MBSB Excl 5 :22.3.2011 to 21.11.2011 all 4.7% only

i dont think Excl 5 interest can be that low in 2009 and 2010,should be around 4.7 -5% then.

Fixed Deposit Rates in Malaysia V6.1, Please Read Post #1

Fixed Deposit Rates in Malaysia V6.1, Please Read Post #1

|

|

Aug 27 2014, 09:23 AM Aug 27 2014, 09:23 AM

|

Senior Member

5,875 posts Joined: Sep 2009 |

MBSB Excl 5 :22.3.2011 to 21.11.2011 all 4.7% only

i dont think Excl 5 interest can be that low in 2009 and 2010,should be around 4.7 -5% then. |

|

|

|

|

|

Aug 27 2014, 02:20 PM Aug 27 2014, 02:20 PM

|

Senior Member

10,001 posts Joined: May 2013 |

Future policies on OPR hike to gear towards 3% inflation target

http://www.theedgemalaysia.com/business-ne...ion-target.html |

|

|

Aug 27 2014, 02:59 PM Aug 27 2014, 02:59 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

In BR to uplift 3 months FD. Saw an old notice on starting 1/1/2014, no more cheque will be issued by BR.

Have to do IBG at RM2 to xfer out the matured FD. The staff was trying to dissuade me saying by end of the month (told her 2 more days only) or beginning of Sept, BR will be changing their rates. |

|

|

Aug 27 2014, 03:14 PM Aug 27 2014, 03:14 PM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(BoomChaCha @ Aug 27 2014, 04:49 AM) See the weather..if the MBSB staff is friendly, then ask lo; otherwise no need to ask la.. Called MBSB today. They said on maturity they can issue cheque. They can TT out if the amount is >100k.Thank you Ah Goat.. This is different from what you mentioned that they will wire out from HQ ? This post has been edited by bbgoat: Aug 27 2014, 03:16 PM |

|

|

Aug 28 2014, 02:34 AM Aug 28 2014, 02:34 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

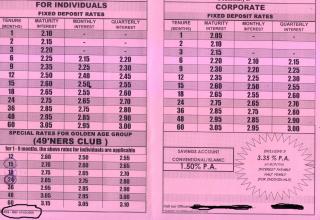

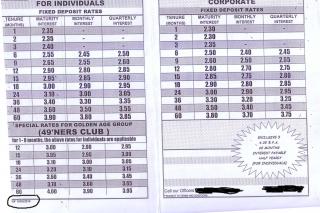

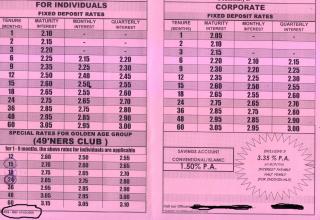

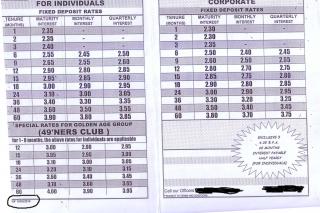

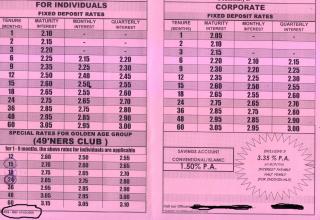

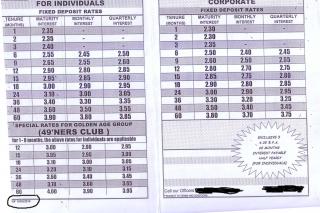

QUOTE(guy3288 @ Aug 27 2014, 09:23 AM) MBSB Excl 5 :22.3.2011 to 21.11.2011 all 4.7% only Ah ha..please see below MBSB old flyers: i dont think Excl 5 interest can be that low in 2009 and 2010,should be around 4.7 -5% then. 1 March 2009: 3.35%

5 October 2009: 4.00%

10 March 2010: 4.25%

15 May 2008: 5% + 3% in SA:

This post has been edited by BoomChaCha: Aug 28 2014, 02:55 AM |

|

|

Aug 28 2014, 03:14 AM Aug 28 2014, 03:14 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(wil-i-am @ Aug 27 2014, 02:20 PM) Future policies on OPR hike to gear towards 3% inflation target Thanks for the link... http://www.theedgemalaysia.com/business-ne...ion-target.html QUOTE(bbgoat @ Aug 27 2014, 02:59 PM) In BR to uplift 3 months FD. Saw an old notice on starting 1/1/2014, no more cheque will be issued by BR. Let's see next week.. ThanksHave to do IBG at RM2 to xfer out the matured FD. The staff was trying to dissuade me saying by end of the month (told her 2 more days only) or beginning of Sept, BR will be changing their rates. A lot of FDs to renew ha lately.. QUOTE(bbgoat @ Aug 27 2014, 03:14 PM) Called MBSB today. They said on maturity they can issue cheque. They can TT out if the amount is >100k. Oh.. you called to MBSB..? This is different from what you mentioned that they will wire out from HQ ? Last time they TT out more than 100K from HQ, not from the branch, consequently lost 2 to 3 days interest.. Thank you for your time, money and energy to call to MBSB.. You placed FDs in both RHB and Affin for 15 months? |

|

|

|

|

|

Aug 28 2014, 08:50 AM Aug 28 2014, 08:50 AM

|

Senior Member

5,875 posts Joined: Sep 2009 |

QUOTE(BoomChaCha @ Aug 28 2014, 02:34 AM) Ah ha..please see below MBSB old flyers: no wonder ...........,1 March 2009: 3.35%

