QUOTE(ys671 @ May 27 2022, 02:30 AM)

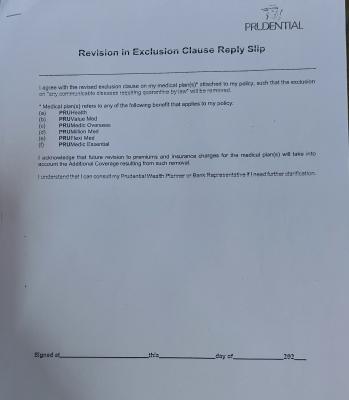

My agent came and give me a form below named Revision in Exclusion Clause Reply Slip.

After i read, i decided to not sign it but my agent tell me it is compulsory? Is this true?

may not be related to your situation/case....tis is just kaypoh info while you wait for real insurance sifus to response

i googled and found this from PRUBSN....

1: What is “communicable diseases requiring quarantine by law”?

Communicable diseases requiring quarantine by law refers to infectious diseases or transmissible diseases that are declared as required quarantine under the Prevention and Control of Infectious Diseases Act 1988, such as COVID-19 mentioned under the Prevention and Control of Infectious Diseases (Amendment of First Schedule) Order 2020.

2: What is the impact to my contributions and Tabarru` deduction if I accept the revision to remove the “communicable diseases requiring quarantine by law” exclusion clause?

There is no immediate change to your current contributions rate and Tabarru` deductions amount when you accept the revision to the exclusion.

However, as we continue to regularly review the contributions and Tabarru` deductions against the healthcare cost to ensure that you are always adequately protected, the future contributions and Tabarru` deductions review will take the Additional Coverage (i.e. coverage for “any communicable disease requiring quarantine by law”) into account.

This is to ensure fair treatment to all certificate holders of the medical plan.

We will notify you based on the notice period below prior to future revision of Tabarru` deductions and contributions,

4: What happens if I do not respond before the end date mentioned in the letter? Will I be able to accept the revision in the future?

This revision to the exclusion clause in your medical plan(s) is a limited period offer to you.

If you do not respond to us before the end date, the terms to your medical plan will remain unchanged and continue to exclude the coverage for “communicable diseases requiring quarantine by law”.

Any submission after the end date will not be accepted."

there is this note too:

#Note: As we regularly review our medical plans, future contribution and/or Tabarru` deduction review will take into account the pandemic protection.

https://www.prubsn.com.my/en/campaigns-anno...mic-protection/

May 9 2022, 10:11 PM

May 9 2022, 10:11 PM

Quote

Quote

0.0199sec

0.0199sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled