QUOTE(eugenecctan @ Oct 18 2012, 10:26 AM)

Nothing to do with Maybank Islamic PMA-i, need introducer becuse it is a current account.

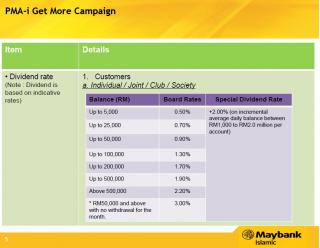

Added on October 18, 2012, 10:31 amStill we will define it as 5% p.a., If you were to place your FD for 1 month, you are getting 3% p.a., but you cannot say that it is not 3 % because you have place it for only 1 month. As long as you have placed it for 1 whole year since 1st of January, then you will be getting full 5%. (Actually more than that, because the 2% is accumulating daily).

The more I look at it, the interesting it becomes.

Here is my evaluation though do kill a lot of brain cells.

1. No need introducer if apply thru website. How still not sure.

2. Its daily calculated based on the example by Eugene. Need to reconfirmed.

3. Does not matter which day of the month we bank in as its calculated daily. Needs further confirmation.

4. One is Monthly dividend calculated daily paid monthly, another is Special dividend paid after the tenure.

I m still waiting for Maybank Islamic manager to call me as their staff staff dare not commit anything..

Added on October 18, 2012, 10:48 amQUOTE(aeiou228 @ Oct 17 2012, 08:07 PM)

Take a look at the sample calculation you attached.

Total savings is RM300K for 1 year.

Total Dividend earned is RM8,631.09 (3%) + RM4,883.50 (2%) = RM13,514.59 per year.

A rough backward calculation, you will get the annualized effective rate of 4.50% (ignoring the 14 days late deposit in Jan).

Another way to look at it is picture no.2, where it stated clearly that only RM244,174.95 (Incremental Average Daily Balance) gets extra 2% dividend. NOT RM300K gets extra 2%.

And one more counter check you can do is, if it is 5% on the entire deposit balance of RM300K, then you should get RM300K x 5% = RM15,000 dividend per annum instead of just RM13,514.59 per annum.

5% p.a. is correct only for RM250K deposited in the calender year of 2012 only.

Eugene is correct.

The initial RM50k is assuming at 31 Dec 2011 your balance is RM50k, so it should be ignored. If you are a new account holder your balance would be RM0.00. So calculate based on that. Did not do the actual calculation though..

This post has been edited by magika: Oct 18 2012, 10:48 AM

This post has been edited by magika: Oct 18 2012, 10:48 AM

Oct 17 2012, 08:07 PM

Oct 17 2012, 08:07 PM

Quote

Quote

0.0274sec

0.0274sec

0.30

0.30

6 queries

6 queries

GZIP Disabled

GZIP Disabled