Added on October 15, 2012, 4:59 pmYou are also getting up to RM50k Death/PD sum covered and up to 3K medical expenses.

This post has been edited by eugenecctan: Oct 15 2012, 04:59 PM

Fixed Deposit Rates in Malaysia V3, Read 1st post to find highest rate.

|

|

Oct 15 2012, 04:56 PM Oct 15 2012, 04:56 PM

Return to original view | Post

#1

|

Senior Member

1,058 posts Joined: Nov 2009 |

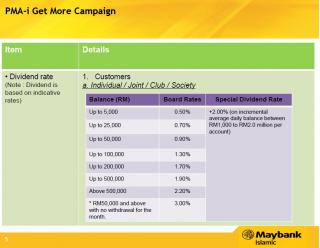

Just sharing here, the best FD is Maybank I-Mudharabah Account. Promotion going to end 31 December 2012, Promotion started on 1st January 2012. With Additional 2%, you can get 5% if you save more than 50K and treat it as FD. I surprise no one know this product.

Added on October 15, 2012, 4:59 pmYou are also getting up to RM50k Death/PD sum covered and up to 3K medical expenses. This post has been edited by eugenecctan: Oct 15 2012, 04:59 PM |

|

|

|

|

|

Oct 16 2012, 09:50 AM Oct 16 2012, 09:50 AM

Return to original view | Post

#2

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(ronnie @ Oct 15 2012, 11:22 PM) Does it mean we put RM50k and we get 5% p.a. for each month until 31 December 2012 ? YES Seems to good to be true.... Added on October 16, 2012, 9:51 am QUOTE(yiyibrowers @ Oct 15 2012, 11:12 PM) Ending soon lar, saving now too late already.This post has been edited by eugenecctan: Oct 16 2012, 09:51 AM |

|

|

Oct 17 2012, 04:30 PM Oct 17 2012, 04:30 PM

Return to original view | Post

#3

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(Gen-X @ Oct 16 2012, 05:36 PM) If yes, then fantastic, in the previous SCB offer, if we open a new account in October 2011, we were guaranteed the 5% interest. Yes, as long as it is new fund, for existing customer, only new fund start from 1st January 2012 are entitle for the additional 2%. It is even better than Standard Chartered 5%, it is because the 2% is daily interest. Maybank never promote this account, the previous promotion on 2011 was additional 3%, but for only 3 months, this year promotion is additional 2%, for the whole year, even better As of now, I still don't understand in full especially the tenure of the deposit **Edited** Anyway, I started another blog called Fixed Deposit Malaysia. Unlike my Fixed Deposit Page where I basically list the FD Promotions in town, in this new blog I will comment on FD promotions in detail and post any promotions relating to FD and CASA too. And you don't need a google ID to comment And the very first "new" post is about OCBC Booster Deals which comprises of 4 different promos. For those of you who are new to OCBC Combo Plan where you can earn 4%pa for 3 Months FD but need to deposit 20% equivalent sum to the FD into a selected Savings Account, click below link to read my article. OCBC Booster Deals - Up to 5% Interest Rate for Fixed Deposit Promotion 2012 Added on October 17, 2012, 4:35 pm QUOTE(tbheng @ Oct 16 2012, 10:58 PM) Oh..., I wonder how could this went undetected from all the FDMCGC members' radars? U're welcome, even Maybank stuff also dunno about these promotion, last year there was a similar promotion, with additional 3% for 3 months, total 6%, but cap to 50K only.MBB seems keeping it rather tight...no ads no news... If I knew about this I would have gone for it in Jan rather than taking the ocbc 4% for 12mth... 1% extra for the entire year is a lot of diff... Now, maybe can join in for a shorter duration... Thanks to eugenecctan for sharing the news. This post has been edited by eugenecctan: Oct 17 2012, 04:35 PM |

|

|

Oct 17 2012, 04:47 PM Oct 17 2012, 04:47 PM

Return to original view | Post

#4

|

Senior Member

1,058 posts Joined: Nov 2009 |

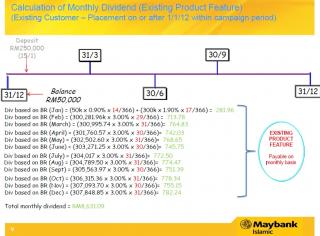

Official calculation from Maybank, it is better to understand yourself rather than asking Maybankers. Most of them will give u wrong information. I know a very helpful and resourceful Maybanker, he is working at Menara Maybank, PM me for his name if you guys seriously want to know more about the product. Or can PM me also with your email address if you need the full document for this product. I will reply only when I free. This post has been edited by eugenecctan: Oct 17 2012, 04:55 PM |

