QUOTE(stinger @ Mar 4 2021, 07:43 PM)

mine is on section B item no.6 , section F was empty 0.00

my old company HR did not put into section F?

Then your calculation should be correct.my old company HR did not put into section F?

Income Tax Issues v4, Scope: e-BE and eB only

|

|

Mar 4 2021, 07:48 PM Mar 4 2021, 07:48 PM

Return to original view | IPv6 | Post

#281

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(stinger @ Mar 4 2021, 07:43 PM) mine is on section B item no.6 , section F was empty 0.00 Then your calculation should be correct.my old company HR did not put into section F? stinger liked this post

|

|

|

|

|

|

Mar 5 2021, 07:55 AM Mar 5 2021, 07:55 AM

Return to original view | Post

#282

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Mar 5 2021, 06:28 AM) I fill my children under 50% for my efilling, same oso for my wife previously ( pegawai said 50% is for pasangan bercerai). You should have hired a tax consultant/agent to prepare your tax return. We dun know n nota penerangan last time didn't mention this. We though all insurance can fill b fill in life insurance n child education, but pegawai said not all. When my wife been audited, pegawai put all the children under my wife, that why she kena a few hundred. When audit my file, no more child to put under my name, so I kena a few k, include saman. Since that day, I know how to fill efilling properly 🤣🤣🤣 |

|

|

Mar 5 2021, 08:26 AM Mar 5 2021, 08:26 AM

Return to original view | Post

#283

|

All Stars

12,387 posts Joined: Feb 2020 |

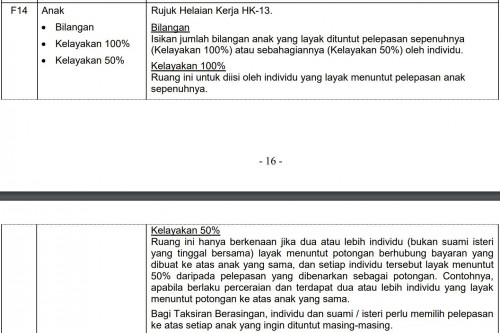

QUOTE(ironman16 @ Mar 5 2021, 06:28 AM) I fill my children under 50% for my efilling, same oso for my wife previously ( pegawai said 50% is for pasangan bercerai). Earlier post you mentioned that you were being audited for YA2019 right?We dun know n nota penerangan last time didn't mention this. We though all insurance can fill b fill in life insurance n child education, but pegawai said not all. When my wife been audited, pegawai put all the children under my wife, that why she kena a few hundred. When audit my file, no more child to put under my name, so I kena a few k, include saman. Since that day, I know how to fill efilling properly 🤣🤣🤣 From Nota Penerangan 2019, it did mention about it:  http://phl.hasil.gov.my/pdf/pdfam/Nota_Penerangan_BE_1.pdf |

|

|

Mar 5 2021, 09:03 AM Mar 5 2021, 09:03 AM

Return to original view | Post

#284

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 5 2021, 09:55 AM Mar 5 2021, 09:55 AM

Return to original view | Post

#285

|

All Stars

12,387 posts Joined: Feb 2020 |

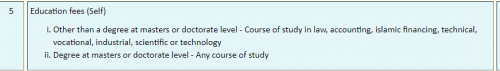

QUOTE(Brendan9303 @ Mar 5 2021, 09:51 AM) Hi All Sifu, Just wondering if i could claim my own studies (professional certification : CFA) under the self education tax relief?   Yes with the exception the course is conducted or hosted by an institution under the list of recognized local institutions or approved professional bodies in Malaysia at the official portal of the Ministry of Higher Education Malaysia at https://www.mohe.gov.my. |

|

|

Mar 5 2021, 10:14 AM Mar 5 2021, 10:14 AM

Return to original view | Post

#286

|

All Stars

12,387 posts Joined: Feb 2020 |

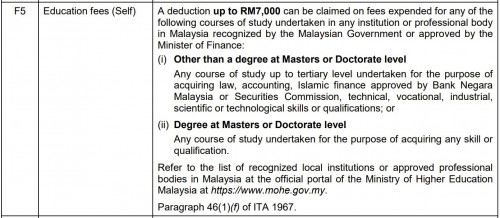

QUOTE(leanman @ Mar 5 2021, 10:08 AM) After my submission, got to know from HR that they made a mistake, where they did not less out the RM6K BIK (exempted) from my income. I have already submitted, meaning i am paying tax for that RM6K. So how do I go about it? Do i file a pindaan, which I think i cannot do that until end April right? Any idea? You may do e-Permohonan Pindaan BE 2020 on 1/4/2021.For 2020, it should appear starting on 1/4/2021.  |

|

|

|

|

|

Mar 5 2021, 10:47 AM Mar 5 2021, 10:47 AM

Return to original view | Post

#287

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 5 2021, 12:55 PM Mar 5 2021, 12:55 PM

Return to original view | IPv6 | Post

#288

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 5 2021, 02:41 PM Mar 5 2021, 02:41 PM

Return to original view | Post

#289

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 5 2021, 03:24 PM Mar 5 2021, 03:24 PM

