STOCK MARKET DISCUSSION V133, Bear coming?

|

|

Jun 26 2013, 10:34 AM Jun 26 2013, 10:34 AM

Return to original view | Post

#1

|

Senior Member

1,213 posts Joined: Apr 2007 |

Sell on 31st July and go away.

|

|

|

|

|

|

Jun 26 2013, 11:24 AM Jun 26 2013, 11:24 AM

Return to original view | Post

#2

|

Senior Member

1,213 posts Joined: Apr 2007 |

^

Not for the patience-less people. IE those that expect 100% return in few days. |

|

|

Jun 26 2013, 01:23 PM Jun 26 2013, 01:23 PM

Return to original view | Post

#3

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(yok70 @ Jun 26 2013, 01:13 PM) Momentum indicators are starting to turn from weak bullish to weak bearish. Still considering whether to hold on to the rest of my 47% or go 100% cash. Market top has been established at 1788. The possibility of downside is higher than upside. Chances of falling towards 200-day MVA at 1670 is high. http://www.theedgemalaysia.com/business-ne...g-stronger.html |

|

|

Jun 26 2013, 01:48 PM Jun 26 2013, 01:48 PM

Return to original view | Post

#4

|

Senior Member

1,213 posts Joined: Apr 2007 |

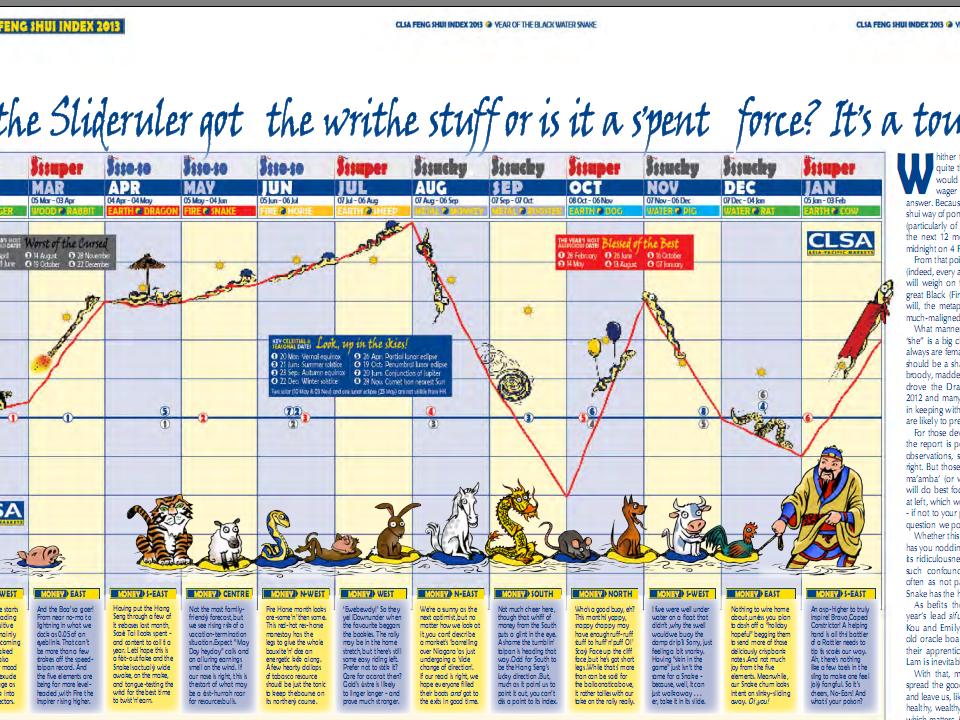

QUOTE(yok70 @ Jun 26 2013, 01:39 PM) I only consider stocks with solid fundamentals.Valuation wise most still got decent upward space. The thing is, I wanna avoid going into the market when the short-mid term outlook is dim. Me no rike when mah share stuck at -5% loss after entry. Even REITs are no longer a safe hedge against equity volatility. 2 months until the big drop, according to fengshui chart. |