|

|

Oct 17 2012, 05:29 PM Oct 17 2012, 05:29 PM

Return to original view | Post

#5

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(aeiou228 @ Oct 17 2012, 04:57 PM) Still 5%, you get more because of the average daily balance, it is accumulating. For normal bank FD, you have to place for 1 year to get 3%. For this account, you can place 1 cent anytime, and you are entitle to get the additional 2% accumulating. |

|

|

Oct 17 2012, 06:32 PM Oct 17 2012, 06:32 PM

Return to original view | Post

#6

|

Senior Member

1,058 posts Joined: Nov 2009 |

|

|

|

|

|

|

Oct 18 2012, 10:26 AM Oct 18 2012, 10:26 AM

Return to original view | Post

#7

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(magika @ Oct 18 2012, 09:56 AM) Thanks. Nothing to do with Maybank Islamic PMA-i, need introducer becuse it is a current account.I think I will apply for OCBC OD, then use OD to apply for Maybank Islamic PMA-i . Just a note, I was on the phone with Maybank hotline enquiring on PMA-i , it seems to confirm that its a current account thereby requiring an introducer. Gonna phone Maybank Islamic to confirm. Added on October 18, 2012, 9:58 am Same case here , been adding Rm1k via giro. Only thing is no matter wat date mature, better keep it untul the first of the following month.. Added on October 18, 2012, 10:31 am QUOTE(aeiou228 @ Oct 17 2012, 08:07 PM) Take a look at the sample calculation you attached. Still we will define it as 5% p.a., If you were to place your FD for 1 month, you are getting 3% p.a., but you cannot say that it is not 3 % because you have place it for only 1 month. As long as you have placed it for 1 whole year since 1st of January, then you will be getting full 5%. (Actually more than that, because the 2% is accumulating daily). Total savings is RM300K for 1 year. Total Dividend earned is RM8,631.09 (3%) + RM4,883.50 (2%) = RM13,514.59 per year. A rough backward calculation, you will get the annualized effective rate of 4.50% (ignoring the 14 days late deposit in Jan). Another way to look at it is picture no.2, where it stated clearly that only RM244,174.95 (Incremental Average Daily Balance) gets extra 2% dividend. NOT RM300K gets extra 2%. And one more counter check you can do is, if it is 5% on the entire deposit balance of RM300K, then you should get RM300K x 5% = RM15,000 dividend per annum instead of just RM13,514.59 per annum. 5% p.a. is correct only for RM250K deposited in the calender year of 2012 only. This post has been edited by eugenecctan: Oct 18 2012, 10:31 AM |

|

|

Oct 18 2012, 11:43 AM Oct 18 2012, 11:43 AM

Return to original view | Post

#8

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(aeiou228 @ Oct 18 2012, 11:15 AM) We ? Gee, you are from maybank ? We = everyone. p.a. meant per annum, 5% p.a., anyhow, as long as you understand, for me it is still 5% interest, hahaha.If it is 5% effective, rm300k should get rm15k dividend. But in your illustration above, it was clearly 4.5%. (ignore the late 14 days deposit) I think you have forgotten about the rm50k balance as at 31.12.2011 which is not entitle to extra 2%. Added on October 18, 2012, 11:21 am It is correct only for the new to PMA investment deposited in calendar 2012. But he was referring to the investment illustration posted above as 5% pa. which is incorrect. Btw, are you the existing PMA-I account holder? else why are you so care about the balance for year 2011? It is only applicable to me. |

|

|

Oct 18 2012, 11:50 AM Oct 18 2012, 11:50 AM

Return to original view | Post

#9

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(magika @ Oct 18 2012, 11:34 AM) Bro, need to ask you the One Million Dollar question... » Click to show Spoiler - click again to hide... «

|

|

|

Oct 18 2012, 11:53 AM Oct 18 2012, 11:53 AM

Return to original view | Post

#10

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(ronnie @ Oct 18 2012, 11:45 AM) Can we still get 5% if we open a PMA-i account with RM50k on 1st Nov ? Yes, you will get, I asked Maybank this question before, deposit first of the month will get you the 3% if no withdrawer. and the 2% is additional interest, you will only get it after this promotion end. Still, total is 5% p.a.Or do we topup RMxx between the Nov and Dec 2012 ? |

|

|

Oct 18 2012, 12:00 PM Oct 18 2012, 12:00 PM

Return to original view | Post

#11

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(Medufsaid @ Oct 18 2012, 11:46 AM) Yes. Brain hurts here too. But er... if I have <RM50k for this musical chair is it worth it? Or I'll go for HSBC 3 months 5%

