Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

GrumpyNooby

|

Jan 12 2021, 10:11 PM Jan 12 2021, 10:11 PM

|

|

QUOTE(myroy @ Jan 12 2021, 10:10 PM) Sorry i am still new, Later when i keep in how much i need to claim from my income tax at lhdn website, do i need to send@provide all receipts to my claim? Or i just need standby incase they request? No need to send. Just book keeping properly up to 7 years as standby in the event being audited. |

|

|

|

|

|

GrumpyNooby

|

Jan 12 2021, 10:31 PM Jan 12 2021, 10:31 PM

|

|

QUOTE(myroy @ Jan 12 2021, 10:29 PM) So anything that i can claim back from my tax, i just need to keep in at e-filing... And after that i got my refund. Thats all right? Yes and you should also save/keep a copy of EA statement (for employment). |

|

|

|

|

|

GrumpyNooby

|

Jan 15 2021, 01:18 PM Jan 15 2021, 01:18 PM

|

|

Personal tax relieves for YA2020 is updated at LHDN portal: Tahun Taksiran 2020: http://www.hasil.gov.my/bt_goindex.php?bt_...nit=1&bt_sequ=1 |

|

|

|

|

|

GrumpyNooby

|

Jan 18 2021, 05:21 PM Jan 18 2021, 05:21 PM

|

|

QUOTE(Azuma-kun @ Jan 18 2021, 05:17 PM) Since this one got extended till 31st December 2021, meaning we get another 2500+2500 tax relief in 2022? Yes. |

|

|

|

|

|

GrumpyNooby

|

Jan 18 2021, 08:39 PM Jan 18 2021, 08:39 PM

|

|

QUOTE(christ14 @ Jan 18 2021, 08:38 PM) holy  so that extra relief of rm 2500 for the whole year right? not start from june like last year? QUOTE(MUM @ Jan 18 2021, 04:49 PM) Tax exemptions for computers, handphones, and tablets worth below RM2,500 to be e xtended until Dec 31, 2021   MCO 2.0: PM announces aid packages worth RM15bil By RASHVINJEET S. BEDI and ASHLEY TANG Monday, 18 Jan 2021 https://www.thestar.com.my/news/nation/2021...e-worth-rm15bil |

|

|

|

|

|

GrumpyNooby

|

Jan 19 2021, 06:56 AM Jan 19 2021, 06:56 AM

|

|

QUOTE(BacktoBasics @ Jan 18 2021, 09:38 PM) So YA 2020 is total of RM 5k and YA 2021 is another RM 5k? Yes. |

|

|

|

|

|

GrumpyNooby

|

Jan 19 2021, 10:41 AM Jan 19 2021, 10:41 AM

|

|

QUOTE(ClarenceT @ Jan 19 2021, 10:39 AM) "Extended" means RM2500 for YA2020 (1/6/20-31/12/20) and RM2500 for YA2021, or RM2500 only for 1/6/2020-31/12/2021?  Use SSPN or PRS case as example, they use the word "extension" right? Meaning they're managing this in term of assessment year. https://www.ppa.my/wp-content/uploads/2020/...ment-Savers.pdfThis post has been edited by GrumpyNooby: Jan 19 2021, 10:42 AM |

|

|

|

|

|

GrumpyNooby

|

Jan 20 2021, 06:55 AM Jan 20 2021, 06:55 AM

|

|

QUOTE(whirlwind @ Jan 20 2021, 04:28 AM) Hi sifus, For life/medical insurance, can I include my non working wife’s life and medical insurance? F15 Insurans nyawa dan KWSP (a) Bayaran premium insurans nyawa atau caruman takaful atas polisi insurans nyawa yang menjamin nyawa individu, suami atau isteri / isteri-isteri dibenarkan potongan. * Bayaran premium insurans nyawa atas polisi yang menjamin nyawa anak TIDAK dibenarkan potongan. F17 Insurans pendidikan dan perubatan Potongan tidak melebihi RM3,000 bagi premium insurans yang dibayar atas polisi pendidikan atau manfaat perubatan untuk individu, pasangan atau anak. http://phl.hasil.gov.my/pdf/pdfam/Nota_Penerangan_BE_1.pdf |

|

|

|

|

|

GrumpyNooby

|

Jan 20 2021, 05:31 PM Jan 20 2021, 05:31 PM

|

|

QUOTE(iamloco @ Jan 20 2021, 05:27 PM) Can I claim tax relief for prepaid data plan? What is the mechanism? Can claim but how you going to provide proof or documentation if being asked for audit? |

|

|

|

|

|

GrumpyNooby

|

Jan 22 2021, 10:46 PM Jan 22 2021, 10:46 PM

|

|

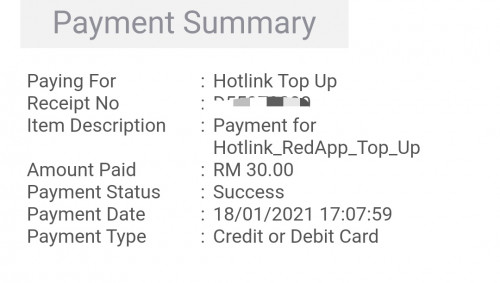

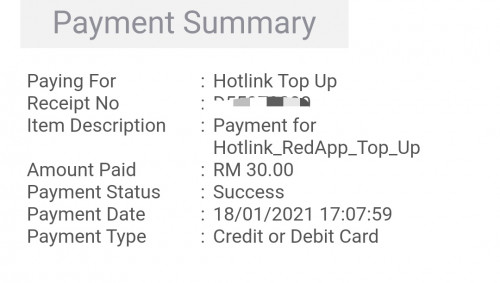

QUOTE(iamloco @ Jan 22 2021, 10:42 PM) But Hotlink send topup payment summary to my email like this  Your Hotlink Top Up could be meant for voice calls and other in-app services? How are you going to proof to the officer that you're using it for data plan subscription? |

