QUOTE(stormaker @ Mar 18 2015, 12:50 PM)

You can agree with the amount but the government still need you to declare that you don't have any additional income that not subjected to PCBIncome Tax Issues v3, Anything related to Personal Income Tax

Income Tax Issues v3, Anything related to Personal Income Tax

|

|

Mar 18 2015, 02:14 PM Mar 18 2015, 02:14 PM

|

Senior Member

702 posts Joined: Jun 2006 |

|

|

|

|

|

|

Mar 18 2015, 02:47 PM Mar 18 2015, 02:47 PM

|

Senior Member

1,110 posts Joined: Oct 2008 |

i won a cash prize from a bank. do i need to pay taxes? they will deposit directly to my account.

|

|

|

Mar 18 2015, 02:48 PM Mar 18 2015, 02:48 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

|

|

|

Mar 18 2015, 02:50 PM Mar 18 2015, 02:50 PM

|

Senior Member

11,554 posts Joined: Aug 2009 |

|

|

|

Mar 18 2015, 02:51 PM Mar 18 2015, 02:51 PM

|

Senior Member

1,110 posts Joined: Oct 2008 |

lottery taxes paid upfront de la. Anyone else more knowledgable?

|

|

|

Mar 18 2015, 02:52 PM Mar 18 2015, 02:52 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(kaiserwulf @ Mar 18 2015, 02:51 PM) Taxable IncomeThe following sources of income are considered taxable in Malaysia: Business or profession Employment Dividends Interests (except bank deposit interests) Discounts Rent collected Royalties Premiums Pensions Annuities URL: https://ringgitplus.com/en/blog/Personal-Fi...letter_20150318 |

|

|

|

|

|

Mar 18 2015, 03:19 PM Mar 18 2015, 03:19 PM

|

Senior Member

3,130 posts Joined: Jun 2006 |

QUOTE(veron208 @ Mar 18 2015, 02:14 PM) You can agree with the amount but the government still need you to declare that you don't have any additional income that not subjected to PCB QUOTE(supersound @ Mar 18 2015, 02:50 PM) Not implemented yet. As government are still figuring counter measures on people that does not has fixed monthly income(like people that always work OT) Oh ... thanks for the clarification. |

|

|

Mar 18 2015, 05:12 PM Mar 18 2015, 05:12 PM

|

Junior Member

25 posts Joined: Jan 2015 |

QUOTE(zeese @ Mar 18 2015, 11:37 AM) The purpose of filing tax exemption is to reduce the income tax amount. That part in bold, yes. If you don't need to pay income tax (your income tax is RM0), what's the point of of filing tax exemption? There's no tax to be exempted/reduced in the first place. (Do you want to make your income tax becomes negative so government pay you money instead? |

|

|

Mar 18 2015, 05:16 PM Mar 18 2015, 05:16 PM

|

Junior Member

25 posts Joined: Jan 2015 |

QUOTE(cute_boboi @ Mar 18 2015, 12:25 PM) Once you started filing, every year need to file (declare). In your case, after you fill up the form or e-filing, the auto calculation will show you no taxable amount. Ah, alright. Thanks. So, you submit, and then print/softcopy and keep for 7 years. In this way, every year you have submission and record tracking. QUOTE(veron208 @ Mar 18 2015, 11:52 AM) The purpose of filing is not only to reduce the tax amount or to claim back. Nah, it's just the digging out receipts to claim tax exemption part that I dislike. Am not very organised so the receipts are stuffed everywhere. But will do! It will be good for you to declare your income in order to you to secure your loans from bank. For employed under BE form, the process of declaration take less than 10 mins. Why fret over such a simple task ? QUOTE(supersound @ Mar 18 2015, 11:49 AM) Nope, you still need to fill up everything. Unless you are telling that your salary won't increase over the years. Okay, thanks for the clarification!This is more on preventing you on getting audited for no reason next time |

|

|

Mar 18 2015, 05:22 PM Mar 18 2015, 05:22 PM

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(CuriousKitten @ Mar 18 2015, 05:16 PM) Nah, it's just the digging out receipts to claim tax exemption part that I dislike. Am not very organised so the receipts are stuffed everywhere. But will do! You need to start a practise, keep a large envelope or folder in an important drawer/cabinet.Each time you buy books, or sports equipment, or valid donations, etc. just put the receipts there. Every year income tax submission, bring out that file, filter/throw those invalid, etc. Each year submission done, put into separate file/envelope as "case closed", label the envelope, e.g. "2015 submission for Year Assessment 2014". Rinse and repeat every year. |

|

|

Mar 18 2015, 09:12 PM Mar 18 2015, 09:12 PM

|

Junior Member

8 posts Joined: Mar 2015 |

Hi all.