Check this out. If less than 50K, e.g. if you save RM5001, then you will be getting 0.7 + 2 which is 2.7%, it is calculate using daily average, so you can withdraw anytime, and save money anytime. with 2.7%, you can treat is as saving account or FD account, still with highest interest. Added on October 18, 2012, 12:04 pmBtw, HSBC offering 3 months 5%??? please share with me more. This post has been edited by eugenecctan: Oct 18 2012, 12:04 PM |

|

|

Oct 18 2012, 01:55 PM Oct 18 2012, 01:55 PM

Return to original view | Post

#12

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(Gen-X @ Oct 18 2012, 01:28 PM) Bro, why you never read my post Maybank Premier Mudharabah Account-i - Up to 4.75% Dividend at my new Fixed Deposit blog? Why dun u share here directly First of all you not getting 5% because the GIA-i 1 month rate is not 3% Secondly, in the same post mentioned above, I did advise that one opens the account and deposit RM50K prior to November in order to get the GIA-i 1 month rate in November. And last but not least, for CASA, unless you are depositing cash, the money needs to be cleared so opening an account on 1st November to get the Gia-i rate will depend on how you deposited your fund. Once again, you are NOT going to get 5% no matter how you calculate because the GIA-i rate is not 3%. IF for less than RM50K, no brainer, go for HSBC 5%. Once again, nobody is going to get 5% for November and December 2012 based on GIA-i 1 month current rate. Very true, with the 2% interest this account is very good for those who open it this year but it is not necessary the highest interest rate for RM5K and below. Click here to my article The Best Savings Account in Malaysia to see savings account offering 2.85% and above with RM50 deposit monthly. Can you share more on the savings account offering 2.85%? Btw, I never call it a saving account if no withdrawer then only can get 2.85%. If no withdrawer allow then why not place in FD directly? This post has been edited by eugenecctan: Oct 18 2012, 01:55 PM |

|

|

Oct 18 2012, 02:26 PM Oct 18 2012, 02:26 PM

Return to original view | Post

#13

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(Gen-X @ Oct 18 2012, 02:04 PM) Share it here, it's freaking long and I have summarized it earlier, see below: HahahahahhahAHHA, if anyone here feel that I am trying to misleading them, sorry ya.As as I said, there are accounts that pay you higher than 2.85% even if you do withdrawal and mentioned in this thread over and over again. You may have earned 5% for previous months but you should not be misleading others that they can get 5% for November or December. Please check the GIA-i rate yourself at Maybank site if you do not wish to visit my blogs. I am PMA-I owner for years, as I said, the rate is variable. the purpose for my sharing not to misleading anyone. It is to share a nice product. Btw, do u ,meant this link -> http://www.maybankislamic.com.my/promo_get...ign-111230.html It is stated very clear 3%, please blame Maybank ya for misleading, if you have the correct info. This post has been edited by eugenecctan: Oct 18 2012, 02:32 PM |