|

|

|

|

|

GrumpyNooby

|

Jan 25 2021, 07:00 PM Jan 25 2021, 07:00 PM

|

|

QUOTE(lyt25_1234 @ Jan 25 2021, 04:41 PM) Can I get Tax Relief for buying Laser Printer for Work From Home during the pandemic? Not eligible unless it comes as part of the computer purchase. That was years ago. |

|

|

|

|

|

GrumpyNooby

|

Jan 27 2021, 02:08 PM Jan 27 2021, 02:08 PM

|

|

QUOTE(contestchris @ Jan 27 2021, 02:03 PM) Quoting the article: Starting from Malaysia income tax Year of Assessment 2014 (tax filed in 2015), taxpayers who have been subjected to MTD are not required to file income tax returns if such monthly tax deductions constitute their final tax. However, they should still file if they want to reduce their taxable income through reliefs. This is more a convenience factor to allow those who did not file to not have negative records.Where is the proof that says taxpayers don’t need to file income tax if there is monthly PCB deduction done (which is what I understand the above paragraph is implying)? Given the above, I should then be safe? Safe if you don't have other source of incomes; purely for employment. |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 01:25 PM Jan 29 2021, 01:25 PM

|

|

QUOTE(MeowSama @ Jan 29 2021, 01:24 PM) I bought a laptop around 3K can I claim max on first and the remaining in second relief?  And you think can or not? |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 04:03 PM Jan 29 2021, 04:03 PM

|

|

QUOTE(AliBaBa_King @ Jan 29 2021, 03:59 PM) Hi all sifus, wasnt sure if this answer has been asked before. Would like to know for lifestyle claim, lets say if i plan to change only processor, motherboard and RAM of my system, is it relief-able? Or must it be in full system? Fully functioning and workable system and not loose or spare parts nor accessories. |

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 08:00 PM Jan 29 2021, 08:00 PM

|

|

QUOTE(christ14 @ Jan 29 2021, 07:59 PM) what got me thinking is the restricted part, like does it mean it has to be seperate? if can combined then why not just say so  I'll wait for Nota Penerangan BE2020 to be released for more clarity. |

|

|

|

|

|

GrumpyNooby

|

Jan 30 2021, 12:51 PM Jan 30 2021, 12:51 PM

|

|

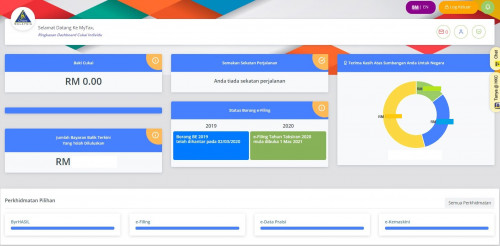

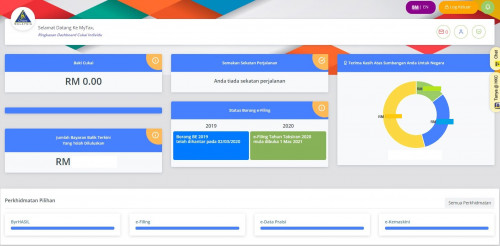

It looks like e-filing page has been revamped to MyTax page:  Link: https://mytax.hasil.gov.my/ |

|

|

|

|

|

GrumpyNooby

|

Jan 31 2021, 06:46 AM Jan 31 2021, 06:46 AM

|

|

e-Buletin HASiL : Melangkah Ke Tahun BaharuIni adalah info rasmi daripada Lembaga Hasil Dalam Negeri Malaysia e-Buletin Hasil merupakan satu medium maklumat berkaitan percukaian yang akan dikeluarkan secara bulanan mulai Januari 2021.

|

|

|

|

|

|

GrumpyNooby

|

Feb 4 2021, 09:53 AM Feb 4 2021, 09:53 AM

|

|

QUOTE(brutalsoul @ Feb 4 2021, 09:50 AM) computer set can claim every year? Yes under lifestyle tax relief. Or if it is notebook, smartphone and tablets, can also claim under special tax relief from PENJANA (2020) and PERMAI (2021). This post has been edited by GrumpyNooby: Feb 4 2021, 09:54 AM |

|

|

|

|

|

GrumpyNooby

|

Feb 13 2021, 04:24 PM Feb 13 2021, 04:24 PM

|

|

QUOTE(ken431256 @ Feb 13 2021, 04:21 PM) Can claim lifestyle tax relief the receipt under my dad's name? Or must be my name? Tax invoice/receipt under whose name? |

|

|

|

|

|

GrumpyNooby

|

Feb 13 2021, 04:26 PM Feb 13 2021, 04:26 PM

|

|

QUOTE(ken431256 @ Feb 13 2021, 04:25 PM) Then, only he can claim the tax relief. |

|

|

|

|

Jan 12 2021, 10:11 PM

Jan 12 2021, 10:11 PM

Quote

Quote

0.0376sec

0.0376sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled