QUOTE(Ramjade @ Dec 6 2021, 02:49 AM)

Age is not importance. I have been doing it for almost 7 years.

I have been though everything, unit trust, sg stocks us stocks.

Msian no need serve NS so 7 years I think you are still not over 30. I hate to use age as argument as it will lead to another topic but just to inform I am in investing 20+ years and reaching 50 soon.

Ok back to topic you are of cuz entitled to your view but when you keep saying you choose X confirm lose monies is purely your point of view and experience. It does not mean everyone is losing monies.

How about I tell you poems for some investment you are losing monies over a long term horizon due to frequent trading? Contra, short sell are common strategies there for a lot investors. I view those close to casino play.

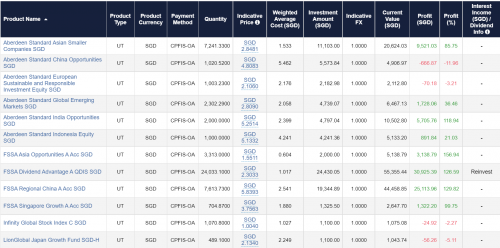

Also in Spore we have this CPF equivalent to your Msia EPF which we cannot withdraw all at age 55 which is why for FSM most of my trades are for CPF which I attach a screenshot in my earlier post. I have cash trade elsewhere which I did not reveal as this is a FSM Spore thread so I want to stick to topic.

You are welcome to post your opinion confirm lose monies etc as this is a forum for all but I feel I need to speak out and let other readers read both sides of the story and form their own opinion whether confirm lose monies is valid based on your argument.

Lastly I will continue to share fund related info in this FSM Spore thread unless admin feel I am violating forum rules. I will also try not to talk about other investment platform as a sign of respect to this thread that is dedicated to FSM Spore.

Dec 2 2021, 02:22 PM

Dec 2 2021, 02:22 PM

Quote

Quote

0.0605sec

0.0605sec

1.12

1.12

7 queries

7 queries

GZIP Disabled

GZIP Disabled