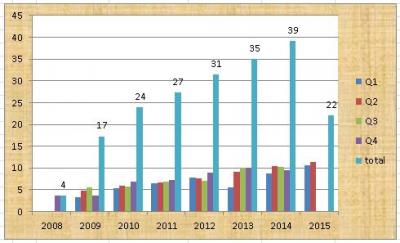

Best so far based on Q1 & Q2. Even if Q3 & Q4 are as low as 2014, it will still be the best year for 2015!

With KLCI's roller coaster ride, Q3 & Q4 are expected to be ???

Cheerio.

EPF DIVIDEND, EPF

|

|

Oct 20 2015, 02:40 PM Oct 20 2015, 02:40 PM

|

Senior Member

4,761 posts Joined: Jun 2007 From: My house |

|

|

|

|

|

|

Oct 21 2015, 08:01 AM Oct 21 2015, 08:01 AM

|

All Stars

18,455 posts Joined: Oct 2010 |

EPF to pay 2.5% dividend under amended EPF Act

http://www.thestar.com.my/News/Nation/2015...vidend-EPF-Act/ |

|

|

Oct 21 2015, 08:05 AM Oct 21 2015, 08:05 AM

|

All Stars

24,391 posts Joined: Feb 2011 |

QUOTE(MGM @ Oct 21 2015, 08:01 AM) EPF to pay 2.5% dividend under amended EPF Act So 2.5% is the minimum? Before this how much was the minimum?http://www.thestar.com.my/News/Nation/2015...vidend-EPF-Act/ |

|

|

Oct 21 2015, 08:12 AM Oct 21 2015, 08:12 AM

|

All Stars

65,339 posts Joined: Jan 2003 |

|

|

|

Oct 21 2015, 08:14 AM Oct 21 2015, 08:14 AM

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

All Stars

65,339 posts Joined: Jan 2003 |

QUOTE(cybpsych @ Feb 7 2015, 08:49 PM) .

QUOTE(Ramjade @ Oct 21 2015, 08:05 AM) iinm, there was none. they always declare based on performance.this amendment will introduce 2nd dividend rate, not replace existing one. This post has been edited by cybpsych: Oct 21 2015, 08:14 AM |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Oct 21 2015, 08:26 AM Oct 21 2015, 08:26 AM

|

All Stars

24,391 posts Joined: Feb 2011 |

|

|

|

|

|

|

Oct 21 2015, 08:27 AM Oct 21 2015, 08:27 AM

|

All Stars

10,319 posts Joined: Dec 2009 From: Malaysia |

"It also seeks to introduce a new section which states that no dividend shall be credited into the account of a member who is not a Malaysian if no contribution has been credited into his or her account over a period of three years."

interesting new section. so non Malaysian can also contribute to EPF? or are they referring to those who gave up their citizenship? |

|

|

Oct 21 2015, 08:34 AM Oct 21 2015, 08:34 AM

|

All Stars

65,339 posts Joined: Jan 2003 |

|

|

|

Oct 21 2015, 08:35 AM Oct 21 2015, 08:35 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(kochin @ Oct 21 2015, 08:27 AM) "It also seeks to introduce a new section which states that no dividend shall be credited into the account of a member who is not a Malaysian if no contribution has been credited into his or her account over a period of three years." Non-Malaysian citizensinteresting new section. so non Malaysian can also contribute to EPF? or are they referring to those who gave up their citizenship? • Foreign workers employed and staying in Malaysia legally may submit a notice of election to contribute using Form KWSP 16B and register as an EPF member using Form KWSP 3. A copy of the Form KWSP 16B must be submitted to the EPF and to the employer. Who can contribute to EPF.... December 9, 2013 http://www.freemalaysiatoday.com/category/...tribute-to-epf/ |

|

|

Oct 21 2015, 08:37 AM Oct 21 2015, 08:37 AM

|

All Stars

12,273 posts Joined: Oct 2010 |

QUOTE "In line with the creation of the KWSP-I account, Section 27 will be amended to enable two dividend rates to be announced for EPF contributors," he said Further under the new amendments, the EPF board may have the power to declare a dividend of not less than 2.5% per annum for members who have not elected for their accounts to be managed according to syariah principles. The Bill also states that the EPF may have the power to declare a dividend of not less than 2.5% per annum for those whose elections have not taken effect. "In respect of contributions made by the members of the Fund whose elections for their accounts be managed according to the Syariah under the proposed section 43A have come into effect, the Board shall declare dividend at any rates according to the actual performance of the investment made by the Board in relation to the accounts," reads the Bill. It's all about Syariah. If you choose not to be under this scheme, then you do not partake in the performance of the Fund. Then their obligation is only 2.5% as far as they are concerned. Meaning everyone irrespective of race and religion is FORCED to accept Islamic principles. This is Malaysian fair and equitable principles. This post has been edited by prophetjul: Oct 21 2015, 08:38 AM |

|

|

Oct 21 2015, 08:40 AM Oct 21 2015, 08:40 AM

|

All Stars

24,391 posts Joined: Feb 2011 |

QUOTE(prophetjul @ Oct 21 2015, 08:37 AM) It's all about Syariah. If you choose not to be under this scheme, then you do not partake in the performance of the Fund. Then their obligation is only 2.5% as far as they are concerned. I don't think that is true. Both also will be given NO LESS THAN 2.5% (from what I read, I understand that both will be minimum 2.5%). Could be wrong here.Meaning everyone irrespective of race and religion is FORCED to accept Islamic principles. This is Malaysian fair and equitable principles. |