|

|

Jun 26 2013, 01:58 PM Jun 26 2013, 01:58 PM

Return to original view | Post

#5

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 26 2013, 01:54 PM) So when the big drop happens in two months time, that fong sway chart is accurate? Considering the market sentiment now, no harm to follow the chart. for June the fong sway chart says go UP. Conclusion? Depend more on fong sway chart. Soon it will be accurate one. Small constant profit better than wild swings for me, heart cannot tahan. |

|

|

Jun 26 2013, 02:13 PM Jun 26 2013, 02:13 PM

Return to original view | Post

#6

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 26 2013, 02:05 PM) Strange. This is like saying it doesn't matter when the Fong Sway chart is wrong. It only matters when it is correct. Consider KLCI all time closing high of 1780 (forget exact) to now of roughly 1725, we only corrected for a mere 3%, perhaps included in the fengshui chart but negligible drop? So we will still sail up to 1800 by end of July. So ride the wave now and sell on 31st July? |

|

|

|

|

|

Jun 26 2013, 02:56 PM Jun 26 2013, 02:56 PM

Return to original view | Post

#7

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 26 2013, 02:37 PM) Dude... check this out. Sifu got a point there. KLCI closing at month end. Feb: 1,637.63 March: 1,671.63 Apr: 1,717.65 May: 1,769.22 Check... Feb closed at 1,637.63. March closed at 1,671.63. KLCI is up 34 pts. Fong Sway chart says big rise in March. Correct. » Click to show Spoiler - click again to hide... « How did Fong Sway chart draw the 34 points? Big up. KLCI closed May at 1,769.22. We are now at 1734.67. We are down 34.5 pts on the index for the month. Question: I understand that 3% can and should be considered a mere correction BUT how are you going to compare this 34 points down with the 34 points up on Feb 2013? Anyway like I say "This is like saying it doesn't matter when the Fong Sway chart is wrong. It only matters when it is correct." But still got 2 market days until end of June right? Later Friday close at 1,769.22+ Then the fengshui chart must be dayum chun liao |

|

|

Jun 26 2013, 03:10 PM Jun 26 2013, 03:10 PM

Return to original view | Post

#8

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 26 2013, 02:59 PM) Still cannot. Look at month of April. End March 1,671.63. April closed at 1,717.65. Aiyoyo. KLCI up 46 pts for April. Which is more than March. How did Pong Sway chart draw April? Kasi chance sikit lah bang Let's put it another way, any forecast/prediction will never be 100% dead on accurate, so allows some significant variance. Disclaimer: Am just fooling around, not trying to prove that the chart is accurate. |

|

|

Jun 26 2013, 03:22 PM Jun 26 2013, 03:22 PM

Return to original view | Post

#9

|

Senior Member

1,213 posts Joined: Apr 2007 |

|

|

|

Jun 26 2013, 03:27 PM Jun 26 2013, 03:27 PM

Return to original view | Post

#10

|

Senior Member

1,213 posts Joined: Apr 2007 |

|

|

|

Jun 26 2013, 04:07 PM Jun 26 2013, 04:07 PM

Return to original view | Post

#11

|

Senior Member

1,213 posts Joined: Apr 2007 |

Ok lah let the fongsui chart topic rest.

I shall necro it when August comes. Completed analyzing Coastal, me like the balance sheet. Anyone want to sell to me at RM1.99? |

|

|

Jun 26 2013, 04:13 PM Jun 26 2013, 04:13 PM

Return to original view | Post

#12

|

Senior Member

1,213 posts Joined: Apr 2007 |

|

|

|

Jun 26 2013, 11:23 PM Jun 26 2013, 11:23 PM

Return to original view | Post

#13

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 26 2013, 06:19 PM) I object. Why you give up on Pong Sway chart so easily? I tell you la, when the time it comes correct, many will go hoo ha over it. When it is wrong, nobody saw and say nothing. Coastal? Why Coastal have so much money? Why Coastal share no oomph past few years? Why Coastal profits no oomph past few years? I never take it seriously in the 1st place. Just find it interesting on how the creator thought of the flow. The beauty of human minds. Smart ones will take advantage of these. My POV would be that the nature of the business is more risky and no constant income stream. So no oomph on the share price. Funds rich cz need more funds for emergency. But that could change with their entry into rig business as its considered recurring income? Didn't study the sector in depth, just some common sense blabbering. Prepared to kena condemn again This post has been edited by V-Zero: Jun 26 2013, 11:24 PM |