Return to original view | Post

#290

|

All Stars

12,387 posts Joined: Feb 2020 |

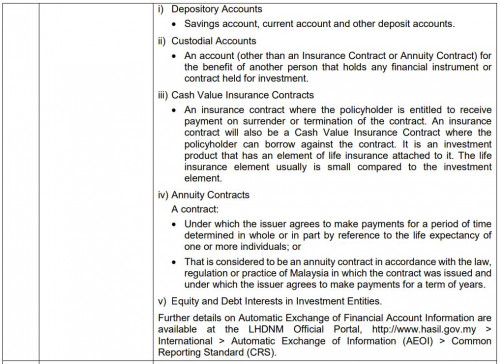

QUOTE(mikhailcbh @ Mar 5 2021, 02:42 PM) Another question, does having an account with FSM Singapore or Tiger Broking count as having account in oversea under tax reporting?  Not sure if falls under Category V: Equity and Debt Interests in Investment Entities This post has been edited by GrumpyNooby: Mar 5 2021, 03:28 PM |

|

|

Mar 5 2021, 05:06 PM Mar 5 2021, 05:06 PM

Return to original view | IPv6 | Post

#291

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 5 2021, 05:10 PM Mar 5 2021, 05:10 PM

Return to original view | IPv6 | Post

#292

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(BacktoBasics @ Mar 5 2021, 05:07 PM) Saw the reply already guys... Available from April 2021... It depends the RM 140 worth of it or not?But do you think it is wise to revise my BE form for the extra claim of maybe RM140? hahaha I worry later I open a can of worms then kena audit and found more mistakes If you had paid tax of RM 40k, the amount is so petty. But, some said RM 140 worth 5 to 10 sets of Happy Meal. |

|

|

Mar 5 2021, 05:17 PM Mar 5 2021, 05:17 PM

Return to original view | IPv6 | Post

#293

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Mar 5 2021, 05:26 PM Mar 5 2021, 05:26 PM

Return to original view | IPv6 | Post

#294

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(BacktoBasics @ Mar 5 2021, 05:24 PM) Good point.. I would also think those submit revised BE would have a higher chance to get selected. Just make it simple: RM 140 vs cost of make yourself present at the LHDN office (could be more than 1 visits) - take annual leaves, parking, petrol, printing documents etcThanks for the heads up Unless you're extremely confident that your filing is precisely accurate or you won't be called for being for audit at all. Well, we got super confident people in this forum who said that he never being rejected by any banks in Malaysia before for credit application. Are you one of those? This post has been edited by GrumpyNooby: Mar 5 2021, 05:29 PM |

|

|

Mar 5 2021, 09:11 PM Mar 5 2021, 09:11 PM

Return to original view | IPv6 | Post

#295

|

All Stars

12,387 posts Joined: Feb 2020 |

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief  MOTAC Link: http://www.motac.gov.my/en/check/registered-hotel If you had booked a hotel or visited a tourist attraction in Malaysia some time between March and December last year, you could be eligible for an income tax relief of up to RM1,000 on the expenses. As you may remember, the government announced in February 2020 that it would introduce a new special tax relief to help stimulate the pandemic-stricken local tourism sector. To qualify for the tax relief, your stay must be at one of the accommodation premises that is officially registered with the Commissioner of Tourism Malaysia. You can easily check this on the Ministry of Tourism, Arts and Culture Malaysia website, which has a searchable list of registered tourist accommodation premises. There are 4,570 accommodation premises registered. This tax relief applies on payments made between 1 March 2020 and 31 December 2021 up to the amount expended, limited at RM1,000 for the assessment year. As is usual with tax relief claims, you will need to keep the relevant receipts and supporting documents for seven years, as it may be requested by LHDN as proof. This tourism-related tax relief is one of several new tax measures introduced to help stimulate the economy as well as lighten the burden of Malaysians in the Covid-19 landscape. Article link: https://ringgitplus.com/en/blog/income-tax/...tax-relief.html MUM liked this post

|

|

|

Mar 7 2021, 07:27 AM Mar 7 2021, 07:27 AM

Return to original view | IPv6 | Post

#296

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 8 2021, 06:40 AM Mar 8 2021, 06:40 AM

Return to original view | Post

#297

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Mar 8 2021, 11:25 AM Mar 8 2021, 11:25 AM

Return to original view | Post

#298

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kevinlim001 @ Mar 8 2021, 11:18 AM)  would like to clarified on the extension. Sorry if this has been asked.. does the extension means for those who have yet to claim the 2500 from june 2020 to dec 2020 they can claim it from jan2021 to dec 2021? OR those who claimed for 2020 still eligible for another 2500 claim in 2021? |

|

|

Mar 8 2021, 04:14 PM Mar 8 2021, 04:14 PM

Return to original view | IPv6 | Post

#299

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(iamloco @ Mar 8 2021, 03:52 PM) Usually when called for audit, is it for any specific year's filing or everything for the past 7 years? Just a general question. It could be very specific clauae or provision.Or specific assessment year. Or full audit like my friend is currently facing. iamloco liked this post

|

| Change to: |  0.1775sec 0.1775sec

0.37 0.37

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 05:42 AM |