QUOTE(Icehart @ Jun 26 2013, 10:57 AM)

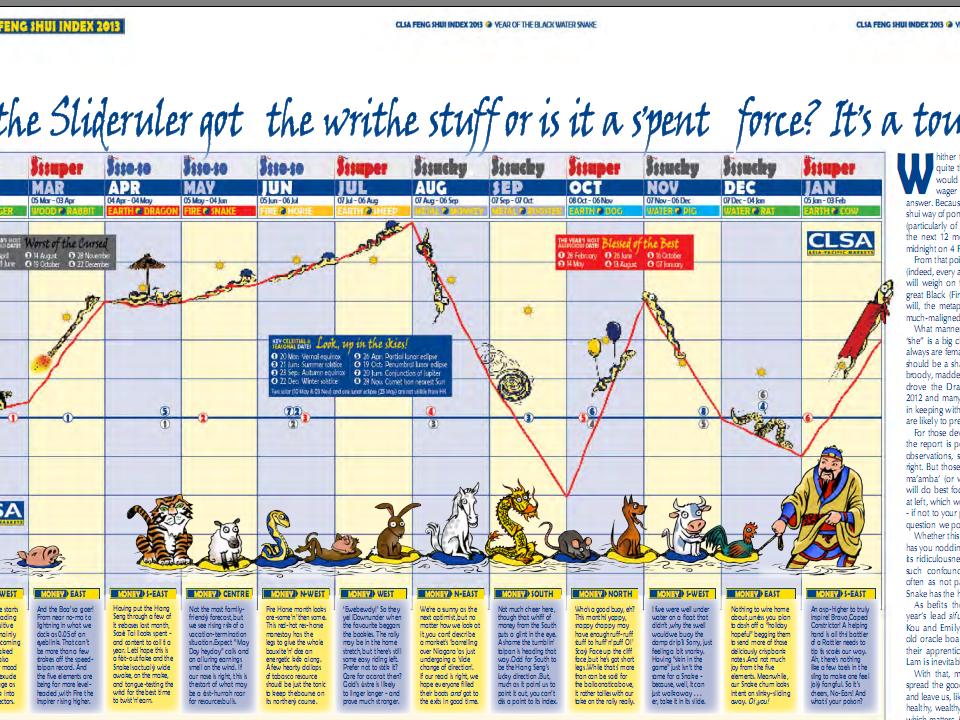

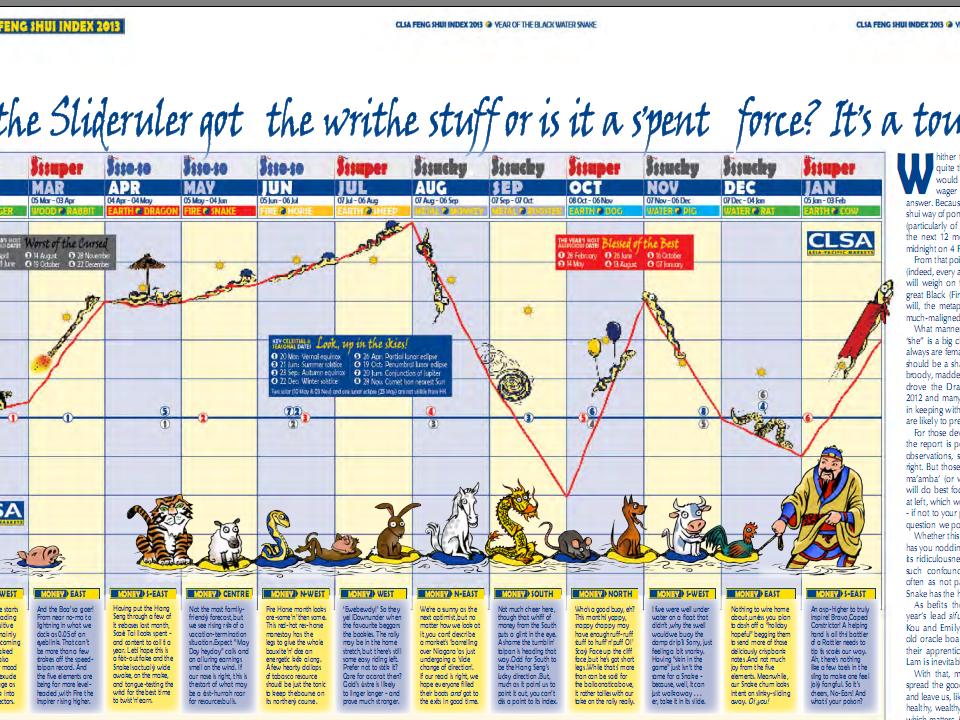

Is this for US or Malaysian market STOCK MARKET DISCUSSION V133, Bear coming?

