QUOTE(Leroi2x @ Nov 28 2020, 08:48 PM)

i have 2 example

first is mine own policy that i buy last year around november

and i pay by monthly mode

so early year i received the annual statement is only capture for 2 month premium which i been paid

second is my friend policy , which buy mid of year

he make payment by annually

and the next year when he received the annual statement is show the annual premium he been paid

so im curious , should we follow the statement as stated yearly premium been paid

or we need to divided the month we been serve the premium ....

as one of my friend-friend work accountant say we need count divided

im confuse now

Yes, need to refer to the statement. first is mine own policy that i buy last year around november

and i pay by monthly mode

so early year i received the annual statement is only capture for 2 month premium which i been paid

second is my friend policy , which buy mid of year

he make payment by annually

and the next year when he received the annual statement is show the annual premium he been paid

so im curious , should we follow the statement as stated yearly premium been paid

or we need to divided the month we been serve the premium ....

as one of my friend-friend work accountant say we need count divided

im confuse now

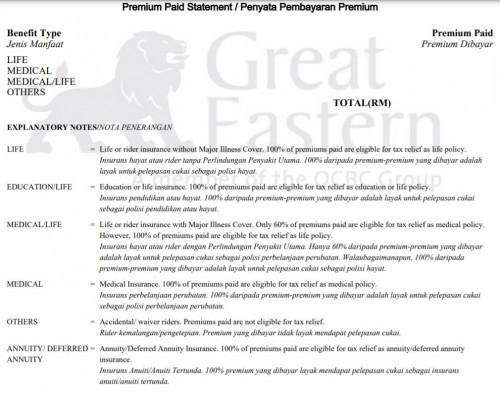

If your policy is ILP, the eligible amount for tax relief is not so straightforward.

The annual statement will breakdown the amount accordingly.

This post has been edited by GrumpyNooby: Nov 28 2020, 08:53 PM

Nov 28 2020, 08:51 PM

Nov 28 2020, 08:51 PM

Quote

Quote

0.1398sec

0.1398sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled