Gold Investment Corner V8, All About Gold

|

|

Mar 31 2025, 09:45 PM Mar 31 2025, 09:45 PM

|

Senior Member

4,498 posts Joined: Mar 2014 |

Crazy stuff.. Gold is16+% YTD (in USD). nexona88 liked this post

|

|

|

|

|

|

Apr 1 2025, 09:16 AM Apr 1 2025, 09:16 AM

|

All Stars

24,463 posts Joined: Nov 2010 |

Trump tariffs looming - Apr 2. gold continues to spike; delightful to see it took only one day to crash thru 3125, now at 3130. 1kg gold bar is now worth RM450,000. 1oz gold coin RM14,000. enjoy yr holiday! silver, however... nothing happened, silversqueeze 2.0 failed, sits at $34. romuluz777 and nexona88 liked this post

|

|

|

Apr 1 2025, 09:34 AM Apr 1 2025, 09:34 AM

Show posts by this member only | IPv6 | Post

#5403

|

Senior Member

1,232 posts Joined: Mar 2019 |

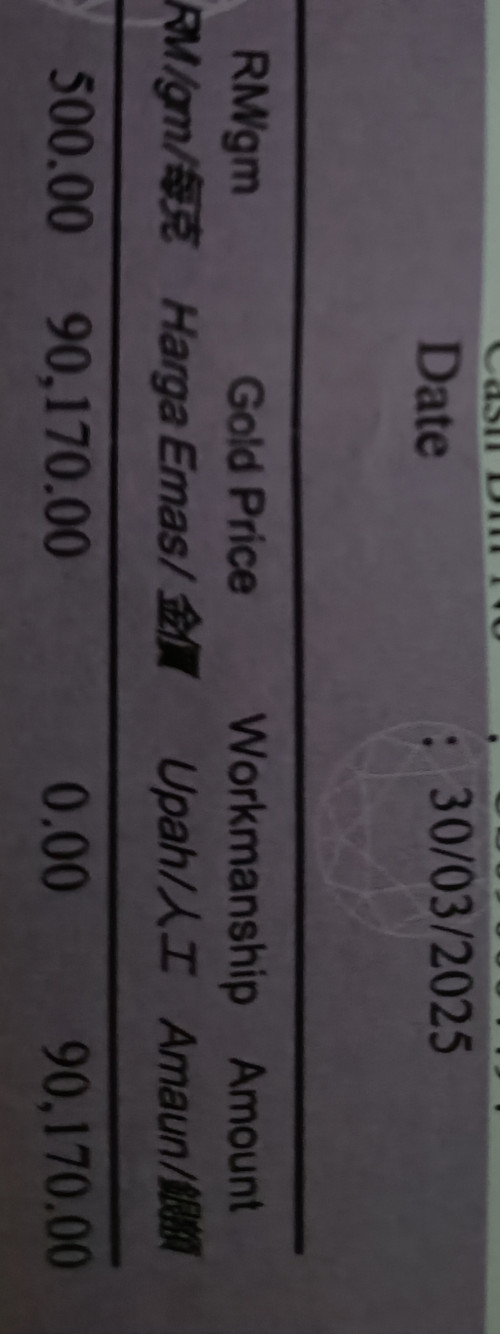

Auntie favors $140k wearable gold instead of pamp swiss.

Admittedly, one of the pieces was an elegantly custom crafted 180gm x $500/gm chain. This post has been edited by Unkerpanjang: Apr 1 2025, 10:30 AM |

|

|

Apr 1 2025, 09:38 AM Apr 1 2025, 09:38 AM

|

All Stars

12,273 posts Joined: Oct 2010 |

|

|

|

Apr 1 2025, 10:02 AM Apr 1 2025, 10:02 AM

|

All Stars

24,463 posts Joined: Nov 2010 |

999.9 gold at shops is priced at rm500/g now.

the way it's going, they'll incr again in a couple of days! it's quite crazy... it was <rm400/g just six months ago. pretty overbought now anyway u look at it, question is when a significant correction will occur. gold ETFs in north america has just started to increased. while consumers in india, europe, parts of asia may be cashing in now, selling. central banks... is china still buying? has japan started to dump some us treasuries to buy gold? |

|

|

Apr 1 2025, 10:18 AM Apr 1 2025, 10:18 AM

Show posts by this member only | IPv6 | Post

#5406

|

Senior Member

1,227 posts Joined: Nov 2012 |

QUOTE(AVFAN @ Apr 1 2025, 10:02 AM) 999.9 gold at shops is priced at rm500/g now. Where to check the country sell and buy for gold commodity for india and europe country?the way it's going, they'll incr again in a couple of days! it's quite crazy... it was <rm400/g just six months ago. pretty overbought now anyway u look at it, question is when a significant correction will occur. gold ETFs in north america has just started to increased. while consumers in india, europe, parts of asia may be cashing in now, selling. central banks... is china still buying? has japan started to dump some us treasuries to buy gold? |