|

|

Oct 21 2015, 08:41 AM Oct 21 2015, 08:41 AM

|

All Stars

12,273 posts Joined: Oct 2010 |

QUOTE(Ramjade @ Oct 21 2015, 08:40 AM) I don't think that is true. Both also will be given NO LESS THAN 2.5% (from what I read, I understand that both will be minimum 2.5%). Could be wrong here. Here....says it all....read carefullyQUOTE Further under the new amendments, the EPF board may have the power to declare a dividend of not less than 2.5% per annum for members who have not elected for their accounts to be managed according to syariah principles .QUOTE "In respect of contributions made by the members of the Fund whose elections for their accounts be managed according to the Syariah under the proposed section 43A have come into effect, the Board shall declare dividend at any rates according to the actual performance of the investment made by the Board in relation to the accounts," reads the Bill. This post has been edited by prophetjul: Oct 21 2015, 08:42 AM |

|

|

Oct 21 2015, 08:53 AM Oct 21 2015, 08:53 AM

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(kochin @ Oct 21 2015, 08:27 AM) "It also seeks to introduce a new section which states that no dividend shall be credited into the account of a member who is not a Malaysian if no contribution has been credited into his or her account over a period of three years." EPF intend to tap migrant monies to prevent outflow of MYR?interesting new section. so non Malaysian can also contribute to EPF? or are they referring to those who gave up their citizenship? |

|

|

|

|

|

Oct 21 2015, 08:56 AM Oct 21 2015, 08:56 AM

|

Senior Member

10,001 posts Joined: May 2013 |

Existing EPF Act

Section 27 Declaration of dividend 27 At or after the end of the financial year, being the 31st December of each year, the Board shall with the approval of the Minister, declare a rate of dividend in respect of that year, being not less than two and one half per centum per annum and, subject to section 50, dividend shall be payable on contributions to the Fund at such rate: Provided that- (a) no rate of dividend exceeding two and one half per centum per annum shall be so declared unless the Board is satisfied that in its opinion the ability of the Fund to meet all payments required to be paid under this Act is not endangered by the declaration of such rate; and (b) no rate of dividend exceeding two and one half per centum per annum shall be so declared if any sums advanced by the Government of Malaysia under section 28 have not then been repaid. |

|

|

Oct 21 2015, 08:59 AM Oct 21 2015, 08:59 AM

|

All Stars

24,391 posts Joined: Feb 2011 |

QUOTE(prophetjul @ Oct 21 2015, 08:41 AM) Then what is this?QUOTE The Bill also states that the EPF may have the power to declare a dividend of not less than 2.5% per annum for those whose elections have not taken effect. It meant even those who didn't make the change, EPF can give dividend of min 2.5%. So is not restricted to those who switch. |

|

|

Oct 21 2015, 09:02 AM Oct 21 2015, 09:02 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Ramjade @ Oct 21 2015, 08:05 AM) QUOTE(cybpsych @ Oct 21 2015, 08:12 AM) iinm, there was none. they always declare based on performance. There was.this amendment will introduce 2nd dividend rate, not replace existing one. EPF act 1991 http://www.kwsp.gov.my/portal/en/web/kwsp/...epf-act-reports QUOTE Section 27 Declaration of dividend 27. At or after the end of the financial year, being the 31st December of each year, the Board shall with the approval of the Minister, declare a rate of dividend in respect of that year, being not less than two and one half per centum per annum and, subject to section 50, dividend shall be payable on contributions to the Fund at such rate: This post has been edited by cherroy: Oct 21 2015, 09:02 AM |

|

|

Oct 21 2015, 09:06 AM Oct 21 2015, 09:06 AM

|

All Stars

24,391 posts Joined: Feb 2011 |

cherroy so what does the new statement meant?

|

|

|

Oct 21 2015, 09:08 AM Oct 21 2015, 09:08 AM

|

All Stars

65,339 posts Joined: Jan 2003 |

QUOTE(cherroy @ Oct 21 2015, 09:02 AM) i see! thanks! thank goodness we've been getting better return |

|

|

Oct 21 2015, 09:10 AM Oct 21 2015, 09:10 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Ramjade @ Oct 21 2015, 08:59 AM) It meant even those who didn't make the change, EPF can give dividend of min 2.5%. So is not restricted to those who switch. The sentence was more due to shariah principle, or islamic banking principal, they cannot have fixed "interest", but based on profit sharing principal.Just like conventional FD vs islamic deposit. They can't put minimum fixed return/interest in islamic product. Correct me if I am wrong. |

|

|

Oct 21 2015, 09:15 AM Oct 21 2015, 09:15 AM

|

All Stars

24,391 posts Joined: Feb 2011 |

QUOTE(cherroy @ Oct 21 2015, 09:10 AM) The sentence was more due to shariah principle, or islamic banking principal, they cannot have fixed "interest", but based on profit sharing principal. So is change in name/principles ? Nothing major on the dividends right?Just like conventional FD vs islamic deposit. They can't put minimum fixed return/interest in islamic product. Correct me if I am wrong. |

| Change to: |  0.0170sec 0.0170sec

0.45 0.45

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 05:19 PM |