QUOTE(rocketm @ Jun 8 2020, 03:49 PM)

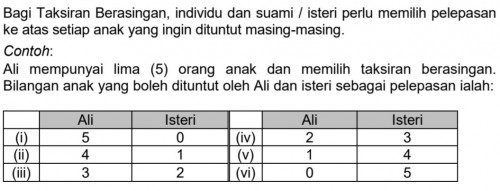

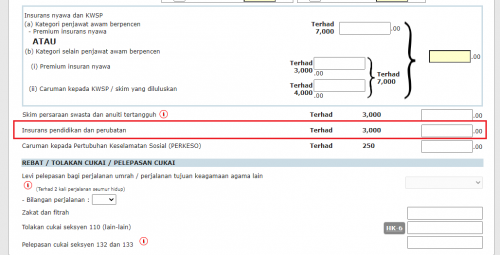

I have some question on classification between life and medical insurance for critical illness coverage.

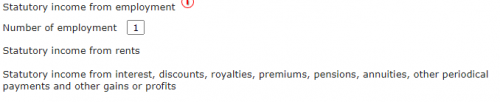

Here is the extract of the premium statement:

[attachmentid=10511379]

Here is the note stated on the last page of the premium statement:

[attachmentid=10511380]

May I know what this critical illness coverage type is for 100% medical or 100% life or 60% medical and the remaining 40% to life?

100% to life Or 60% to medical.Here is the extract of the premium statement:

[attachmentid=10511379]

Here is the note stated on the last page of the premium statement:

[attachmentid=10511380]

May I know what this critical illness coverage type is for 100% medical or 100% life or 60% medical and the remaining 40% to life?

Jun 8 2020, 03:54 PM

Jun 8 2020, 03:54 PM

Quote

Quote

0.2405sec

0.2405sec

0.91

0.91

7 queries

7 queries

GZIP Disabled

GZIP Disabled