QUOTE(ascend @ Jul 31 2012, 02:20 PM)

hahaha, you are right,the link was for previous promo. This month no such offer, latest T&C link belowhttp://www.ocbc.com.my/personal-banking/Pr...2%20%282%29.pdf

Fixed Deposit Rates in Malaysia V2, Read 1st post to find highest rate.

|

|

Jul 31 2012, 03:18 PM Jul 31 2012, 03:18 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(ascend @ Jul 31 2012, 02:20 PM) hahaha, you are right,the link was for previous promo. This month no such offer, latest T&C link belowhttp://www.ocbc.com.my/personal-banking/Pr...2%20%282%29.pdf |

|

|

|

|

|

Jul 31 2012, 06:26 PM Jul 31 2012, 06:26 PM

|

Senior Member

1,624 posts Joined: Apr 2011 |

|

|

|

Jul 31 2012, 06:35 PM Jul 31 2012, 06:35 PM

|

Senior Member

2,620 posts Joined: Apr 2012 |

|

|

|

Jul 31 2012, 11:09 PM Jul 31 2012, 11:09 PM

|

Junior Member

133 posts Joined: May 2011 |

QUOTE(Gen-X @ Jul 31 2012, 08:47 AM) On the contrary, many here do highlight Bank Raykat "FD" rates over and over again like you but there's nothing much to discuss about it since it is straight forward. Thanks bro.. What worries me is that many ppl are discussing abt 3.x% while BR giving 4%.. logically ppl will go for that rite.. So my decision as a newbie to choose BR shud be not wrong, right? Thanks...Same goes for Affin's 12 month 3.6% which is much better than most commercial banks' promos, but there's nothing to discuss about it too. On the other hand, other banks have limited time promotions, it is highlighted/discussed so that others are aware of options out there. And most of these promos have T&C attached to it so we discuss about them to work out the effective interest rates. And most "confusing" T&C is by SCB with their ADB requirements for savings account. More stress and riskier job = Big Money Added on July 31, 2012, 11:13 pm QUOTE(magika @ Jul 31 2012, 10:56 AM) Yup, thats why has to belanja Starbuck cofee virtually for some kind soul to simplify it.. Sorry uncle, didnt mean to be negative at all... Sory ya..Not necesary riskier job= Big money.. Nowadays all sorts of compliance documents plus answering NC (non compliance) queries plus plus all sorts of audits (more than 6 per year) plus all sorts of certification plus plus all sorts of meetings plus all sorts of reports = no actual work done = hypertension + heart problem.. One of my staff (hpertension + diabetic) went for optional retirement. While finishing his accumulated leave (optional retirement already approved) , met him and announce his hpertension + diabetic reading has went back to normal..he..he.. Unfotunately before he finished his leave, received a letter stating LHDN will tax him hard for his gratuity n now he is back to work.. Added on July 31, 2012, 10:58 am I am with you, complicated turn me off thats why unless some kind person simplified it, otherwise no..no.. Added on July 31, 2012, 11:24 am just correct the figures enough maa no need negative comment .. This post has been edited by rajivshm: Jul 31 2012, 11:13 PM |

|

|

Aug 1 2012, 12:23 AM Aug 1 2012, 12:23 AM

|

Senior Member

1,624 posts Joined: Apr 2011 |

QUOTE(magika @ Jul 31 2012, 10:56 AM) Yup, thats why has to belanja Starbuck cofee virtually for some kind soul to simplify it.. the ISO certification is actually helping the company established the essential system to meet international requirements......but many MR (management representative) misunderstand it and end up the means to the ends become ends themselves.Not necesary riskier job= Big money.. Nowadays all sorts of compliance documents plus answering NC (non compliance) queries plus plus all sorts of audits (more than 6 per year) plus all sorts of certification plus plus all sorts of meetings plus all sorts of reports = no actual work done = hypertension + heart problem.. This post has been edited by gsc: Aug 1 2012, 12:23 AM |

|

|

Aug 1 2012, 12:29 AM Aug 1 2012, 12:29 AM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(rajivshm @ Jul 31 2012, 11:09 PM) Thanks bro.. What worries me is that many ppl are discussing abt 3.x% while BR giving 4%.. logically ppl will go for that rite.. So my decision as a newbie to choose BR shud be not wrong, right? Thanks... Bro, if your logic refers to greed, yes it is human nature And you got to understand that Fixed Deposit and Bank Rakyat Islamic Investment Account are actually different. The Bank Rakyat's products are based on profit sharing principles, so with my little or no knowledge of this profit sharing meaning, I would think logically if they are making more profit, you should be getting more in dividends and vice-versa right? But this is not the case. Anyway, go read the last few pages where it was discussed about your money being insured by PIDM versus government of Malaysia. Also do a serach on Bank Rakyat to read more on previous discussions. QUOTE(rajivshm @ Jul 31 2012, 02:10 AM) FYI, im small timer la, just grad and wana do some savings, lets say 1k per month or 2 months. so izit save for me to dump tat in BR? Oh, by the way, I wanted to salute you earlier but forgot. With you depositing RM1K everymonth, that's commendable This post has been edited by Gen-X: Aug 1 2012, 12:31 AM |

|

|

|

|

|

Aug 1 2012, 05:52 AM Aug 1 2012, 05:52 AM

|

Senior Member

4,230 posts Joined: Jan 2009 |

Anyone received the RM300 cashback for the SCB promo in last May/Jun for the CASA a/c opening?

|

|

|

Aug 1 2012, 09:18 AM Aug 1 2012, 09:18 AM

|

Senior Member

2,620 posts Joined: Apr 2012 |

QUOTE(gsc @ Aug 1 2012, 12:23 AM) the ISO certification is actually helping the company established the essential system to meet international requirements......but many MR (management representative) misunderstand it and end up the means to the ends become ends themselves. agreed. With so much prestige attached to certification, practically most CEO will deemed it as a personal failure nevermind if their company profit never acheived their shareholder expectation. LHDN recently make a backtrack for gratuity on optional retirement deposited in EPF to betax exempted. Ooh, some of my FDs maturing this week, so most probably will go to OCBC combo, though hoping have longer terms with better interest rates.. |

|

|

Aug 1 2012, 09:44 AM Aug 1 2012, 09:44 AM

|

Junior Member

133 posts Joined: May 2011 |

QUOTE(Gen-X @ Aug 1 2012, 12:29 AM) Bro, if your logic refers to greed, yes it is human nature I still dont really understnd. read those posts d... but being insured by govt of Malaysia shud also be safe, right? Im just worried if i dun get back my $$ upon maturity of FD. DIE liao.. haha...And you got to understand that Fixed Deposit and Bank Rakyat Islamic Investment Account are actually different. The Bank Rakyat's products are based on profit sharing principles, so with my little or no knowledge of this profit sharing meaning, I would think logically if they are making more profit, you should be getting more in dividends and vice-versa right? But this is not the case. Anyway, go read the last few pages where it was discussed about your money being insured by PIDM versus government of Malaysia. Also do a serach on Bank Rakyat to read more on previous discussions. Oh, by the way, I wanted to salute you earlier but forgot. With you depositing RM1K everymonth, that's commendable by the way, not 1k everymonth la... sometimes 2 or 3 months once only possible. unless i starve... anyway thanks bro... |

|

|

Aug 1 2012, 10:44 AM Aug 1 2012, 10:44 AM

|

Senior Member

2,620 posts Joined: Apr 2012 |

QUOTE(rajivshm @ Aug 1 2012, 09:44 AM) I still dont really understnd. read those posts d... but being insured by govt of Malaysia shud also be safe, right? Im just worried if i dun get back my $$ upon maturity of FD. DIE liao.. haha... Everything is a risk , high risk or low risk.. if FD dont get back on maturity then.. nowhere else is safe..by the way, not 1k everymonth la... sometimes 2 or 3 months once only possible. unless i starve... anyway thanks bro... Because you are new to FD just be aware of sweet talk by bank or any one promising high returns much much more than average.. greed kills.. If you should received any better offers , post it in this forum.. got a lot of experienced forummers can dissect for you.. This post has been edited by magika: Aug 1 2012, 10:55 AM |

|

|

Aug 1 2012, 11:22 AM Aug 1 2012, 11:22 AM

|

All Stars

18,469 posts Joined: Oct 2010 |

QUOTE(1282009 @ Aug 1 2012, 05:52 AM) My tracking period for the rm300 cash back promo is from 29-may to 31-july but the bank officer just told me not to withdraw until 29-Aug just to be sure. they can't understand their own TNC. Now need read up and bring the tnc again and go back to argue. Just hate this. |

|

|

Aug 1 2012, 11:27 AM Aug 1 2012, 11:27 AM

|

Senior Member

2,620 posts Joined: Apr 2012 |

QUOTE(MGM @ Aug 1 2012, 11:22 AM) My tracking period for the rm300 cash back promo is from 29-may to 31-july but the bank officer just told me not to withdraw until 29-Aug just to be sure. they can't understand their own TNC. Now need read up and bring the tnc again and go back to argue. Just hate this. hows your blood pressure readings..he..he. |

|

|

Aug 1 2012, 11:46 AM Aug 1 2012, 11:46 AM

|

Junior Member

29 posts Joined: Dec 2011 |

QUOTE(MGM @ Aug 1 2012, 11:22 AM) My tracking period for the rm300 cash back promo is from 29-may to 31-july but the bank officer just told me not to withdraw until 29-Aug just to be sure. they can't understand their own TNC. Now need read up and bring the tnc again and go back to argue. Just hate this. The terms and conditions clearly stated that "All cashback rewards will be credited during the month immediately after the relevant tracking period" which means any time from 1 August to 31 August (if your tracking period is until 31 July).If the tracking period is until 31 July, I take it to mean that it will no longer be tracked after 31 July - that means can withdraw money from 1 Aug onwards. The important thing is: you have to determine whether your tracking period is until 31 July or 31 August. |

|

|

|

|

|

Aug 1 2012, 12:11 PM Aug 1 2012, 12:11 PM

|

All Stars

18,469 posts Joined: Oct 2010 |

QUOTE(stchan @ Aug 1 2012, 11:46 AM) The terms and conditions clearly stated that "All cashback rewards will be credited during the month immediately after the relevant tracking period" which means any time from 1 August to 31 August (if your tracking period is until 31 July). Open acc on 29-5(Tues) with rm32700 and made a ATM withdrawal of rm50 and keep the balance until 31-July.If the tracking period is until 31 July, I take it to mean that it will no longer be tracked after 31 July - that means can withdraw money from 1 Aug onwards. The important thing is: you have to determine whether your tracking period is until 31 July or 31 August. ADB from 29-5 to 31-7 is consistently rm32650. So satisfied all requirement to entitle for rm300 cash back in August. Should be allowed to withdraw most of the deposit from 1-8-12. |

|

|

Aug 1 2012, 12:13 PM Aug 1 2012, 12:13 PM

|

Senior Member

12,534 posts Joined: Mar 2009 From: Penang, KL, China, Indonesia.... |

New promo from CIMB.. not very exciting...

STEP UP FIXED DEPOSIT OFFER (UNTIL 31 DECEMBER 2012) Up to 5.00% p.a. on a 6-month Step Up Fixed Deposit** with a minimum placement of RM50,000 for new and existing CIMB Preferred members. Month 1-5 = 3.10%, Month 6 =5% Average ... 3.42% p.a... for 6 months. This post has been edited by gark: Aug 1 2012, 12:14 PM |

|

|

Aug 1 2012, 12:33 PM Aug 1 2012, 12:33 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

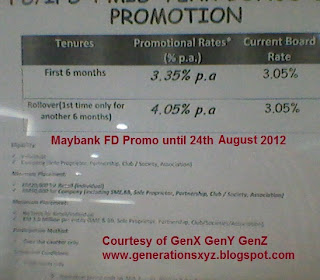

QUOTE(gark @ Aug 1 2012, 12:13 PM) New promo from CIMB.. not very exciting... Thanks Bro, posted it at Post#1STEP UP FIXED DEPOSIT OFFER (UNTIL 31 DECEMBER 2012) Up to 5.00% p.a. on a 6-month Step Up Fixed Deposit** with a minimum placement of RM50,000 for new and existing CIMB Preferred members. Month 1-5 = 3.10%, Month 6 =5% Average ... 3.42% p.a... for 6 months. For Non Preferred members, the CIMB Step Up FD Promo until end of the year is as follows: 1-5 Months 3.1% 6th Month 4.88% (slightly lower than Preferred) Minimum RM5K and in multiples of RM5K Click here to CIMB webpage on Step Up FD PRomo. QUOTE(Zoe26 @ Jul 27 2012, 11:20 AM) I just come back from maybank,they have FD promotion too.First 6 month is 3.35% , second 6 month is 4.15% .Average is 3.75% . QUOTE(Gen-X @ Jul 27 2012, 05:32 PM) For the MBB FD Promo. this is what I was informed: Both above MMB Promo reported by Zoe'26's and me questionable. What I reported above was informed to me by phone. Today I actually went to MMB and here's what MBB is offering currently:1st 6 Months 3.35% and roll over (allowed 1 time only) for 2 months 4.05% and applicable for over the counter placement only. Promo ends 24 August 2012. Minimum Fresh Fund Individual RM20K Minimum Fresh Fund Company RM50K Based on above, average 3.525% The good thing about MBB is that their FD Promos are also open to companies too. As you can see, Zoe26's info and mine are not the same. Anyone else got info on MBB FD Promo, please report. Once again, for latest FD Promos, please read page#1 or click here to my Fixed Deposit Promotion Page. 1st 6 Months 3.35% and roll over (allowed 1 time only) for 6 months 4.05% and applicable for over the counter placement only. Promo ends 24 August 2012. Minimum Fresh Fund Individual RM20K Minimum Fresh Fund Company RM50K Based on above, average 3.7%  To see image above enlarged, and also my comments of FD Promos click here to my FD Page. This post has been edited by Gen-X: Aug 1 2012, 02:25 PM |

|

|

Aug 1 2012, 02:26 PM Aug 1 2012, 02:26 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

FD Musical Chair members and also not bothered with FD Interest Rates members, please report at Fixed Deposit Interest Rates in Malaysia V3

|

|

Topic ClosedOptions

|

| Change to: |  0.0311sec 0.0311sec

0.34 0.34

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 06:41 AM |