5 October 2009: 4.00%

10 March 2010: 4.25%

15 May 2008: 5% + 3% in SA:

But your 1st rate 4.7% referred to Exclusive 5 rate. Then below all referred to 49'ners rate pulak, and not Exclusive 5 rates. This post has been edited by guy3288: Aug 28 2014, 08:55 AM |

|

|

Aug 28 2014, 02:30 PM Aug 28 2014, 02:30 PM

|

Senior Member

1,035 posts Joined: May 2010 |

QUOTE(BoomChaCha @ Aug 28 2014, 02:34 AM) Ah ha..please see below MBSB old flyers: I have just checked V1 of the FD thread, the 5% MBSB FD was posted there...but I was not around in this forum during that time 1 March 2009: 3.35%

5 October 2009: 4.00%

10 March 2010: 4.25%

15 May 2008: 5% + 3% in SA:

Why was the Exclusive 5 rate offered in a helter-skelter manner? 5% > 4.90% > 3.35% > 4% > 4.25% > 4.70% |

|

|

Aug 28 2014, 05:51 PM Aug 28 2014, 05:51 PM

|

Junior Member

104 posts Joined: Sep 2013 |

QUOTE(X_hunter @ Aug 21 2014, 01:42 PM) Finally i parked my money in UOB today, 13 month@3.9%. Hello Hunter, I just open UOB 13 months FD 3.90% but the officer mentioned that I must place 2k in the SA. This make me feel that UOB is a bit sneaky as they did not tell the customer the whole story in the term & condition. Need to open a SA for them to deposit the interest which will be paid half yearly and the min amount needed to open the SA is Rm20. It comes with Atm card, no passbook. The sales manager tried to intro me the saving plan which they collaborate with Prudential, 5.88% with min 9k investment, but i didn't want that. It's more suitable for long term saving. This post has been edited by FDInvestor: Aug 28 2014, 05:55 PM |

|

|

Aug 28 2014, 07:45 PM Aug 28 2014, 07:45 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(guy3288 @ Aug 28 2014, 08:50 AM) no wonder ..........., All are Exclusive 5, not 49'ners Club.But your 1st rate 4.7% referred to Exclusive 5 rate. Then below all referred to 49'ners rate pulak, and not Exclusive 5 rates. Please look at the below flyers on your right bottom side one more time: 1 March 2009: 3.35% https://forum.lowyat.net/uploads/attach-95/...-1409165175.jpg 5 October 2009: 4.00% https://forum.lowyat.net/uploads/attach-95/...-1409165443.jpg 10 March 2010: 4.25% https://forum.lowyat.net/uploads/attach-95/...-1409165648.jpg 15 May 2008: 5% + 3% in SA (this 5% is written on the top side of the flyer): https://forum.lowyat.net/uploads/attach-95/...-1409164360.jpg QUOTE(HJebat @ Aug 28 2014, 02:30 PM) I have just checked V1 of the FD thread, the 5% MBSB FD was posted there...but I was not around in this forum during that time Oh..? Really.. can show the link? If it is troublesome for you to find it, then never mind...Thanks QUOTE(HJebat @ Aug 28 2014, 02:30 PM) Why was the Exclusive 5 rate offered in a helter-skelter manner? Because MBSB reacted to OPR changed and FD market condition, and also to run 5 years FD promo5% > 4.90% > 3.35% > 4% > 4.25% > 4.70% just like the 5% + 3% in SA.. This post has been edited by BoomChaCha: Aug 28 2014, 08:26 PM |

|

|

Aug 28 2014, 08:45 PM Aug 28 2014, 08:45 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

I got confused.

MBB no CASA. Step up. ER3.85% 12 M but its merdeka campaign. How come the merdeka campaign in 1st page is 6 month? |

|

|

Aug 28 2014, 10:01 PM Aug 28 2014, 10:01 PM

|

Senior Member

1,035 posts Joined: May 2010 |

QUOTE(BoomChaCha @ Aug 28 2014, 07:45 PM) Here it is: MBSB 5% FDQUOTE(BoomChaCha @ Aug 28 2014, 07:45 PM) Because MBSB reacted to OPR changed and FD market condition, and also to run 5 years FD promo I meant the margin of an increase or a decrease in their rate.just like the 5% + 3% in SA.. 5% to 4.90% is a decrease of 0.10% |

|

|

Aug 28 2014, 11:20 PM Aug 28 2014, 11:20 PM

|

Senior Member

2,525 posts Joined: Sep 2013 |

Any idea why HSBC FD rate always lower than Maybank and Public Bank. Was thinking of transferring all my Public Banks one to HSBC because HSBC only needs 200k for premier banking