STOCK MARKET DISCUSSION V133, Bear coming?

|

|

Jun 26 2013, 02:18 PM Jun 26 2013, 02:18 PM

|

Senior Member

1,669 posts Joined: Jul 2007 |

|

|

|

|

|

|

Jun 26 2013, 02:20 PM Jun 26 2013, 02:20 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(cherroy @ Jun 26 2013, 02:08 PM) OPR is not going to be raised with current economy condition. I think it depends on how well EPF could absorb the Govt Bonds selling by FF .It is suicide for central bank to raise rate at this moment or near term, when equities market is volatile, economy is getting slower and no pressure of inflation, (commodities price soft and gold price plunging). Having said that, I would agree Reit price should go down a bit more, as at the moment, yield is too low (due to too much cash chasing too little thing). I do not understand why many keep on saying interest rate is going to be hike... too many media cooking? Bond price drop sending yield higher, yes. Interest rate, over night rate that set by central bank being raised? Chance is remote. If US treasury jumps to 3% ( now about 2.6% ) , our Govt Bonds currently could be less than 3% on average ...... Our ringgit could drop like a stone too. This post has been edited by SKY 1809: Jun 26 2013, 02:20 PM |

|

|

Jun 26 2013, 02:22 PM Jun 26 2013, 02:22 PM

|

Senior Member

3,815 posts Joined: Feb 2012 |

|

|

|

Jun 26 2013, 02:22 PM Jun 26 2013, 02:22 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(SKY 1809 @ Jun 26 2013, 02:09 PM) Ya kinda true also. the key point is to catch fishes based on valuation pov more than market sentiment.But many fundamentalists still able to catch fishes at super low prices... Perhaps they forget to tell u they do keep lot of cash and waiting for more opportunities. Their reasons for u not to time the markets ........... when price down and fundamental stays, valuation is getting cheaper and cheaper, that's why fundamentalists start buying in more. |

|

|

Jun 26 2013, 02:25 PM Jun 26 2013, 02:25 PM

|

Senior Member

7,960 posts Joined: Dec 2007 From: Kuala Lumpur |

QUOTE(Bonescythe @ Jun 26 2013, 11:46 AM) Actually when Bursa Announcement got Lemon Chan.. The nominee (proxy) account already started to sell sell sell and make all kind of fakes transaction already. So all the newbie will think RC just entered, and they enter together with RC.. and hit hit hit.. But actually hitting their proxy disposed stocks. plz remind newbies once in a while for their own good... dun become water fish and get slaughtered... |

|

|

Jun 26 2013, 02:25 PM Jun 26 2013, 02:25 PM

|

Senior Member

3,482 posts Joined: Sep 2007 |

QUOTE(yok70 @ Jun 26 2013, 02:22 PM) the key point is to catch fishes based on valuation pov more than market sentiment. How if fundamentalist get wrong anf the stock change in fundamental, but it just he couldn't see it when price down and fundamental stays, valuation is getting cheaper and cheaper, that's why fundamentalists start buying in more. Valuation also change that time |

|

|

|

|

|

Jun 26 2013, 02:26 PM Jun 26 2013, 02:26 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

|

|

|

Jun 26 2013, 02:26 PM Jun 26 2013, 02:26 PM

|

Senior Member

1,633 posts Joined: Jan 2007 |

today seems like got people push down "wafer price" hmmm

|

|

|

Jun 26 2013, 02:26 PM Jun 26 2013, 02:26 PM

|

Senior Member

4,342 posts Joined: Apr 2010 From: The place that i call home :p |

Check into bear or bulls market........

|

|

|

Jun 26 2013, 02:30 PM Jun 26 2013, 02:30 PM

|

Junior Member

55 posts Joined: Mar 2012 |

|

|

|

Jun 26 2013, 02:30 PM Jun 26 2013, 02:30 PM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(yok70 @ Jun 26 2013, 02:22 PM) the key point is to catch fishes based on valuation pov more than market sentiment. But when they forsee a banking crisis or asset bubble to burst , then they still need to time the market.when price down and fundamental stays, valuation is getting cheaper and cheaper, that's why fundamentalists start buying in more. WB also time the market to go into US property sectors .........He did not just jump in the moment property crashes at rock bottom values. In fact, he buys because he expects US property trend to be reversed soon. ........... This post has been edited by SKY 1809: Jun 26 2013, 02:31 PM |

|

|

Jun 26 2013, 02:34 PM Jun 26 2013, 02:34 PM

|

All Stars

12,698 posts Joined: Jun 2010 From: kuala lumpur |

QUOTE(SKY 1809 @ Jun 26 2013, 02:30 PM) But when they forsee a banking crisis or asset bubble to burst , then they still need to time the market. when they foresee a banking crisis or asset bubble to burst, that's under fundamental changes. WB also time the market to go into US property sectors .........He did not just jump in the moment property crashes at rock bottom values. In fact, he buys because he expects US property trend to be reversed soon. ........... if you called that time the market, well at that level, they are the same thing with 2 faces then. like my mistake made pre-GE, that's a time the market without much fundamental concern. This post has been edited by yok70: Jun 26 2013, 02:36 PM |

