheicher you want. If you still want to pick FSM cause you can buy smaller funds, by all means go ahead. Just heads up you will be paying more over the long term Vs usih dollardex or Poems. So the 100 min investment is the selling point for FSM now. Seriously over 20+ years in FSM my fund profits covered the platform fees I have checked for both CPF and cash. Key is choose the correct fund and invest medium to long term. Don't do too much buy/sell if want to do that use POEMS ETF/stocks for faster profits/losses. PS Btw I'm Sporean TOS liked this post

|

|

|

Dec 4 2021, 03:25 PM Dec 4 2021, 03:25 PM

|

Junior Member

692 posts Joined: Nov 2021 |

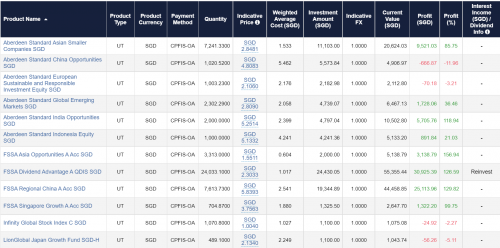

First off let me clarify I am not a FSM Spore employee nor did I receive monies from FSM Spore to help them promote their services. I am with them since 2000 so maybe I can share some snippet of my portfolio.

Attached is some of my CPF-OA investment. Look at entries in green color they are there for at least 10+ years. Then look at the entries in red color those are bought this year 2021. So what fund investment had taught me is this is really for medium to long term holding. If your expectation is within 1-2 year see green color maybe funds are not suitable for you. For faster returns try ETF/stocks or perhaps casino even. Those are super fast profits/losses. As for ppl asking why I want to pay FSM quarterly platform fees correct? If you look at my green color profits and % what are those platform fees? Agreed I can get even more profits if there is 0 platform fees which is why I am now re-looking at dollarDEX and POEMS as they have improved their fund related info and services so much after so many years later. I believe since yesterday to next week will be a sea of red. This happen so many times over my 20+ years investment horizon. You have to overcome this fear. Once a lot of ppl start pulling out may actually be the best time to enter. Again this is not 100% true as I have lost using this strategy too. Lastly, like all investment diversification is key. Do not just invest on funds or ETF or stocks alone. I have funds, REIT and non-REIT stocks, Fixed Deposit, insurance endowment etc at the same time too. And most importantly cold hard cash must maintain a portion for emergency. This is in case you are forced to liquidate those built-up investment at a big loss for emergency needs.  |

|

|

Dec 4 2021, 10:23 PM Dec 4 2021, 10:23 PM

|

Junior Member

128 posts Joined: Jan 2007 |

QUOTE(Ramjade @ Dec 3 2021, 02:16 PM) Wrong. Dollardex and poems got no quarterly platform fees. Wondering any reason you recommend dollardex over poems?So said as I said if you like paying fees and giving away free money, by all means use FSM sg for uni trust. If you are Singaporean or eorkig in sg with some local address, I will recommend dollardex. Poems is for Malaysian ehi don't have sg address, not working or studying in sg.pick wheicher you want. If you still want to pick FSM cause you can buy smaller funds, by all means go ahead. Just heads up you will be paying more over the long term Vs usih dollardex or Poems. Thinking to open an account with either one for low risk investment like Bond Fund or REITS, any recommendations? Thanks! |

|

|

Dec 4 2021, 11:49 PM Dec 4 2021, 11:49 PM

Show posts by this member only | IPv6 | Post

#811

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(TaiGoh @ Dec 4 2021, 10:23 PM) Wondering any reason you recommend dollardex over poems? Because if you got no sg address or sg working pass, they won't accept you. Not sure which one. It's been long time since I emailed them.Thinking to open an account with either one for low risk investment like Bond Fund or REITS, any recommendations? Thanks! If you are a Malaysian who's not rich looking to invest overseas, you won't have sg address and unlikely you are working in sg. |

|

|

Dec 5 2021, 12:30 AM Dec 5 2021, 12:30 AM

|

Junior Member

128 posts Joined: Jan 2007 |

QUOTE(Ramjade @ Dec 4 2021, 11:49 PM) Because if you got no sg address or sg working pass, they won't accept you. Not sure which one. It's been long time since I emailed them. If I am working in Singapore for example, is there any advantage to choose Dollardex over poems just wondering?If you are a Malaysian who's not rich looking to invest overseas, you won't have sg address and unlikely you are working in sg. |

|

|

Dec 5 2021, 12:45 AM Dec 5 2021, 12:45 AM

Show posts by this member only | IPv6 | Post

#813

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(TaiGoh @ Dec 5 2021, 12:30 AM) If I am working in Singapore for example, is there any advantage to choose Dollardex over poems just wondering? No. Just come down to interface, ease of use and see whether they have the fund you want to buy or not. TaiGoh liked this post

