PETALING JAYA: A number of banks will raise their base lending rates (BLR) and base financing rates (BFR) in tandem with Bank Negara’s announcement to raise the overnight policy rate (OPR) by 25 basis points (bps) from 3% to 3.25% effective tomorrow.

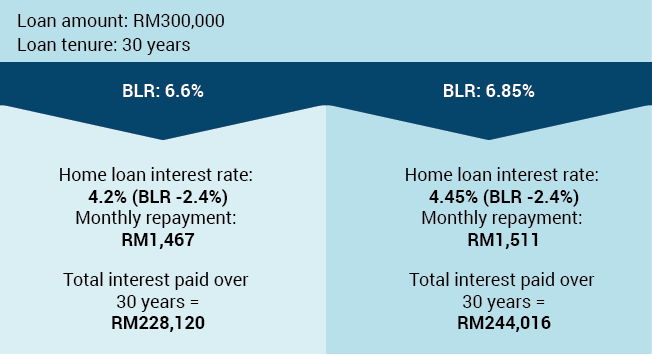

As a result, the BLR and BFR will be adjusted to 6.85% from 6.6% per annum previously.

The banks that have confirmed that the new rates will be effective tomorrow include Malayan Banking Bhd (Maybank), Hong Leong Bank Bhd (HLBB), CIMB Group Holdings Bhd, Public Bank Bhd, Alliance Financial Group Bhd and OCBC Malaysia.

It is understood that some banks may announce the interest rate revision on a different date, as they are still considering the quantum of the deposit rates, which will impact their earnings eventually.

Bank Simpanan Nasional senior vice-president and head of distribution Akhsan Zaini told StarBiz: “ We are still studying the impact of the rate hike on our bank before we announce the adjustment next week, tentatively.”

He also said the bank had yet to decide on how much it would adjust for its deposit rates.

CIMB Research expects the rate hike to enhance banks’ earnings by 1% to 2%, as their net interest margins (NIM) widen.

Maybank Investment Bank Research, on the other hand, anticipates NIM growth to be short-lived due to price competition.

The research unit had said in an earlier report: “Our forecasts already assume a 50-bps rate hike in 2014, and as a result, we are looking at a marginal four-bps aggregate NIM improvement in 2015 versus a seven-bps contraction in 2014.”

Some banks have also announced the revision of their deposit rates, but the quantum varies from one lender to another as well as the deposit tenure.

Among others, Maybank’s deposit rates will be revised upwards by up to 15 bps.

HLBB and Hong Leong Islamic Bank Bhd (HLISB) will increase their fixed-deposit and Term Deposit-I rates by up to 25 bps.

Following the revision, HLBB and HLISB’s new deposit rates for one, six and 12 months would be 3.05%, 3.2% and 3.3%, respectively.

Hong Leong Banking Group’s managing director Tan Kong Khoon said the group would continue to work closely with its customers to address their financing and savings needs. Meanwhile, OCBC Bank (M) Bhd and OCBC Al-Amin Bank Bhd will be increasing their fixed-deposit and General Investment Account-i rates respectively by up to 20 bps, depending on tenures effective July 21.

In a statement, Maybank said: “The last revision in Maybank’s BLR and Maybank Islamic’s BFR was on May 11, 2011 when they were revised from 6.3% to 6.6% per annum.”

OCBC Bank’s mortgage lending rate, the alternative to using BLR for home loans, will also increase, to 5.7% compared with 5.45% previously.

JP Morgan Research noted that it was cautious on banks, as the combination of rate hikes and subsidy rationalisation would test the credit risk management of Malaysia’s consumer-led loan growth in the past five years.

It preferred liquid banks and upgraded HLBB and Maybank to “overweight” from “neutral”.

SOS so far I only notice this announcement from Maybank website but not other bank yet.

Read from an old post related to BLR increment, saying bank has no right to increase our repayment amount, instead they will silently extend our loan serving period..

I just bought an apartment few months back and for the 0.25% increment will extend my repayment period from 30 years to 32 years.

Let's discuss what is the impact on property market after the increment on BLR, will it slow down the market? property price drop? speed up burble burst? help our country economy?

Jul 17 2014, 10:45 AM

Jul 17 2014, 10:45 AM

Quote

Quote

0.0286sec

0.0286sec

1.32

1.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled