Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v3, Anything related to Personal Income Tax

|

danieljaya

|

Jan 10 2015, 04:16 PM Jan 10 2015, 04:16 PM

|

Getting Started

|

QUOTE(Ned_Fromthenorth @ Jan 9 2015, 04:37 PM) hey guys i registered for e hasil but because of my computer messed up i failed to record the no permohonan, so now i cant request the PIN. what should i do? tried calling 1-800-88-5436 but no one answer. You may try to call 03-7713 6655 or you can try to go http://maklumbalas.hasil.gov.my/ for getting your pin. |

|

|

|

|

|

danieljaya

|

Jan 10 2015, 04:47 PM Jan 10 2015, 04:47 PM

|

Getting Started

|

QUOTE(renee78 @ Jan 5 2015, 02:09 PM) I'm a sole proprietor and yearly submitting form B. Now thinking of hiring people. I understand need to register with EPF and Socso when I start to hire people. I was wondering if I also need to register with LHDN as they will be below the salary to pay income tax? If below the threshold to pay the income tax, you may register it later with LHDN. |

|

|

|

|

|

danieljaya

|

Jan 17 2015, 10:02 AM Jan 17 2015, 10:02 AM

|

Getting Started

|

QUOTE(KingDamo @ Jan 15 2015, 12:38 PM) Looking for personal tax info and help. What are the usual charges for a consultant's help? I receive income from two countries not MY, stay less than 180 days in MY and absent in year end or start (NR). 1. Consultancy fees from SG company for work in ID 2. Monthly salary from ID company for work in ID Mother ask me fast fast declare income before GST so can buy property wor. I don't really care about buying or not, but just want to declare my income. Since income not derived from Malaysia, I'm basically not taxable right? Please shed some light thank you. 1. This is the first time you receive income from the mentioned two countries? 2. All the while you submit your return in which country? |

|

|

|

|

|

danieljaya

|

Jan 18 2015, 10:42 AM Jan 18 2015, 10:42 AM

|

Getting Started

|

QUOTE(KingDamo @ Jan 17 2015, 04:05 PM) 1. Yesh 2. Never really submitted anything until recently. Currently pay tax to Indonesia for income 2. 1. Consultancy fees from SG company for work in ID This also should be reported to indonesia tax authority. |

|

|

|

|

|

danieljaya

|

Jan 18 2015, 02:48 PM Jan 18 2015, 02:48 PM

|

Getting Started

|

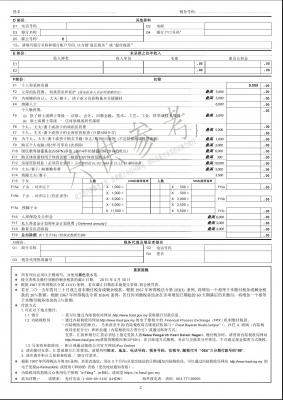

Assuming that you made RM38,202.25 in 2015... Chargeable Income Your Chargeable Income = Your taxable income - (Standard RM9,000 individual tax relief + 11% EPF Contribution of your salary) which means Your Chargeable Income = RM38,202.25 - (RM9,000 + RM4,202.25) = RM25,000 Based on the tax rate table above, RM25,000 would be taxed RM150 on the first RM20,000 and RM250 on the remaining RM5,000 at rate of 5% which brings it up to about RM400 in tax. RM400 Rebate After taking into account the RM400 rebate for those with a chargeable income of RM35,000 or less, you'll be paying RM400 - RM400 = RM0 (no tax de o)  As refer to http://savemoney.my/personal-income-tax-malaysia-2014#mintax |

|

|

|

|

|

danieljaya

|

Jan 18 2015, 07:01 PM Jan 18 2015, 07:01 PM

|

Getting Started

|

QUOTE(T231H @ Jan 18 2015, 03:40 PM) Published in April 30, 2014... If an individual earns an annual employment income of RM26,501 (after EPF deduction), he would have to register a file. Registration for an income tax reference number can be made at any IRB branch or you can enquire at the Customer Service Centre at 1800-88-5436. A penalty equal to three times the amount of the tax (which is before any set-off, repayment or relief under the Income Tax Act) is payable if a person defaults in furnishing a tax return. http://www.thestar.com.my/News/Nation/2014...ur-tax-returns/hope that answered you question Registration for an income tax reference number can be made via online at IRB website. http://edaftar.hasil.gov.my/dafsgjpn.php |

