QUOTE(Oklahoma @ Oct 18 2020, 09:21 PM)

Yes.Income Tax Issues v4, Scope: e-BE and eB only

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Oct 18 2020, 09:22 PM Oct 18 2020, 09:22 PM

Return to original view | IPv6 | Post

#161

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Oct 18 2020, 09:25 PM Oct 18 2020, 09:25 PM

Return to original view | IPv6 | Post

#162

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 18 2020, 09:42 PM Oct 18 2020, 09:42 PM

Return to original view | IPv6 | Post

#163

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 18 2020, 10:03 PM Oct 18 2020, 10:03 PM

Return to original view | IPv6 | Post

#164

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Oklahoma @ Oct 18 2020, 09:53 PM) I see, what happens if there is a problem with the filing? I wont have the acknowledgement of receipt for 2020 next year right? If there's a problem, you need to do amendment yourself via Pindaan e-BE within certain period. Otherwise, you will be likely be served with love letter calling you for a coffee session demanding extra supporting documents and/or directly being served a letter of penalty of being fined for a sum due to wrong filing or wrongly keyed in figure. Example as in Post #6597 Remember that this is self-assessment & self-declaration; one should be honest and file responsibly for not getting into tax evasion. If you're not sure if you're filing correctly, you should seek for professional taxation or accounting advices out there. There're credited and certified accountants and tax advisors out there to assist you. If you didn't receive any letter, your filing for the year should be close but you're still required to keep all the supporting documents (including receipts) for claiming tax relieves for min 7 years. Even though the assessment for the particular year is closed but that doesn't mean that LHDN is not allowed to investigate you for any suspicious filing from yester-years. This post has been edited by GrumpyNooby: Oct 18 2020, 10:06 PM |

|

|

Oct 24 2020, 01:08 PM Oct 24 2020, 01:08 PM

Return to original view | IPv6 | Post

#165

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(jiaen0509 @ Oct 24 2020, 01:06 PM) For Pemilik Tunggal business. Do we need to register bussiness at LHDN? If you have business income, you should file Borang B regardless it is sole proprietor or partnership.Or next year declare Borang B will do? Currently BE. QUOTE S2: Apakah perbezaan di antara Borang BE dan B? J2: Borang BE - pendapatan di bawah Sek 4(b) – 4(f) Akta Cukai Pendapatan 1967 dan diisi oleh individu pemastautin yang mempunyai punca pendapatan selain daripada perniagaan. Borang B - pendapatan di bawah Sek 4(a) – 4(f) Akta Cukai Pendapatan 1967 dan diisi oleh individu yang mempunyai punca pendapatan perniagaan (tunggal) atau perkongsian. S3: Bolehkah saya melaporkan pendapatan perniagaan saya jika saya menerima Borang BE? J3: Tidak boleh. Pendapatan perniagaan perlu dilaporkan dalam Borang B. http://lampiran1.hasil.gov.my/pdf/pdfam/FA..._27012015_1.pdf This post has been edited by GrumpyNooby: Oct 24 2020, 01:10 PM |

|

|

Oct 25 2020, 02:28 PM Oct 25 2020, 02:28 PM

Return to original view | IPv6 | Post

#166

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(shinkawa @ Oct 25 2020, 02:23 PM) guys, i dont understand why i kena rm4k tax which i never face before. Under which clause that you're being fined for?i completed tax filing this year April for 2019 and no need pay anything. Now i received letter from LHDN that i have tax to pay with penalti total RM4K. WTF almost heart attack |

|

|

|

|

|

Oct 25 2020, 02:35 PM Oct 25 2020, 02:35 PM

Return to original view | IPv6 | Post

#167

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(shinkawa @ Oct 25 2020, 02:32 PM) Any income or bonus or windfall that you forgotten to declare?Or under-declared income? Or overly declared tax relieves? This post has been edited by GrumpyNooby: Oct 25 2020, 02:36 PM |

|

|

Oct 25 2020, 03:11 PM Oct 25 2020, 03:11 PM

Return to original view | IPv6 | Post

#168

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(shinkawa @ Oct 25 2020, 03:06 PM) This clause means that they didn't receive your BE form.Could be due to late submission. We got one forumer encountered similarly too when he/she submitted the e-BE on the very last day/hour. Suggest you get in touch with the officer at the tax branch that your tax file is being assigned to. |

|

|

Oct 27 2020, 02:50 PM Oct 27 2020, 02:50 PM

Return to original view | Post

#169

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(shinkawa @ Oct 27 2020, 02:45 PM) ok update on my case. it seem i accidentally left out the pendapatan berkanun field. its empty.. shit.. i thought i double check everything. Do you get refund of "excess" of MTD you paid last year via salary deduction since Pendapatan Berkanun is 0?I have to pay first and then submit rayuan for the penalty fees. I meant did LHDN actually bank in the "excess" to your designated bank account? |

|

|

Nov 11 2020, 04:04 PM Nov 11 2020, 04:04 PM

Return to original view | IPv6 | Post

#170

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(QSYT @ Nov 11 2020, 04:00 PM) Just want to check for the PRS, the statement below, is that means that once invest in PRS, can submit for tax relief in subsequent year without the need to topup and can claim till year 2021. Kinda confuse. Obviously no."This tax incentive is available for a period of 10 years, ending year 2021" No contribution/top up, cannot claim. |

|

|

Nov 20 2020, 05:14 PM Nov 20 2020, 05:14 PM

Return to original view | IPv6 | Post

#171

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Nov 23 2020, 09:13 AM Nov 23 2020, 09:13 AM

