QUOTE(kimyee73 @ Oct 22 2015, 11:40 PM)

QUOTE(kimyee73 @ Oct 23 2015, 12:54 PM)

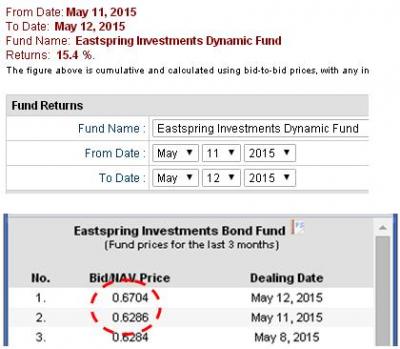

Switch out profit only. If budget is good, still have the capital to ride up. If no good, I have ammunition to go back in when it crash.

QUOTE(Ramjade @ Oct 23 2015, 02:22 PM)

see the example as posted by kimyee73 above?when you sell some units...you take out some money out of that fund like the RM 19800 you mentioned.

some don't advise that....like post# 576.

I too says...let it RUN until the valuation is "seems" to be a lot higher than others..

Oct 23 2015, 02:30 PM

Oct 23 2015, 02:30 PM

Quote

Quote

0.0190sec

0.0190sec

0.48

0.48

6 queries

6 queries

GZIP Disabled

GZIP Disabled