|

|

|

|

|

Oct 18 2012, 02:47 PM Oct 18 2012, 02:47 PM

Return to original view | Post

#14

|

Senior Member

1,058 posts Joined: Nov 2009 |

|

|

|

Oct 18 2012, 03:17 PM Oct 18 2012, 03:17 PM

Return to original view | Post

#15

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(ascend @ Oct 18 2012, 03:03 PM) Btw, as i have said, it is variable, it is like u cannot confirm that next month will be 2.75, can you? Added on October 18, 2012, 3:26 pm QUOTE(aeiou228 @ Oct 18 2012, 03:12 PM) No, I don't have existing PMA-I account yet. I appreciated your sharing of PMA-I in this thread and it prompted my interest and that's why I actively participated in the discussions pertaining to this promo Split this into 2 accounts, easier to understand, based on my understand,I care because I found a discrepancy of 4.5% being defined as 5% (assuming the GIA-I is fixed at 3% and Extra dividend is fixed at 2%) and I wish to debate about it Anyway, you are right about 5%p.a (assuming the GIA-I is fixed at 3% and Extra dividend is fixed at 2%) only if customer is NEW TO PMA-I in the calender year 2012 with zero balance as at 31.12.2011. Since you mentioned that it only applicable to you as an existing PMA-I customer with balance as at 31.12.2011, perhaps you can share with me what is my effective % for the entire calender year of 2012, if :- My existing PMA-I Balance as at 31st Dec 2011 = RM30,000 I top up on 1st Jan 2012 = RM70,000 Balance as at 31st Dec 2012 = RM100,000 Assuming:- No withdrawal thru out year 2012 GIA-I and extra dividend fixed at 3% + 2% thru out year 2012. Thank you for the 30K, you will be still getting 3% every month. It is accumulating, meant for January, you will get 30k + 3%p.a., for February, you will get (30K + 3%) +3%p.a. ...... December for the 70k, you will get 5%p.a., but again, it is accumulating, for 3%p.a. (same calculation as above for 30k) and also for the 2%. (Also accumulating by daily average) ***** Assuming it is 5%, I dun wan to misleading anyone. Btw, the calculation was provided by Maybank to me, I am just sharing. Added on October 18, 2012, 3:29 pmBtw, 1 question, if you were to open new account on 1st November, you will get your interest on 31st of November, the above 2.75 is for 16Oct - 15Nov. Maybe you should check with Maybank on how much you will get for November and December. This post has been edited by eugenecctan: Oct 18 2012, 03:29 PM |

|

|

Oct 18 2012, 11:58 PM Oct 18 2012, 11:58 PM

Return to original view | Post

#16

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(Gen-X @ Oct 18 2012, 06:14 PM) The extra 2% interest is on incremental of RM1K. In other words, the probability of earning effective 5% (assuming that one gets 3% for the GIA-i) is very slim. Wah, everyone are still discussing about this topic. Anyway, we all must thank eugenecctan for highlighting this great product in 2012. And looks like he is the smartest of the lot and most likely earning more in terms of effective interest for this entire year versus us wasting time moving our funds playing FD Musical Chair, hahaha Next year, first thing to check is Maybank Premier Mudharabah Account-i What to do, not a good time to invest in property, share market or even gold. Time for saving, and waiting for them to bust.. Added on October 19, 2012, 12:10 am QUOTE(aeiou228 @ Oct 18 2012, 05:18 PM) Thank you for time Bro. Dividend for 2012 (912.48) should be getting 2% as well. Btw, my formula maybe wrong, it is just an estimation on how much you might get for the 5%*** My old tool of trade (financial calculator) still working fine abide covered with dust, I still agak-agak remember how to do some simple compound interest calculation With the assumptions that: GIA-I rate is 3% pa compounded monthly. Extra Dividend is 2% compounded monthly. (Actually extra dividend is paid yearly but I assumed paid monthly for easy calculation) For the 30K, the compounded dividend for 2012 is = 912.48 For the 70K, the compounded dividend for 2012 is = 3,581.33 Therefore total monthly compounded dividend for calender year 2012 is RM4,493.81. Right ?? Hence 4.49% p.a effective return out of RM100,000 investment amount. I really couldn't figure out where is the other supposedly 0.5% came from. Above is based on your formula ie split to two account. This post has been edited by eugenecctan: Oct 19 2012, 12:10 AM |

|

|

Nov 19 2012, 04:39 PM Nov 19 2012, 04:39 PM

Return to original view | Post

#17

|

Senior Member

1,058 posts Joined: Nov 2009 |

Hey guys, I am back. I have 2 questions.

1) How to check GIA-i interest for Premier Mudharabah Account-i? Please share the link, thanks. 2) Is HSBC 5% interest for new branch promotion still valid? Thanks. This post has been edited by eugenecctan: Nov 19 2012, 04:40 PM |

|

|

Nov 19 2012, 04:51 PM Nov 19 2012, 04:51 PM

Return to original view | Post

#18

|

Senior Member

1,058 posts Joined: Nov 2009 |

QUOTE(magika @ Nov 19 2012, 04:47 PM) Rate Effective For New/Renewed Accounts For The Period From 16 October 2012 To 15 November 2012No update yet for this month. Thanks. |

|

|

Jan 14 2013, 04:23 PM Jan 14 2013, 04:23 PM

Return to original view | Post

#19

|

Senior Member

1,058 posts Joined: Nov 2009 |

Hey guys, what is the best FD rate?

|

|

|

Jan 14 2013, 04:35 PM Jan 14 2013, 04:35 PM

Return to original view | Post

#20

|

Senior Member

1,058 posts Joined: Nov 2009 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0276sec 0.0276sec

0.66 0.66

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 09:53 AM |