more depressing news on BLR increase:

http://www.thestar.com.my/Business/Busines...al-house-buyer/An informal poll with property professionals, potential house buyers and a lender on the various issues in the property market today, including the BLR increase and lending based on gross/net selling prices and the effects on mortgage payments.

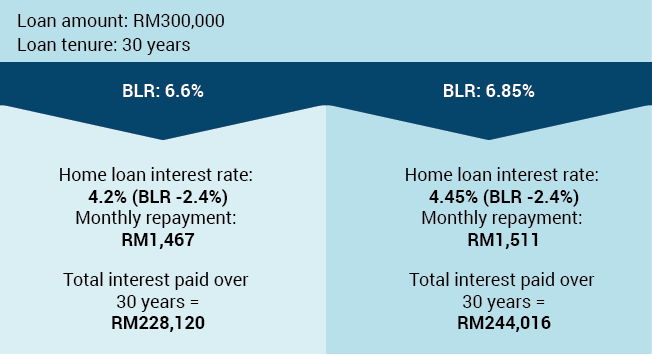

AND so the much-anticipated increase in the overnight policy rate (OPR) of 0.25% came. And with this increase, so will the base lending rate (BLR) on which mortgage rates are based, moving from the previous 6.6% to 6.85%. But this week’s increase in the BLR is not the only issue affecting the current property market.

There are other concerns, starting with the most recent. According to an informal poll with four property professionals, this increase of 0.25% is “marginal and will not impact mortgage payments significantly.”

Nevertheless, it is best not let our guard down because any increase, however small, impacts one way or another. The OPR resembles a set of tentacles that reach far into the nooks and corners of the economy – and our pockets. The OPR is the rate at which banks lend to each other.

Changes in the OPR invariably and inevitably are passed to consumers through a series of changes in the BLR of commercial banks and financial institutions, be it personal loans, mortgages and, hopefully, in the fixed deposit rates.

Henry Butcher Marketing Sdn Bhd chief operating officer Tang Chee Meng, on the current round of increase, says the Government will “not want to spook the market.”

Another round?

So the increase will be “gradual”, he says.

“Whether there will be another round later on depends on the economy,” Tang adds.

To really comprehend the significance of this round of increase on the property market, it is pertinent to consider the various anti-speculation measures imposed this year. These various measures work together to impact the market.As it is, the various anti-speculation measures have already taken effect, as seen in the slower sales today.

Savills Rahim & Co managing director Robert Ang says:

“Sales have been slow since this year. This increase in BLR will make property investors think twice. It will be translated into a higher investment cost.”Ang says this marginal increase is “psychological”. There may be another round of increase before the end of the year, he adds.

Insignificant an increase of 0.25% may be, a total increase of 0.5% over the longer term will be significant.Says a 40-year-old home buyer who is mulling a purchase: “I am not so bothered by this increase in BLR. I am more concerned about the goods and services tax (GST) which comes into effect next year. That will be far more painful for me, which is why I am thinking of buying now.”

Tax consultants are already holding interviews and talks on the effects of the GST on the economy. Although the residential segment of the property market is GST-exempt, there are concerns about its impact.

Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector president Siders Sittampalam advises caution.

Net and gross price

“It will have an impact on prices and value. The GST is imposed on construction materials. The whole value chain has to bear it. When the price of the final product is calculated, for example in a developer’s launch, the developer will factor in the GST that he has paid into the launching price. There is no way a developer will absorb the GST that he has paid. He will not take a hair cut.”

Siders says he expects developers to put launches on hold, which reduces supply. With the drop in supply and demand remaining the same, the price goes up.

Besides the BLR and the GST, another current issue besetting the housing market are the marketing strategies developers employ which invariably raises the price of housing over the longer term.

A property consultant who wants to remain anonymous says a package which comes with air-conditioners, electrical products like washing machines, refrigerators and “free” legal fees increases the overall house price.

“This happens in the primary market when a buyer buys from the developer. The selling price is a package comprising a discount, electrical products and legal fees. The buyer thinks the legal fees are being absorbed by the developer. In reality, all these products and fees have already been factored into the price of the house,” he says.

Based on two different examples, a condominium and a double-storey landed unit, the source says a closer examination of both reveals that the extras tend to push up prices (see chart).

“Buyers are happy when they are given a discount. But this discount is actually factored into the price of the house. In the sale and purchase agreement, the price of the house is stated as RM800,000, the gross price. He gets a loan based on this gross selling price. He will be paying less if the loan were to be based on the net selling price,” he says.

Consider scenario 1 for a double-storey house. The house is sold for RM800,000. If the free stuff and discount were to be removed, the net price is actually RM756,500, a difference of RM43,500.

The monthly mortgage payment under a BLR of 6.6%-2.4% is RM3,369. Under the new rates, it is RM3,762, a difference of RM393.

If one were to take a loan based on net selling price under the new rates, he will be paying RM206 less, that is RM3,556.

Under scenario 2, the net selling price of the house is RM797,100, a reduction of RM43,900 from its launching price of RM841,000. The monthly mortgage payment is a difference of RM207. Over a 35-year loan tenure, these differences in BLR and gross/net selling price calculations will be considerable.

The basis of selling a house based on gross price, instead of the net price, results in the next launch being priced higher. It has a snow-balling effect for subsequent launches.

Jan 16 2014, 11:23 AM, updated 12y ago

Jan 16 2014, 11:23 AM, updated 12y ago

Quote

Quote

1.1863sec

1.1863sec

1.35

1.35

6 queries

6 queries

GZIP Disabled

GZIP Disabled