|

|

|

|

|

|

Aug 29 2014, 12:52 AM Aug 29 2014, 12:52 AM

|

Senior Member

5,875 posts Joined: Sep 2009 |

QUOTE(BoomChaCha @ Aug 28 2014, 07:45 PM) All are Exclusive 5, not 49'ners Club. sorry i was wrong, did not check properly. i thought i was mbsb regular yet could not remember at all those low rates.Please look at the below flyers on your right bottom side one more time: i tried hard looking for my Fd records, could not find any for MBSB for 2009-2010. found sukok simpanan rakyat, merdeka bond, Sukok 1M, all so good at 5% Found BSN promo then gave 4.38% for 2yr FD fr 5.2.09-5.2.11. sorry off topic. |

|

|

Aug 29 2014, 03:05 AM Aug 29 2014, 03:05 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(HJebat @ Aug 28 2014, 10:01 PM) Here it is: MBSB 5% FD Oh... deep shxt loh.. Did not know that this has been started since many years in this forum..? Thanks so much for the link, Warrior.. QUOTE(HJebat @ Aug 28 2014, 10:01 PM) I meant the margin of an increase or a decrease in their rate. 5% to 4.90% is a decrease of 0.10% (1) Banks FD competitions (2) Volatile FD rates or OPR kept changing up and down at that time? QUOTE(kkk8787 @ Aug 28 2014, 11:20 PM) Any idea why HSBC FD rate always lower than Maybank and Public Bank. Was thinking of transferring all my Public Banks one to HSBC because HSBC only needs 200k for premier banking (1) I am comparing these 2 banks like this:HSBS is Jaguar and May Bank is Perodua. Jaguar spare parts are more expensive than Perodua, and Jaguar service is better. So, you pay more money (earn less interest rate) for a better car and better service. (2) I think HSBC primary target market is foreigners or for people (especially businessmen) who are traveling a lot. These type of customers do not care about FD rate. (3) HSBC is an investment house, they want you to invest rather than put money in FD. This post has been edited by BoomChaCha: Aug 29 2014, 03:06 AM |

|

|

Aug 29 2014, 03:18 AM Aug 29 2014, 03:18 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(guy3288 @ Aug 29 2014, 12:52 AM) sorry i was wrong, did not check properly. i thought i was mbsb regular yet could not remember at all those low rates. No problem.i tried hard looking for my Fd records, could not find any for MBSB for 2009-2010. found sukok simpanan rakyat, merdeka bond, Sukok 1M, all so good at 5% Found BSN promo then gave 4.38% for 2yr FD fr 5.2.09-5.2.11. sorry off topic. It seems you have been a MBSB customer for a long time.. Wah.. the rates are very fantastic..Congratulations.. Sukok 1 million..? What is Sukok? |

|

|

Aug 29 2014, 07:19 AM Aug 29 2014, 07:19 AM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(BoomChaCha @ Aug 29 2014, 03:18 AM) No problem. SUKUK is like gov bond last time.... Heavenly rated and yet taken down or don't have idea whats happening now. Last i heard is that related to racial issues....It seems you have been a MBSB customer for a long time.. Wah.. the rates are very fantastic..Congratulations.. Sukok 1 million..? What is Sukok? |

|

|

Aug 29 2014, 07:43 AM Aug 29 2014, 07:43 AM

|

Senior Member

2,525 posts Joined: Sep 2013 |

QUOTE(BoomChaCha @ Aug 29 2014, 03:05 AM) Oh... deep shxt loh.. So not recommended to put all in hsbc?Did not know that this has been started since many years in this forum..? Thanks so much for the link, Warrior.. (1) Banks FD competitions (2) Volatile FD rates or OPR kept changing up and down at that time? (1) I am comparing these 2 banks like this: HSBS is Jaguar and May Bank is Perodua. Jaguar spare parts are more expensive than Perodua, and Jaguar service is better. So, you pay more money (earn less interest rate) for a better car and better service. (2) I think HSBC primary target market is foreigners or for people (especially businessmen) who are traveling a lot. These type of customers do not care about FD rate. (3) HSBC is an investment house, they want you to invest rather than put money in FD. |

|

|

Aug 29 2014, 09:40 AM Aug 29 2014, 09:40 AM

|

Senior Member

6,614 posts Joined: Mar 2011 |

QUOTE(BoomChaCha @ Aug 29 2014, 03:18 AM) No problem. You miss out SUKUK ? Last year there is one that I bought matured around May/June. I think the pay out was 5% every quarter (can't be 100% sure). Every time that it came out, long queue's in the participating banks. I only bought one but heard that few series was issued. It seems you have been a MBSB customer for a long time.. Wah.. the rates are very fantastic..Congratulations.. Sukok 1 million..? What is Sukok? |

|

|

Aug 29 2014, 10:32 AM Aug 29 2014, 10:32 AM

|

Senior Member

10,001 posts Joined: May 2013 |

Was informed Affin offer 3.80% for FD 12 mths

Subject to min RM500k n today is last day |

|

Topic ClosedOptions

|

| Change to: |  0.0422sec 0.0422sec

0.32 0.32

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 01:47 PM |