|

|

|

|

|

|

Dec 5 2021, 12:57 PM Dec 5 2021, 12:57 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(TaiGoh @ Dec 5 2021, 12:30 AM) If I am working in Singapore for example, is there any advantage to choose Dollardex over poems just wondering? Some history poems has been around in Spore for a long time even earlier than FSM or dollarDex which started around 2000. Poems were doing stock/ETF investing more than fund so their fund selection in those times are limited since not their main focus.Now year 2021 I would think if in future you want to also invest stock/ETF on top of fund Poems is better. dollarDex seem only focus on fund investment. As for fund selection I have checked both offer almost same. Btw year 2000 dollarDex online interface was 'flawed' which is why I opt for FSM then. Now is 2021 they may have improved alot. |

|

|

Dec 5 2021, 01:14 PM Dec 5 2021, 01:14 PM

|

Junior Member

692 posts Joined: Nov 2021 |

Anyone invest on funds purely based on FSM recommended funds? Let me share my experience.

Their recommendations are not 100% flop but it is not 100% win too. Reason I can think of is their recommendations are based on past historical performance no indication of its future performance. Second some funds when they recommend are already at their historical highest fund price since launched. It can go even higher but can fell down too! Like stocks,etf once some brokerage recommend price shoot up so already invested ppl are just waiting for these newbies rushing in to sell to them and share price drop. Fund is a basket of stocks so lesser drop but still it is drop. My opinion for FSM recommended fund is it is worth a look but don't just plainly invest. E.g the fund is at highest price the probability of price drop can be the same as going even higher. Do more research maybe a competitor fund with very close performance say second place but price still way below highest price is a better invest than the actual recommended fund etc etc. |

|

|

Dec 5 2021, 04:35 PM Dec 5 2021, 04:35 PM

|

Junior Member

128 posts Joined: Jan 2007 |

QUOTE(sgh @ Dec 5 2021, 12:57 PM) Some history poems has been around in Spore for a long time even earlier than FSM or dollarDex which started around 2000. Poems were doing stock/ETF investing more than fund so their fund selection in those times are limited since not their main focus. Thanks.Now year 2021 I would think if in future you want to also invest stock/ETF on top of fund Poems is better. dollarDex seem only focus on fund investment. As for fund selection I have checked both offer almost same. Btw year 2000 dollarDex online interface was 'flawed' which is why I opt for FSM then. Now is 2021 they may have improved alot. If you talking about US Stocks or ETFs, I will use Interactive Brokers, did not really explore SG Stocks or ETFs yet but I think that can be achieved with Interactive Brokers as well, just not sure which one is cheaper. |

|

|

Dec 5 2021, 05:53 PM Dec 5 2021, 05:53 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(TaiGoh @ Dec 5 2021, 04:35 PM) Thanks. Ok before one try to invest in stock,etf directly be aware of how it works regardless you use which broker. Their price is real time what you buy and sell is locked at the time of txn. Fund and SA are forward pricing I think. When you do a buy or sell the price you see is indicative not the actual price at time of txn.If you talking about US Stocks or ETFs, I will use Interactive Brokers, did not really explore SG Stocks or ETFs yet but I think that can be achieved with Interactive Brokers as well, just not sure which one is cheaper. I read in SA thread ppl complain getting less of what they see on screen when they sell at SA and long time ago in FSM too. These ppl do not fully understand how it works before they invest. Buy overseas stock,etf always have this extra fees, currency conversion etc factors involved when you perform a trade. You can check online all the various brokerages and banks for the lowest fee. I avoid all that by invest in funds where fund managers do all those for me by paying them fees in the form of expense ratio etc. For local stock,etf can use poems but sometimes the bid and ask can be a pain. You either buy up or sell down if cannot wait. Take note of the buy see fees incurred for each trade. The more you flip the more you pay and that is when brokerage firm very happy as each trade they earn monies. Lastly happy investing and please invest what you can lose. Don't invest your whole fortune into it. |