|

|

|

|

|

Apr 1 2025, 10:23 AM Apr 1 2025, 10:23 AM

Show posts by this member only | IPv6 | Post

#5407

|

Senior Member

1,232 posts Joined: Mar 2019 |

QUOTE(prophetjul @ Apr 1 2025, 09:38 AM) Cheers, bro. After CNY, my regular coffee shop raised Milo Kosong Peng from $2.30 to $2.70. Your proven msg to younger forumers is just buy gold -- hard asset with high liquidity. I just copy exact. We continue to stay happy, healthy n travel active, bro. |

|

|

Apr 1 2025, 10:34 AM Apr 1 2025, 10:34 AM

|

All Stars

24,463 posts Joined: Nov 2010 |

QUOTE(Zhik @ Apr 1 2025, 10:18 AM) there is no single source for all these.just gotta read, read, watch new videos from the gurus as they come. just google gold news. not all are useful, some are pure BS, of course. for country reserves, the official nos. are there but may not be updated too well. https://tradingeconomics.com/country-list/gold-reserves e.g. china reserves 2280. this is from DEC 2024. there is speculation china central bank has been under reporting, buying via other institutions incl insurance cos, foreign entities. also, it may be buying via barter bypassing $ use from russia, funding ukraine war. all in all, some believe china actually holds DOUBLE the official reported figure to World Gold Council. so, be careful what u read! This post has been edited by AVFAN: Apr 1 2025, 10:36 AM |

|

|

Apr 1 2025, 05:56 PM Apr 1 2025, 05:56 PM

Show posts by this member only | IPv6 | Post

#5409

|

Junior Member

698 posts Joined: Jul 2018 |

now still can buy gold?

if buy where buy gold is better? 1) physical gold (no good - buy and sell need around 25% paid commission) 2) touch n go emas 3) bursa etf (less active, less people trade) 4) Unit trust gold (which unit trust is better) 5) future gold (very risk) 6) others Anyone can advise? |

|

|

Apr 1 2025, 06:16 PM Apr 1 2025, 06:16 PM

|

Senior Member

2,215 posts Joined: Oct 2010 |

QUOTE(edwin1002 @ Apr 1 2025, 06:56 PM) now still can buy gold? For no.1, the 25% take off is typically at the mall retailers....u can get much better deals at reputable gold traders.if buy where buy gold is better? 1) physical gold (no good - buy and sell need around 25% paid commission) 2) touch n go emas 3) bursa etf (less active, less people trade) 4) Unit trust gold (which unit trust is better) 5) future gold (very risk) 6) others Anyone can advise? |

|

|

Apr 1 2025, 07:40 PM Apr 1 2025, 07:40 PM

Show posts by this member only | IPv6 | Post

#5411

|

Junior Member

431 posts Joined: Apr 2010 |

QUOTE(edwin1002 @ Apr 1 2025, 05:56 PM) now still can buy gold? 1) Silver Bullion MY- fair spread for physical gold esp bars above 20g, but have to buy lump sum. Good if you have big capital.if buy where buy gold is better? 1) physical gold (no good - buy and sell need around 25% paid commission) 2) touch n go emas 3) bursa etf (less active, less people trade) 4) Unit trust gold (which unit trust is better) 5) future gold (very risk) 6) others Anyone can advise? UOB - seems cheaper, never tried. 6) Maybank MiGA- 2% ish spread. Quite tough and expensive to convert to physical. There is no bad time to buy gold. Start small as a baseline, then cost average up or down accordingly. |

|

|

Apr 1 2025, 07:41 PM Apr 1 2025, 07:41 PM

|

All Stars

24,463 posts Joined: Nov 2010 |

QUOTE(romuluz777 @ Apr 1 2025, 06:16 PM) For no.1, the 25% take off is typically at the mall retailers....u can get much better deals at reputable gold traders. 25% may be for some jewelry, with plenty of workmanship.the shop i visited, the spread is 12-15% depending on the actual 999.9 bar or coin, if u buy & sell back to them with cert/receipt. QUOTE(edwin1002 @ Apr 1 2025, 05:56 PM) now still can buy gold? no good answer, depends who u ask.goldman sachs says 3300; morgan stanley says 3400 - by year end others say 4000, 25,000... if buy where buy gold is better? 1) physical gold (no good - buy and sell need around 25% paid commission) gold shops are for convenience, but v high spread. bigger amounts, check out those bullion traders; spread is acceptable 3.6-3.8%; cash or bank transfer only. https://www.silverbullion.com.my/Shop/Buy/Gold_Bars https://mybulliontrade.com/product-category.../buy-gold-bars/ 2) touch n go emas - small values, maybe <rm10k? 3) bursa etf (less active, less people trade) - low spread, low volume, ok for small mid amounts. 4) Unit trust gold (which unit trust is better) no idea. 5) future gold (very risk) - high risk/high gain; "it's easy to make profit with futures but very hard to hold on to it". 6) others - paper gold from banks... maybank, uob, cimb; spread 1-1.5%; convenient, no guarantee, nothing to hold. gold isn't cepat kaya. be prepared to hold 3, 5, 10, 20 years. |