I am looking for a way to reduce my total taxable income to save more money. I have a daily full time job in Malaysia and a part time service-based freelance foreign income. What is the best way to save on tax payable? The freelance income is recurring monthly and TT to my bank account from US but amount is not fixed. Option 1: Find a job in Singapore and stay there since the tax rate is lower than Malaysia. Thus, reducing my total taxable income while the freelance income remain TT to Malaysia bank account. In other words, income tax is file in both countries. Is that possible? Option 2: Open a sole proprietor/Sdn. Bhd company. Outsource my work as project based to foreign people in other country around the world. The outsource work will be use as deduction for business expenses. There is very little expenses can be deduct since the service work can be done at anywhere. Just need a laptop and internet connection. Maybe require to buy some softwares or server hosting as business operation also. |

|

|

Mar 18 2015, 09:14 PM Mar 18 2015, 09:14 PM

|

Junior Member

381 posts Joined: Feb 2012 |

-deleted-

This post has been edited by patrickthissen: Mar 23 2015, 01:18 PM |

|

|

Mar 19 2015, 08:53 AM Mar 19 2015, 08:53 AM

|

Senior Member

1,110 posts Joined: Oct 2008 |

QUOTE(David83 @ Mar 18 2015, 02:52 PM) Taxable Income Ooo... thanks.. feel much richer already The following sources of income are considered taxable in Malaysia: Business or profession Employment Dividends Interests (except bank deposit interests) Discounts Rent collected Royalties Premiums Pensions Annuities URL: https://ringgitplus.com/en/blog/Personal-Fi...letter_20150318 |

|

|

|

|

|

Mar 19 2015, 09:42 AM Mar 19 2015, 09:42 AM

|

Junior Member

12 posts Joined: Mar 2015 |

hi all,

just come across a question, for rental income as i know you may deduct the term loan interest as expenditure as well, what if i take refinancing for the shop lot and repay it for another resident unit(which cant deduct interest loan) am i still eligible to deduct the loan interest from the shop lot since it is refinancing and not the loan for first time purchase. thanks alot. |

|

|

Mar 19 2015, 10:31 AM Mar 19 2015, 10:31 AM

|

All Stars

52,874 posts Joined: Jan 2003 |

QUOTE(jo3456 @ Mar 19 2015, 09:42 AM) hi all, You can only deduct direct expenses incurred from the unit that you're renting out.just come across a question, for rental income as i know you may deduct the term loan interest as expenditure as well, what if i take refinancing for the shop lot and repay it for another resident unit(which cant deduct interest loan) am i still eligible to deduct the loan interest from the shop lot since it is refinancing and not the loan for first time purchase. thanks alot. |

|

|

Mar 19 2015, 08:57 PM Mar 19 2015, 08:57 PM

|

Junior Member

406 posts Joined: May 2006 From: :) |

Filed my tax on 5th, received the refund by today. Somehow the amount received is lesser, not sure why.

|

|

|

Mar 19 2015, 09:03 PM Mar 19 2015, 09:03 PM

|

Senior Member

2,661 posts Joined: Jan 2003 |

|

|

|

Mar 19 2015, 11:26 PM Mar 19 2015, 11:26 PM

|

Senior Member

1,388 posts Joined: May 2012 |

|

|

|

Mar 20 2015, 10:29 AM Mar 20 2015, 10:29 AM

|

Junior Member

66 posts Joined: Jan 2015 |

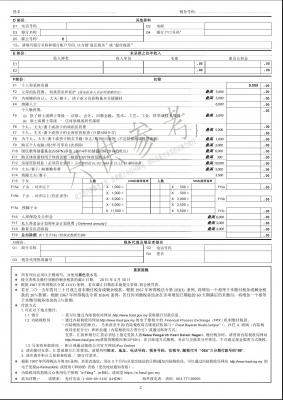

This is the chinese version of income tax return form for Form BE YA 2014.

http://www.hasil.gov.my/pdf/pdfborang/BE2014_Chinese_1.pdf Attached thumbnail(s)

|

|

|

Mar 20 2015, 12:11 PM Mar 20 2015, 12:11 PM

|

All Stars

48,583 posts Joined: Sep 2014 From: REality |

QUOTE(KOHTT @ Mar 19 2015, 11:26 PM) good tips |

|

Topic ClosedOptions

|

| Change to: |  0.0299sec 0.0299sec

0.46 0.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 04:36 AM |