QUOTE(Avangelice @ Sep 3 2015, 02:40 PM)

Btw who made the mistake of taking advantage of the sales then only regretted it because funds went deep red this week

Ha ha! I already expected this. Keep waiting but may not for long.Fundsupermart.com v11, Grexit or not, Europe will sail on...

|

|

Sep 3 2015, 10:07 PM Sep 3 2015, 10:07 PM

|

Senior Member

1,007 posts Joined: Oct 2006 From: island up north |

|

|

|

|

|

|

Sep 3 2015, 10:47 PM Sep 3 2015, 10:47 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Sep 4 2015, 11:55 AM Sep 4 2015, 11:55 AM

Show posts by this member only | IPv6 | Post

#1983

|

Junior Member

5 posts Joined: Oct 2013 |

QUOTE(ben3003 @ Sep 3 2015, 03:47 PM) i think ppl rush in and buy during merdeka promo, even drop 1%, u still earn 0.5% if u buy at normal charge 2%. That's y those buying with public mutual manurelife agent 5.5% sc, need how long to recover? summore i got fren enter at high, then msia drop like flies, his fund negative double digit until today also cannot recover. Even u buy bond also kena charge at those agent, 5 or 3% i forget oledi. i think is also 5%. Of course lower SC means more savings but entry point NAV matters as well;to me, less sc mean u squeeze more value/unit out of ur investment. I was very apprehensive when Fundsupermart started imposing platform fees on bond funds and have stayed away from bond funds. I just hope Funsupermart Malaysia does not follow in the footsteps of Fundsupermart Singapore and impose platform fees across all funds; A recurring platform fee will eat more into our investment compared to a one off sales charge(SC) |

|

|

Sep 4 2015, 11:56 AM Sep 4 2015, 11:56 AM

Show posts by this member only | IPv6 | Post

#1984

|

Junior Member

5 posts Joined: Oct 2013 |

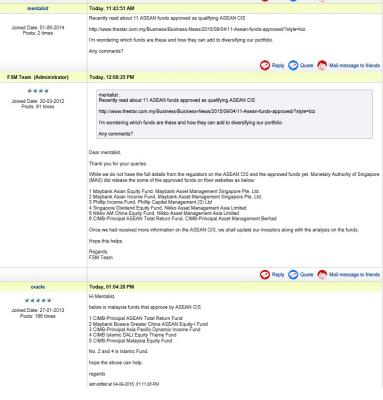

Recently read about 11 ASEAN funds approved as qualifying ASEAN CIS

http://www.thestar.com.my/Business/Busines...oved/?style=biz I'm wondering which funds are these and how they can add to diversifying our portfolio. Any comments? |

|

|

Sep 4 2015, 12:38 PM Sep 4 2015, 12:38 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(cslong @ Sep 4 2015, 11:56 AM) Recently read about 11 ASEAN funds approved as qualifying ASEAN CIS CIMB-PRINCIPAL ASEAN TOTAL RETURN FUNDhttp://www.thestar.com.my/Business/Busines...oved/?style=biz I'm wondering which funds are these and how they can add to diversifying our portfolio. Any comments? URL: http://fundsupermart.com.my/main/fundinfo/...umber=MYCIMB017 Ponzi 2.0 wants to apply for the CIS-compliant: URL: http://www.cimb-principal.com.my/News-@-No...ncome_Fund.aspx This post has been edited by David83: Sep 4 2015, 12:41 PM |

|

|

Sep 4 2015, 04:41 PM Sep 4 2015, 04:41 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

Do you think there's a Malaysia day sales?

|

|

|

|

|

|

Sep 4 2015, 05:28 PM Sep 4 2015, 05:28 PM

Show posts by this member only | IPv6 | Post

#1987

|

Junior Member

5 posts Joined: Oct 2013 |

|

|

|

Sep 4 2015, 07:11 PM Sep 4 2015, 07:11 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Sep 4 2015, 07:38 PM Sep 4 2015, 07:38 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(cslong @ Sep 4 2015, 11:56 AM) Recently read about 11 ASEAN funds approved as qualifying ASEAN CIS found this at FSM website forumhttp://www.thestar.com.my/Business/Busines...oved/?style=biz I'm wondering which funds are these and how they can add to diversifying our portfolio. Any comments? http://www.fundsupermart.com.my/main/commu...pid=0142&page=1 Attached thumbnail(s)

|

|

|

Sep 4 2015, 11:00 PM Sep 4 2015, 11:00 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

FSM Fund Choice: 2 Years Down The Road!

It has been two years since we took the initiative to launch the “FSM Fund Choice” series! While it has just been two short years, the “FSM Fund Choice” series has served well as an excellent tool to introduce investors to variety of funds on our platform. Given the wide range and amount of funds (258 funds as the time of writing) on our platform, it might be quite daunting for investors to process all of the funds’ information (fund fact sheets, semi-annual/annual reports, prospectus, etc.) and figure out those that best suit their investment objectives and fit in their portfolios. This is where these monthly FSM Fund Choice articles can fill the gap, serving as shortcuts for investors to gain exposure and knowledge on opportunistically-selected recommended funds or good quality funds available on our platform, more like the seasonal picks that restaurants have in their menus. These funds were selected based on features such as performance, resiliency, investment universe, investment strategy or even due to the fact that these funds allow investors to tap into regions/countries that we believe have decent upside potentials and could add value to their portfolios. Table 1 below shows a list of fund choices that we have suggested over the past year: OUR TAKE ON PORTFOLIO POSITIONING At this juncture, we continue to overweight equities vis-à-vis bonds, given that the former still poised to deliver higher potential return as compared to the latter. Asia ex-Japan region has always been a sweet spot for investors to invest in and we remain very positive on this region given its potential higher growth and its relatively cheaper valuation after the correction. In terms of single country investments, we prefer nations in the North Asia region, such as Hong Kong and China, and remain underweight positions in Southeast Asia’s countries such as Thailand and Indonesia. On the bond side, being cognisant of the risks of rising interest rate environment going forward, we suggest investors to avoid longer-duration developed sovereign debt while opting for shorter duration bonds that are less sensitive to interest rate changes. Investors can also consider Asia and EM bonds that sports relatively attractive yield spreads among its peers, allowing investors to enjoy higher potential return within the bond space, although investors need to take note that these bond segments come with relatively higher credit risks. CONCLUSION While our list of Recommended Unit Trusts (The Most Anticipated Recommended Funds 2015/16 is OUT!) serves as a starting point for investors, this FSM Fund Choice serves as a complement to it, providing investors with more details on good quality funds available on our platform. Investors who are determined to take a more active role in fund selection and portfolio construction should consider looking into these fund choices. For investors who have enquiries related to these fund choices or the portfolio construction process, they may contact our friendly Client Investment Specialist (CIS) Team at cis.my@fundsupermart.com. URL: http://fundsupermart.com.my/main/research/...-the-road--6260 |

|

|

Sep 4 2015, 11:01 PM Sep 4 2015, 11:01 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

FSM Fund Choice: Libra AsnitaBond Fund [September 2015]

Amid recent volatility in equity markets, investors may be discouraged from equity investments even though the fall in markets have brought valuations to more attractive levels. As investors ride through expected near term volatility, we believe a solid bond fund would help to stabilize the portfolio and deliver decent yields at the same time. Attractive yields, negative correlation with equity markets and a strong track record are the reasons why we have chosen Libra AsnitaBond Fund. CONCLUSION Diversification is a bread and butter concept in the investment world but its importance is only often recognized during the market turmoil. Notwithstanding the old adage of “Don’t Put All Your Eggs in One Basket”, it is also crucial for investors to know how to choose a good “basket” in order to reap a good investment result from a well-constructed portfolio during these volatile times. As Islamic bonds/sukuk provide good value in terms of diversification and yield, we believe Libra AsnitaBond Fund, which has an outstanding historical performance, should be nonetheless a great “basket” for investors who wish to gain some exposures in the Islamic fixed income market. URL: http://fundsupermart.com.my/main/research/...mber-2015--6265 Fund URL: http://fundsupermart.com.my/main/fundinfo/...number=MYLIBABF |

|

|

Sep 5 2015, 08:21 AM Sep 5 2015, 08:21 AM

|

Junior Member

210 posts Joined: Jul 2015 |

Dear sifus, mind to share your opinion of placing money in Cash Management Fund (RHB Cash Management Fund 2)? Sorry if this question has been raised several times