|

|

|

|

|

danieljaya

|

Jan 22 2015, 01:39 PM Jan 22 2015, 01:39 PM

|

Getting Started

|

QUOTE(Cubed1437 @ Jan 21 2015, 05:31 PM) If a person is in a training contract for 1 year, does he need to pay tax? Also, the 30k min requirement is gross salary or after minusing rebates/deductables? If one is below 30k, he should register with LHDN too or wait until increase in salary? Last question, when do you need to pay tax? Before what date, is it for one year straight? Sorry for the simple questions, new guy in the working world here! Self Assessment for individuals will begin in Year 2004. The implementation of Self Assessment is based on the concept of “Pay, Self-Assess and File”. Under the Self Assessment System, taxpayers are entrusted with the responsibilities to assess and pay their taxes due to the Government. It is an act that should be carried out voluntarily by everyone who is liable to tax. Nevertheless, the Inland Revenue Board (IRB) will carry out audits on a selective basis to verify the information provided by taxpayers. You need to pay if you are start to liable to tax which is above the min requirement. The due date for submission of Form BE for Year of Assessment 2014 is 30 April 2015. The grace period for e-Filing of Form BE (e-BE) for Year of Assessment 2014 is given until 15 May 2015.   |

|

|

|

|

|

danieljaya

|

Jan 23 2015, 09:05 AM Jan 23 2015, 09:05 AM

|

Getting Started

|

QUOTE(karl7077 @ Jan 23 2015, 08:31 AM) Real estate agent need to request EA form from employer? Income based on commission , sometimes no income for the month, and employer need to deduct PCB for real estate agent? You have to file Form CP58. The Form CP58 must be provided to the agent, dealer or distributor by 31 March of the following year. |

|

|

|

|

|

danieljaya

|

Jan 30 2015, 02:47 PM Jan 30 2015, 02:47 PM

|

Getting Started

|

QUOTE(panmaa92 @ Jan 29 2015, 05:58 PM) how much amount of threshold for sales and service tax that need to be register?? 500k |

|

|

|

|

|

danieljaya

|

Feb 3 2015, 08:26 PM Feb 3 2015, 08:26 PM

|

Getting Started

|

QUOTE(iamkid @ Jan 31 2015, 12:52 AM) Hi, I would like to ask about the LHDN bayaran ansuran cukai (the one that pay income tax for next year, a few months pay once) In 2012, we got this ansuran thingy and pay accordingly for 2013. In 2013, the taxable amount lesser than ansuran paid. Till now 2015 also haven get the balance back. What can do? Can minus the balance from the 2014 year (going to start do soon)'s tax? Eg in 2014 need to pay Rm100, LHDN owe us RM60. Then we pay RM40 only now Boleh? Thanks in advance!  it is better than you pay RM100 to them first, then only claim back your RM40 REFUND. or else you write in to them saying that you want to offset your tax payable by using the RM40 credit. |

|

|

|

|

|

danieljaya

|

Feb 24 2015, 08:23 AM Feb 24 2015, 08:23 AM

|

Getting Started

|

QUOTE(simplesmile @ Feb 23 2015, 08:38 PM) I paid medical insurance for my parents. Can I claim the premium as income tax relief? Or maybe claim relief as parents medical expenses? According to Income Tax Act 1967 Subsection 49(1D) A relief not exceeding RM3,000 is available on insurance premiums paid in respect of education or medical benefits for an individual, husband, wife, or child. In other words, if you paid medical insurance for your parents you can not claim as relief neither medical expenses as the payment for premium is not constitute as medical expenses in the first place. |

|

|

|

|

|

danieljaya

|

Feb 24 2015, 11:15 AM Feb 24 2015, 11:15 AM

|

Getting Started

|

QUOTE(veron208 @ Feb 24 2015, 09:53 AM) In another words means I can claim for medical insurance that I paid for my children and wife ? But the insurance must state me as the rider ? According to PUBLIC RULING COMPUTATION OF INCOME TAX PAYABLE BY A RESIDENT INDIVIDUAL http://www.hasil.gov.my/pdf/pdfam/PR2_2005.pdf A medical policy must satisfy the following criteria - 1. the policy can be a stand-alone policy or as a rider to a life insurance policy. If it is a rider, only the rider premium can qualify for deduction; 2. where a dread disease cover is attached to a basic policy, the whole amount of the rider premium paid is allowed as a deduction 3. premium waiver benefit rider and travel medical expenses insurance are not allowable as deduction. |

|

|

|

|

|

danieljaya

|

Feb 25 2015, 03:21 PM Feb 25 2015, 03:21 PM

|

Getting Started

|

QUOTE(hokuan @ Feb 25 2015, 02:29 PM) Hi, I've just started a sole proprietor business few months ago, and wanted to open an account for income tax. I have filled up the form and submitted it through e-hasil website to apply for nombor cukai pendapatan. However, I couldnt find the button to upload relevant documents such as IC and business registration. Will the button appear later or I have to email them? Please visit here to upload your document http://www.hasil.gov.my/goindex.php?kump=2...1&unit=4&sequ=1 |

|

|

|

|

|

danieljaya

|

Mar 7 2015, 02:26 PM Mar 7 2015, 02:26 PM

|

Getting Started

|

QUOTE(yao_mou_gao_cho @ Mar 6 2015, 06:21 PM) Hi guys... I have a question about TP1 form. If I submit the TP1 form on March 2015, can I project the relief till the end of 2015? For example books/magazines relief (max. RM1000), actual spend until March 2015 is RM200. But in the TP1 form submitted on March 2015, I put RM1000. At the end of 2015, I manage to max out the book/magazines expenditure (RM1000). Will I be penalized? The TP1 form which included relief should be submitted as and when there are reliefs to be claimed and no receipt needed to submit to employers. However, do closely monitor the relief and make sure it reach rm1000 by end of the year. Source: http://www.thestar.com.my/News/Nation/2014...lan-starts-now/This post has been edited by danieljaya: Mar 7 2015, 02:27 PM |

|

|

|

|

|

danieljaya

|

Mar 7 2015, 10:58 PM Mar 7 2015, 10:58 PM

|

Getting Started

|

QUOTE(yao_mou_gao_cho @ Mar 7 2015, 05:34 PM) Let say I did not reach RM1000 by end of the year, can I just do the e-filing next year March/April and pay the balance? Or I will be penalized due to false TP1 form submission?  It mentioned in the article "For those who make mistakes in a TP1 form or forgot to submit it to their employers, IRB public relations officer Masrun Maslim said they could still opt to file the annual tax returns before April 30 next year." http://www.thestar.com.my/News/Nation/2014...lan-starts-now/This post has been edited by danieljaya: Mar 7 2015, 10:58 PM |

|

|

|

|

|

danieljaya

|

Mar 8 2015, 09:47 PM Mar 8 2015, 09:47 PM

|

Getting Started

|

QUOTE(wenqing @ Mar 8 2015, 05:02 PM) Hi all sifu. I face a problem when trying to get No Pin . it says my email need to register at LHDMN. Anyone help? call to them 03 62091000. Ask the receptionist look for efiling pin number personal. Try to call around 9am. |

|

|

|

|

|

danieljaya

|

Mar 10 2015, 11:17 PM Mar 10 2015, 11:17 PM

|

Getting Started

|

QUOTE(wil-i-am @ Mar 10 2015, 10:49 PM) Restricted to RM6k pa ony If you received free petrol more than 6th in exercising your employment.. claim for deduction for official duty can be made in computing your employment income |

|

|

|

|

|

danieljaya

|

Mar 18 2015, 10:43 AM Mar 18 2015, 10:43 AM

|

Getting Started

|

QUOTE(xngjn @ Mar 17 2015, 03:14 PM) I got a one time off project (around 20k). I still a student. do I need to fill income tax? As a part time job I dont have epf all those and no EA form Basically i can say no need. If you got more project to come, do alert to apply income tax no. |

|

|

|

|

|

danieljaya

|

Mar 18 2015, 11:24 AM Mar 18 2015, 11:24 AM

|

Getting Started

|

Tax payers may pay their income tax and real property gain tax (RPGT) at https://byrhasil.hasil.gov.my/creditcard/ using credit card. All VISA, Mastercard and American Express credit cards issued in Malaysia can be used for this service. Any one try this? |

|

|

|

|

Jan 10 2015, 04:16 PM

Jan 10 2015, 04:16 PM

Quote

Quote

0.0529sec

0.0529sec

0.24

0.24

7 queries

7 queries

GZIP Disabled

GZIP Disabled