|

|

Dec 5 2021, 06:31 PM Dec 5 2021, 06:31 PM

Show posts by this member only | IPv6 | Post

#818

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(TaiGoh @ Dec 5 2021, 04:35 PM) Thanks. Don't bother with poems or fsm for us stocks and etf. They are expensive Vs interactive broker.If you talking about US Stocks or ETFs, I will use Interactive Brokers, did not really explore SG Stocks or ETFs yet but I think that can be achieved with Interactive Brokers as well, just not sure which one is cheaper. Also save yourself money and don't bother about sg stocks. They are only good for reits and banks. Nothing else. QUOTE(sgh @ Dec 5 2021, 05:53 PM) Ok before one try to invest in stock,etf directly be aware of how it works regardless you use which broker. Their price is real time what you buy and sell is locked at the time of txn. Fund and SA are forward pricing I think. When you do a buy or sell the price you see is indicative not the actual price at time of txn. Actually you pay more for funds at 1.8%p.a Vs DIY at around 0.4% one time fee if you are just holding.I read in SA thread ppl complain getting less of what they see on screen when they sell at SA and long time ago in FSM too. These ppl do not fully understand how it works before they invest. Buy overseas stock,etf always have this extra fees, currency conversion etc factors involved when you perform a trade. You can check online all the various brokerages and banks for the lowest fee. I avoid all that by invest in funds where fund managers do all those for me by paying them fees in the form of expense ratio etc. For local stock,etf can use poems but sometimes the bid and ask can be a pain. You either buy up or sell down if cannot wait. Take note of the buy see fees incurred for each trade. The more you flip the more you pay and that is when brokerage firm very happy as each trade they earn monies. Lastly happy investing and please invest what you can lose. Don't invest your whole fortune into it. Whether the fund is making money or losing money, you are guaranteed to lose 1.8%p.a This post has been edited by Ramjade: Dec 5 2021, 06:31 PM TaiGoh liked this post

|

|

|

Dec 6 2021, 02:31 AM Dec 6 2021, 02:31 AM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(Ramjade @ Dec 5 2021, 06:31 PM) Don't bother with poems or fsm for us stocks and etf. They are expensive Vs interactive broker. Hi you seem to have very strong opinion on some investment ppl have done. Can I ask how old are you in real life and how long have you been investing?Also save yourself money and don't bother about sg stocks. They are only good for reits and banks. Nothing else. Actually you pay more for funds at 1.8%p.a Vs DIY at around 0.4% one time fee if you are just holding. Whether the fund is making money or losing money, you are guaranteed to lose 1.8%p.a E.g you say sg stocks only good for REIT and banks, fund make or lose monies guaranteed to lose 1.8% etc. If you are looking for quick bucks I don't think sg us stock,etf or funds are suitable for you. As Msian Genting Highlands casino is a few hrs drive away. Play big small 5-10 min you get your 100 or 0% profits,losses immediately. This is a FSM Spore thread so I thought this is a good forum to exchange views on fund investing but you keep talking about lose monies. Can I ask you lose monies very big in FSM before? If yes I can understand becuz investment inherently come with risk. I hope you lost not a lot so can recoup via interactive brokers as you mention. |

|

|

Dec 6 2021, 02:49 AM Dec 6 2021, 02:49 AM

Show posts by this member only | IPv6 | Post

#820

|

All Stars

24,333 posts Joined: Feb 2011 |

QUOTE(sgh @ Dec 6 2021, 02:31 AM) Hi you seem to have very strong opinion on some investment ppl have done. Can I ask how old are you in real life and how long have you been investing? Age is not importance. I have been doing it for almost 7 years.E.g you say sg stocks only good for REIT and banks, fund make or lose monies guaranteed to lose 1.8% etc. If you are looking for quick bucks I don't think sg us stock,etf or funds are suitable for you. As Msian Genting Highlands casino is a few hrs drive away. Play big small 5-10 min you get your 100 or 0% profits,losses immediately. This is a FSM Spore thread so I thought this is a good forum to exchange views on fund investing but you keep talking about lose monies. Can I ask you lose monies very big in FSM before? If yes I can understand becuz investment inherently come with risk. I hope you lost not a lot so can recoup via interactive brokers as you mention. I have been though everything, unit trust, sg stocks us stocks. I am just staring the obvious. Sg stocks are lousy quality. I stay by what I said, they are only good for reits and banks. Maybe around 4 stocks that are good outside of reits but otherwise the rest are rubbish. Its a fact. When you invest in unit trust whether the fund make or lose money, you are paying 1.5-1.8%p.a in fees. That's why I said you will lose 1.8%p.a unless you DIY. No I don't go Genting. I will only recommend fsm for sg reits. That's all. Other stuff, use other platform. Other stuff apart from sg reits, I will tell everyone avoid FSM at all cost. Reasons: 1) why pay more? You are losing good money over time by paying platform fees when there's no fees on their competitor site. 2) they sucks for overseas stocks. 3) cause other better plarofrm exist and I don't have loyalty to FSM. 4) I will recommend the platform if I used it and like it. If it fail my test, I won't recommend it all. For now fsm sg have only passed my test for sg reits and fail other stuff. If one day, it decided to have no plarofrm4 fees and us fees is as competitive as interactive broker, Moomoo, tiger, I will recommend it. For now no. It's only useful for sg REITs. I use poems sg for unit trust and interactive broker for us stocks. So as I said above, if you like giving free money to FSM, by all means go ahead. I dont give free money to fsm or banks if I can help it. I can't and I won't stop you. I just tell you that you are losing good money to FSM over long term. This post has been edited by Ramjade: Dec 6 2021, 02:56 AM TaiGoh liked this post

|

| Change to: |  0.0310sec 0.0310sec

0.29 0.29

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 04:30 AM |