|

|

Jun 26 2013, 02:37 PM Jun 26 2013, 02:37 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(V-Zero @ Jun 26 2013, 02:13 PM) nonono Dude... check this out. Consider KLCI all time closing high of 1780 (forget exact) to now of roughly 1725, we only corrected for a mere 3%, perhaps included in the fengshui chart but negligible drop? So we will still sail up to 1800 by end of July. So ride the wave now and sell on 31st July? KLCI closing at month end. Feb: 1,637.63 March: 1,671.63 Apr: 1,717.65 May: 1,769.22 Check... Feb closed at 1,637.63. March closed at 1,671.63. KLCI is up 34 pts. Fong Sway chart says big rise in March. Correct.  How did Fong Sway chart draw the 34 points? Big up. KLCI closed May at 1,769.22. We are now at 1734.67. We are down 34.5 pts on the index for the month. Question: I understand that 3% can and should be considered a mere correction BUT how are you going to compare this 34 points down with the 34 points up on Feb 2013? Anyway like I say "This is like saying it doesn't matter when the Fong Sway chart is wrong. It only matters when it is correct." |

|

|

|

|

|

Jun 26 2013, 02:41 PM Jun 26 2013, 02:41 PM

|

Senior Member

896 posts Joined: Jul 2012 |

QUOTE(Boon3 @ Jun 26 2013, 02:37 PM) Dude... check this out. If the feng shui chart is correct, then we dun need analysis and many will be rich ady lo..i trust everyone know if for reference only... KLCI closing at month end. Feb: 1,637.63 March: 1,671.63 Apr: 1,717.65 May: 1,769.22 Check... Feb closed at 1,637.63. March closed at 1,671.63. KLCI is up 34 pts. Fong Sway chart says big rise in March. Correct.  How did Fong Sway chart draw the 34 points? Big up. KLCI closed May at 1,769.22. We are now at 1734.67. We are down 34.5 pts on the index for the month. Question: I understand that 3% can and should be considered a mere correction BUT how are you going to compare this 34 points down with the 34 points up on Feb 2013? Anyway like I say "This is like saying it doesn't matter when the Fong Sway chart is wrong. It only matters when it is correct." |

|

|

Jun 26 2013, 02:53 PM Jun 26 2013, 02:53 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Madbull @ Jun 26 2013, 02:41 PM) If the feng shui chart is correct, then we dun need analysis and many will be rich ady lo..i trust everyone know if for reference only... Nope. I won't even use this Pong Sway chart for reference. |

|

|

Jun 26 2013, 02:56 PM Jun 26 2013, 02:56 PM

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 26 2013, 02:37 PM) Dude... check this out. Sifu got a point there. KLCI closing at month end. Feb: 1,637.63 March: 1,671.63 Apr: 1,717.65 May: 1,769.22 Check... Feb closed at 1,637.63. March closed at 1,671.63. KLCI is up 34 pts. Fong Sway chart says big rise in March. Correct. » Click to show Spoiler - click again to hide... « How did Fong Sway chart draw the 34 points? Big up. KLCI closed May at 1,769.22. We are now at 1734.67. We are down 34.5 pts on the index for the month. Question: I understand that 3% can and should be considered a mere correction BUT how are you going to compare this 34 points down with the 34 points up on Feb 2013? Anyway like I say "This is like saying it doesn't matter when the Fong Sway chart is wrong. It only matters when it is correct." But still got 2 market days until end of June right? Later Friday close at 1,769.22+ Then the fengshui chart must be dayum chun liao |

|

|

Jun 26 2013, 02:58 PM Jun 26 2013, 02:58 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Jun 26 2013, 02:59 PM Jun 26 2013, 02:59 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(V-Zero @ Jun 26 2013, 02:56 PM) Sifu got a point there. But still got 2 market days until end of June right? Later Friday close at 1,769.22+ Then the fengshui chart must be dayum chun liao Still cannot. Look at month of April. End March 1,671.63. April closed at 1,717.65. Aiyoyo. KLCI up 46 pts for April. Which is more than March. How did Pong Sway chart draw April? |

|

|

Jun 26 2013, 02:59 PM Jun 26 2013, 02:59 PM

|

Senior Member

16,872 posts Joined: Jun 2011 |

|

|

|

Jun 26 2013, 03:01 PM Jun 26 2013, 03:01 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(SKY 1809 @ Jun 26 2013, 02:20 PM) I think it depends on how well EPF could absorb the Govt Bonds selling by FF . Malaysia 10 years is about always at around 3.5~4%.If US treasury jumps to 3% ( now about 2.6% ) , our Govt Bonds currently could be less than 3% on average ...... Our ringgit could drop like a stone too. Actually it is not RM drop, but USD has tremendous strength. RM vs AUD, is actually appreciating. Those said USD is worthless, and short USD, bear USD, now being hit left and right, due to massive QE previously. As many USD bear, either short USD, holding others currency or go into gold market. The extreme USD bear, short USD, long gold, is the worst scenario for time being. Left being whacked, right being slapped. This post has been edited by cherroy: Jun 26 2013, 03:04 PM |

|

Topic ClosedOptions

|

| Change to: |  0.0287sec 0.0287sec

0.64 0.64

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 10:09 AM |