|

|

Apr 1 2025, 08:35 PM Apr 1 2025, 08:35 PM

Show posts by this member only | IPv6 | Post

#5413

|

Senior Member

4,498 posts Joined: Mar 2014 |

QUOTE(edwin1002 @ Apr 1 2025, 05:56 PM) if buy where buy gold is better? 1) physical gold (no good - buy and sell need around 25% paid commission) 2) touch n go emas 3) bursa etf (less active, less people trade) 4) Unit trust gold (which unit trust is better) 5) future gold (very risk) 6) others Anyone can advise? I own both the Bursa etf and GLD which is a US based etf and the biggest in the world. Why?.because I have a MYR and USD portfolio. Bursa etf is in MYR, so save on forex costs. It has other advantages, like the gold is in Singapore and theoretically easier to redeem physical. GLD gold is in London and like impossible to redeem for normal people. Disadvantage of Bursa gold etf is higher management fees which in long run is not as good as GLD. This post has been edited by Cubalagi: Apr 1 2025, 08:35 PM |

|

|

|

|

|

Apr 1 2025, 08:39 PM Apr 1 2025, 08:39 PM

Show posts by this member only | IPv6 | Post

#5414

|

Senior Member

1,227 posts Joined: Nov 2012 |

Not much movement today. Let's how it go during US day time.

Something is brewing. |

|

|

Apr 1 2025, 09:49 PM Apr 1 2025, 09:49 PM

|

All Stars

24,463 posts Joined: Nov 2010 |

QUOTE(Zhik @ Apr 1 2025, 08:39 PM) the anger in trump is definitely brewing.tonight, tmr likely little action. trmr night is when he announce the details of the tariffs - what countries, what items, what rate. some are still hoping he will be kind, spare this, spare that. what i read, only vietnam has said they will reduce tariffs on imported USA cars, chicken legs. can't blame him if he announces even more severe tariffs on every country. btw, malaysia is one of the "dirty 15" which he said he will target the tariffs on. whatever he does, one thing is certain - inflation everywhere will accelerate. |

|

|

Apr 2 2025, 09:35 AM Apr 2 2025, 09:35 AM

|

All Stars

12,273 posts Joined: Oct 2010 |

$3,132 HIGH

|

|

|

Apr 2 2025, 09:48 AM Apr 2 2025, 09:48 AM

|

All Stars

24,463 posts Joined: Nov 2010 |

QUOTE(prophetjul @ Apr 2 2025, 09:35 AM) 3148 was the record high, yesterday.tonight, we watch... trump to announce tariff details at 4am local time. there'll be fireworks unless he chicken out last minute and withdraw his threats/plans. i m expecting him to go all out - strengthening dollar + inducing inflation. gold price $3150/oz, RM451/g by tmr morning... i wish la... chewysoon82 liked this post

|

|

|

Apr 2 2025, 10:21 AM Apr 2 2025, 10:21 AM

Show posts by this member only | IPv6 | Post

#5418

|

Senior Member

1,227 posts Joined: Nov 2012 |

QUOTE(AVFAN @ Apr 2 2025, 09:48 AM) 3148 was the record high, yesterday. They say depend on the details of tariff. If it is not so significant then market might just go up while gold go down....tonight, we watch... trump to announce tariff details at 4am local time. there'll be fireworks unless he chicken out last minute and withdraw his threats/plans. i m expecting him to go all out - strengthening dollar + inducing inflation. gold price $3150/oz, RM451/g by tmr morning... i wish la... How u think? |

|

|

Apr 2 2025, 10:34 AM Apr 2 2025, 10:34 AM

|

All Stars

24,463 posts Joined: Nov 2010 |

QUOTE(Zhik @ Apr 2 2025, 10:21 AM) They say depend on the details of tariff. If it is not so significant then market might just go up while gold go down.... the details surely matter.How u think? there probably will be some exemptions, tax rebates, etc. but overall, i doubt he wants to be seen to be weak at all. he is already frustrated with Putin not agreeing to his ukraine peace plan. more likely he'll go hard on the tariffs, withdraw when the time comes. poker, u know, great game. |

|

|

Apr 2 2025, 11:42 AM Apr 2 2025, 11:42 AM

|

Junior Member

69 posts Joined: Nov 2017 |

My assumption was that they would sell it through the news.

|

| Change to: |  0.0186sec 0.0186sec

0.65 0.65

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 02:20 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote