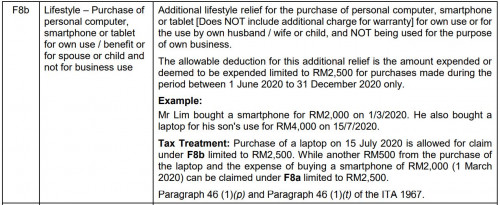

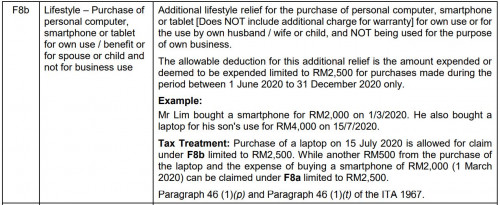

Additional lifestyle relief for the purchase of personal computer, smartphone or tablet [Does NOT include additional charge for warranty] for own use or for the use by own husband / wife or child, and NOT being used for the purpose

of own business

The allowable deduction for this additional relief is the amount expended or deemed to be expended limited to RM2,500 for purchases made during the period between 1 June 2020 to 31 December 2020 only.

Example:

Mr Lim bought a smartphone for RM2,000 on 1/3/2020. He also bought a laptop for his son's use for RM4,000 on 15/7/2020.

Tax Treatment: Purchase of a laptop on 15 July 2020 is allowed for claim under F8b limited to RM2,500. While another RM500 from the purchase of the laptop and the expense of buying a smartphone of RM2,000 (1 March

2020) can be claimed under F8a limited to RM2,500.

Paragraph 46 (1)(p) and Paragraph 46 (1)(t) of the ITA 1967

Good news, apparently one can claim an expensive device bought later after 1/6/2020 for both F8a(ii) and F8b with a single tax invoice/receipt.

Good news, apparently one can claim an expensive device bought later after 1/6/2020 for both F8a(ii) and F8b with a single tax invoice/receipt.

Feb 22 2021, 10:18 AM

Feb 22 2021, 10:18 AM

Quote

Quote

0.0305sec

0.0305sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled