QUOTE(swch @ Oct 16 2023, 07:55 PM)

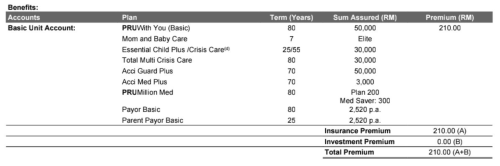

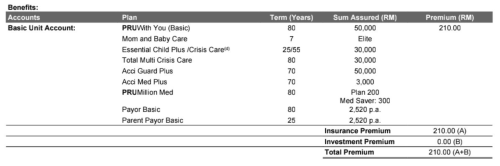

Hi all, would like to ask for your opinions if the quotation given for the pregnancy insurance is alright.

My only question so far will be if total multi crisis (having read through the fine print) is necessary for an infant or the premium will be around the same if I purchase TMC down the years, taking into acc that the essential child plus will be converted to crisis care at ANB 25.

Think of it as a economy rice, this is like a complete meal. But maybe you feel rice more important to have more, then you might want to remove something else which you deem is excessive.

But if it doesn't cost you much. Why not keep the benefit?

I sell prudential myself and some clients would ask if this or that is necessary and you would be surprised that not everyone wants a complete meal that covers everything.

But then again different ppl have different approach toward protection.

TMCC will help to cover a more complete Critical Illness including early stage as well as compared to crisis care.

Jul 20 2023, 11:57 PM

Jul 20 2023, 11:57 PM

Quote

Quote

0.0231sec

0.0231sec

0.15

0.15

6 queries

6 queries

GZIP Disabled

GZIP Disabled