Return to original view | Post

#172

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(spreeeee @ Nov 23 2020, 09:11 AM) sharp eyes! Of course, no.yes, actually i didn't declare the tax relief for year 2017 (i checked again my submission form), hence i amended my earlier post. so, since i filed income tax relief 2570 for year 2018, means i declared lesser tax relief of 3000 (5570-2570). my next question would be, can i declare the shortfall in next coming tax relief? |

|

|

Nov 23 2020, 09:47 AM Nov 23 2020, 09:47 AM

Return to original view | Post

#173

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Nov 23 2020, 10:08 AM Nov 23 2020, 10:08 AM

Return to original view | Post

#174

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Nov 23 2020, 08:12 PM Nov 23 2020, 08:12 PM

Return to original view | IPv6 | Post

#175

|

All Stars

12,387 posts Joined: Feb 2020 |

IRB CEO: Govt should consider introducing capital gains tax

KUALA LUMPUR (Nov 23): Malaysia should consider implementing the capital gains tax, instead of the inheritance tax, said the head of the Inland Revenue Board (IRB). IRB chief executive officer (CEO) Datuk Seri Sabin Samitah said that while decisions to introduce new taxes lie with the government, it should look at implementing the capital gains tax as the inheritance tax may not have much impact on government revenue given its narrower structure. https://www.theedgemarkets.com/article/irb-...pital-gains-tax |

|

|

Nov 26 2020, 10:37 AM Nov 26 2020, 10:37 AM

Return to original view | Post

#176

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(iamoracle @ Nov 26 2020, 10:37 AM) I am interested in buying a Lenovo laptop. Unfortunately, the model ETA shipping is 8 weeks. What matters is the date on the tax invoice ...If I place my order now, can I claim income tax relief for computer purchase for Y2020 if my order shipped to me in Y2021? FYI - Lenovo will officially charge buyer only if the order has been shipped. Any experience? Thanks in advance. iamoracle liked this post

|

|

|

Nov 26 2020, 12:07 PM Nov 26 2020, 12:07 PM

Return to original view | Post

#177

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(iamoracle @ Nov 26 2020, 11:09 AM) For the benefit of others, this is the response that I just received from Lenovo. Tax invoice should be the official document. Hello, Lenovo cannot charge until the order is shipped. However, before shipment Lenovo can provide you a pro-forma invoice . Tax invoice will get generated only after shipment. If you would like a pro-forma invoice, kindly provide your order number. A pro-forma invoice is Ok for tax relief claim, right? Try to clarify with a tax consultant or LHDN personnel. iamoracle liked this post

|

|

|

Nov 26 2020, 02:16 PM Nov 26 2020, 02:16 PM

Return to original view | Post

#178

|

All Stars

12,387 posts Joined: Feb 2020 |

IRB to stop receiving payments via posted cheques from Jan 1

KUALA LUMPUR (Nov 26): The Inland Revenue Board will stop receiving payments made via posted cheques from Jan 1 next year. In a statement today, IRB said from that date, tax payments can be made via its official website www.hasil.gov.my, banking portals, counters at IRB payment centres, counters of appointed banks, cheque or cash deposit machines or ATMs. “However, this stoppage does not apply for Property Gains Tax, Public Entertainers Income Tax (Seniman Kembara), Witholding Tax and compounds,” the statement said. https://www.theedgemarkets.com/article/irb-...d-cheques-jan-1 |

|

|

Nov 27 2020, 06:30 AM Nov 27 2020, 06:30 AM

Return to original view | IPv6 | Post

#179

|

All Stars

12,387 posts Joined: Feb 2020 |

MyTax : Gerbang Informasi Percukaian

For English version, please click this link: http://www.hasil.gov.my/img/MyTax_V_BI.jpg |

|

|

Nov 28 2020, 08:38 PM Nov 28 2020, 08:38 PM

Return to original view | IPv6 | Post

#180

|

All Stars

12,387 posts Joined: Feb 2020 |

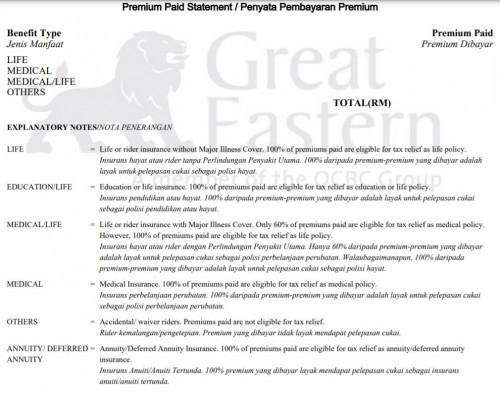

QUOTE(Leroi2x @ Nov 28 2020, 08:33 PM) hi all , would like to ask You have to refer to annual statement to know how many amount is eligible for tax relief.if i currently dont have a life insurance and i plan to buy a life insurance now ,before end of year lets say the annual premium is 3k , and i decide to pay annually but not monthly would i have tax relief of 3k ,since i already pay premium for 3k or 3k/12 month = 250 for tax relief , as the insurance only run 1 month I don't think 100% of premium paid will be allotted into life insurance coverage.  Frequency of payment won't impact eligible amount of tax relief as long as the premium paid is for 2020. This post has been edited by GrumpyNooby: Nov 28 2020, 08:48 PM |

| Change to: |  0.6796sec 0.6796sec

0.69 0.69

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 03:43 AM |