|

|

|

Sep 5 2015, 11:24 AM Sep 5 2015, 11:24 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Lord_Penguin @ Sep 5 2015, 08:21 AM) Dear sifus, mind to share your opinion of placing money in Cash Management Fund (RHB Cash Management Fund 2)? Sorry if this question has been raised several times Q: What are the benefits of the Cash Management Fund? A: Below are some features of the Cash Management Fund: • Zero sales charge to purchase, or to redeem. • Potentially earns higher returns, with the fund actively managed by a dedicated fund manager. (compared to saving a/c rate) • Daily returns on the Cash Management Fund. Daily returns are based on historical pricing. • No lock-in period. As long as there is a sufficient amount of monies maintained in your Cash Management Fund, it can be used to make payment for your cash purchases upon transaction. We will not need to wait for your cheque or Internet bill payment to reach us before we start to process your cash purchases. When you sell your unit trusts, you may choose to park the sales proceeds in the Cash Management Fund to facilitate your future cash purchases, while earning potentially higher returns for it. BUT not as liquid as cash in ATM machines.... |

|

|

|

|

|

Sep 5 2015, 11:26 AM Sep 5 2015, 11:26 AM

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(Lord_Penguin @ Sep 5 2015, 08:21 AM) Dear sifus, mind to share your opinion of placing money in Cash Management Fund (RHB Cash Management Fund 2)? Sorry if this question has been raised several times Tis is a vehicle for u to park idle Funds on temporary basis while waiting for opportunities or intended objectives |

|

|

Sep 5 2015, 12:18 PM Sep 5 2015, 12:18 PM

Show posts by this member only | IPv6 | Post

#1995

|

Junior Member

5 posts Joined: Oct 2013 |

|

|

|

Sep 5 2015, 01:29 PM Sep 5 2015, 01:29 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

|

|

|

Sep 5 2015, 07:06 PM Sep 5 2015, 07:06 PM

|

Senior Member

1,007 posts Joined: Oct 2006 From: island up north |

Ho ho ho! My end of month Aug'15 portfolio performance drop like flies. Overall IRR for main portfolio drop to 3.05%. Now probably getting worse. Best and worst fund were

CIMB Global Titan 14.24% IRR EI Small Cap 8.01% IRR RHB Asian Total Return 6.6% ROI AMB Ethical Fund -19.73% IRR Libra Consumer & Leisure -6.56% ROI AMB Dividend Trust -5.98% ROI |

|

|

Sep 6 2015, 08:06 AM Sep 6 2015, 08:06 AM

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(David83 @ Aug 3 2015, 09:54 PM) QUOTE(David83 @ Sep 2 2015, 07:53 PM) in Aug there are some major global selloff....and yet your portfolio ROI and IRR just got affected by 0.3 and 0.1% respectively when compared to July.... whereelse yklooi got affected by a large %. July IRR 4.13, ROI 9.16 Aug IRR 2.42, ROI 5.52 kimyee73 may I know how much is your M.O.M portfolio affected? I maybe wrong..i guess you cannot beat David83's, in terms of portfolio stability.... btw, any regulars here got their M.O.M portfolio IRR beatings David83's portfolio's stability? can share your portfolio % of allocation kah? This post has been edited by MUM: Sep 6 2015, 08:26 AM |

|

|

Sep 6 2015, 08:31 AM Sep 6 2015, 08:31 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

MUM If you noticed, my portfolio is very heavy in Asia ex Japan and there's no fixed income funds in it too! LOL ...

|

|

|

Sep 6 2015, 08:54 AM Sep 6 2015, 08:54 AM

|

All Stars

14,867 posts Joined: Mar 2015 |

QUOTE(David83 @ Sep 6 2015, 08:31 AM) MUM If you noticed, my portfolio is very heavy in Asia ex Japan and there's no fixed income funds in it too! LOL ... the attached data from FSM shows Asia X Jpn funds returns in your portfolio holding not good leh for Aug I thought fixed income funds are supposed to stabilise the portfolio or reduce losses when EQ market corrected like recently? This post has been edited by MUM: Sep 6 2015, 09:19 AM Attached thumbnail(s)

|

|

Topic ClosedOptions

|

| Change to: |  0.0363sec 0.0363sec

0.24 0.24

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 07:13 AM |