|

|

|

|

|

Jun 27 2013, 08:26 AM Jun 27 2013, 08:26 AM

Return to original view | Post

#14

|

Senior Member

1,213 posts Joined: Apr 2007 |

|

|

|

Jun 27 2013, 08:44 AM Jun 27 2013, 08:44 AM

Return to original view | Post

#15

|

Senior Member

1,213 posts Joined: Apr 2007 |

|

|

|

Jun 27 2013, 08:51 AM Jun 27 2013, 08:51 AM

Return to original view | Post

#16

|

Senior Member

1,213 posts Joined: Apr 2007 |

^ I looked into Gadang and Salcon's annual report yesterday and I stopped not even half-way.

Don't really like the financial. Perhaps am not really into properties/cyclical sector. |

|

|

Jun 27 2013, 09:10 AM Jun 27 2013, 09:10 AM

Return to original view | Post

#17

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 27 2013, 08:59 AM) Good effort but I object. Pong Sway again Cos I won't stretch it that far back. The data, has to be more relevant. Hehe.. for this point, you have the right to object to my objections. » Click to show Spoiler - click again to hide... « You look again at the very first Coastal chart I posted. What would be an interesting thing to note? Those are random charts. In case you do not know, I am a trader. Gadang and Salcon, you can actually see some sort of similarities with Coastal. The reason to buy is the said 'potential'... Gadang got it's new mega housing project. Salcon diversifying big time into properties with the son of a property master. Coastal diversifying into the rig business. And if you take out the 'potential' there's nothing much to shout about. So yes, Gadang and Salcon's annual report is not something you want to read. » Click to show Spoiler - click again to hide... « Probably people expecting good things during 2011-2012, but then the gross profit dropped quite a chunk. That explains the drop from Feb - June 2012. Yup I won't be looking at it if there's no potential. I'm more of an investor with passion in trading. And well.. I read annual reports while working everyday. |

|

|

Jun 27 2013, 09:46 AM Jun 27 2013, 09:46 AM

Return to original view | Post

#18

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 27 2013, 09:35 AM) Ok... no more P & S for now. Here's another thing. As you can see in your chart, Coastal shares did extremely well up to 2011. It was terror geng. It became an investor darling of a stock. Here's the thing. If one bought say after 2011 ( because Coastal was an investing hot stock) and held the stock until today, they would find their investment rather fruitless, and as you have now noted, Coastal profits since 2011 have been pretty poor. Ah yes my previous holding gave me 5% ROI for 1 year or so. As of now still no sign of recovery yet, probably the only thing stopping it from rolling over is the strong balance sheet. With their entry into rig biz, might give some potential into this otherwise boring stock. Anyway I retain my entry price of not more than RM1.99 or else I'd skip. |

|

|

Jun 27 2013, 09:55 AM Jun 27 2013, 09:55 AM

Return to original view | Post

#19

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(Boon3 @ Jun 27 2013, 09:51 AM) Whet the .... I object la ..... This means you are saying Pong Sway can be wrong for April, May, June and maybe July but most important is August ah? LOL! Like I said.... Pong Sway is only terror geng when it is correct. When it is wrong, nobody see nothing and nobody say nothing. You see ar those roadside/pasar pagi/pasar malam/pasar tengah malam/whatever offering forecast services, quite alot uncle auntie go one. Then if its not accurate they'll like forget about it, if its correct, you also know what happen. Follow the herd, will you? |

|

|

Jun 27 2013, 10:04 AM Jun 27 2013, 10:04 AM

Return to original view | Post

#20

|

Senior Member

1,213 posts Joined: Apr 2007 |

QUOTE(gark @ Jun 27 2013, 10:00 AM) Ini hantam kasi pengsan. QUOTE(Boon3 @ Jun 27 2013, 10:01 AM) I object... I utterly cannot tahan that song 'I will follow you...... ' Stock market follow here, follow there... you always be one or two steps behind liao. How to win in the long run? Sialcom/Maxshyt/Yiumobile? |

|

Topic ClosedOptions

|

| Change to: |  0.0410sec 0.0410sec

0.62 0.62

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 02:10 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote