QUOTE(!@#$%^ @ Dec 3 2020, 09:53 PM)

Sorry, corrected.(2) expires by 31/12/2020

Private Retirement Fund, What the hell is that??

|

|

Dec 3 2020, 09:55 PM Dec 3 2020, 09:55 PM

Show posts by this member only | IPv6 | Post

#4601

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Dec 3 2020, 09:59 PM Dec 3 2020, 09:59 PM

Show posts by this member only | IPv6 | Post

#4602

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

|

|

|

Dec 4 2020, 12:46 AM Dec 4 2020, 12:46 AM

|

Senior Member

1,315 posts Joined: Aug 2007 |

|

|

|

Dec 4 2020, 12:49 AM Dec 4 2020, 12:49 AM

Show posts by this member only | IPv6 | Post

#4604

|

Senior Member

5,637 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Dec 4 2020, 01:49 AM Dec 4 2020, 01:49 AM

|

Senior Member

1,315 posts Joined: Aug 2007 |

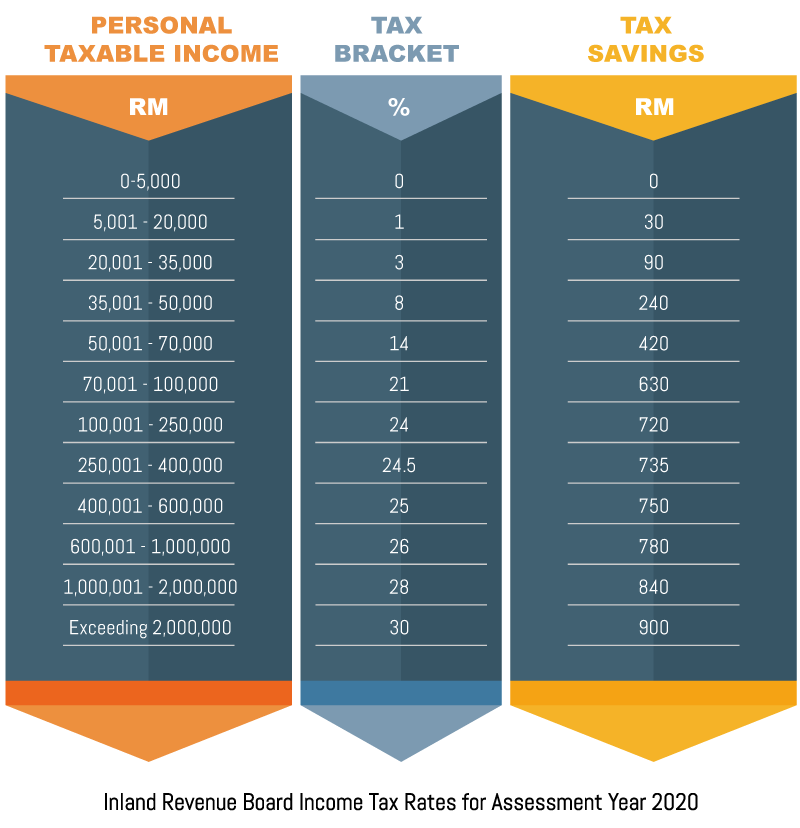

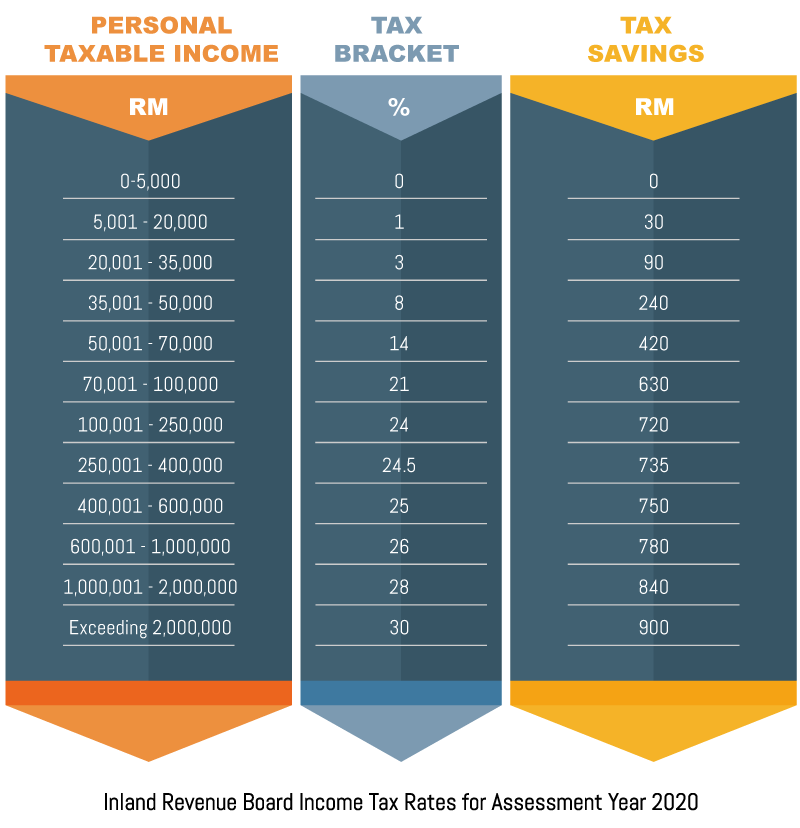

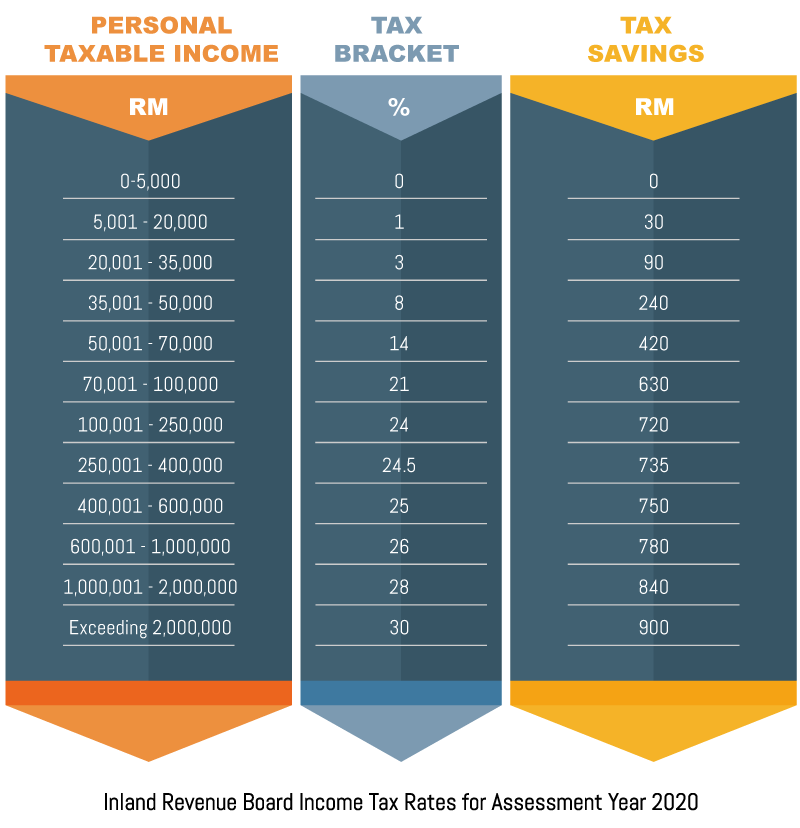

QUOTE(victorian @ Dec 4 2020, 12:49 AM) yeplike for PRS if in 24% bracket, you "earn" rm720 Is there any such table for 4k for EPF? Thinking to invest some, also force to lock in some money  https://www.ppa.my/prs-tax-relief/ |

|

|

Dec 4 2020, 01:55 AM Dec 4 2020, 01:55 AM

Show posts by this member only | IPv6 | Post

#4606

|

Senior Member

5,637 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(onthefly @ Dec 4 2020, 01:49 AM) yep Yes, if you are freelancer you can contribute yourself and also get tax relieflike for PRS if in 24% bracket, you "earn" rm720 Is there any such table for 4k for EPF? Thinking to invest some, also force to lock in some money  https://www.ppa.my/prs-tax-relief/ |

|

|

|

|

|

Dec 4 2020, 05:07 AM Dec 4 2020, 05:07 AM

Show posts by this member only | IPv6 | Post

#4607

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(onthefly @ Dec 4 2020, 12:46 AM) Side track abit 1. EPF Contribution Maximum Tax Relief: RM4,000 how much get in return by contributing 4k to EPF ( not via salary ) ? QUOTE(onthefly @ Dec 4 2020, 01:49 AM) yep It will be just like PRS. If income bracket is 24% your 'savings' will be RM 960.like for PRS if in 24% bracket, you "earn" rm720 Is there any such table for 4k for EPF? Thinking to invest some, also force to lock in some money  https://www.ppa.my/prs-tax-relief/ This post has been edited by Cyclopes: Dec 4 2020, 05:10 AM onthefly liked this post

|

|

|

Dec 4 2020, 10:08 AM Dec 4 2020, 10:08 AM

Show posts by this member only | IPv6 | Post

#4608

|

Probation

16 posts Joined: Sep 2020 |

Would need some advices on the CIMB funds to go for if i want to topup? Currently having "Principal PRS Plus Asia Pacific Ex Japan Class A".

Thanks. |

|

|

Dec 4 2020, 10:10 AM Dec 4 2020, 10:10 AM

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Dec 4 2020, 11:07 AM Dec 4 2020, 11:07 AM

Show posts by this member only | IPv6 | Post

#4610

|

Probation

16 posts Joined: Sep 2020 |

|

|

|

Dec 4 2020, 12:39 PM Dec 4 2020, 12:39 PM

|

Senior Member

1,315 posts Joined: Aug 2007 |

QUOTE(QSYT @ Dec 4 2020, 11:07 AM) depend your situation like risk, age, etcyou can have look at https://gllt.morningstar.com/e6qvxuu98r/fun...anguageId=en-GB and fsmone. Few recommendation also in this thread WaNaWe900 liked this post

|

|

|

Dec 4 2020, 04:14 PM Dec 4 2020, 04:14 PM

|

Junior Member

50 posts Joined: Jan 2012 |

Hi all, if purchase PRS from FSMONE.

1. First time purchase with the PRS Provider through FSMONE is required to submit the first time applications form. May I know is it possible if we choose Formless PRS application via FSMONE Mobile Website without submit any form? ***For First time buyer with the PRS Provider and with FSMONE. |

|

|

Dec 4 2020, 04:18 PM Dec 4 2020, 04:18 PM

Show posts by this member only | IPv6 | Post

#4613

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(proJay @ Dec 4 2020, 04:14 PM) Hi all, if purchase PRS from FSMONE. Yes but only can buy PRS funds from that 3 specific PRS providers: Affin Hwang, Kenanga and Principal1. First time purchase with the PRS Provider through FSMONE is required to submit the first time applications form. May I know is it possible if we choose Formless PRS application via FSMONE Mobile Website without submit any form? ***For First time buyer with the PRS Provider and with FSMONE. This post has been edited by GrumpyNooby: Dec 4 2020, 04:42 PM |

|

|

|

|

|

Dec 4 2020, 04:21 PM Dec 4 2020, 04:21 PM

|

Junior Member

50 posts Joined: Jan 2012 |

|

|

|

Dec 4 2020, 04:23 PM Dec 4 2020, 04:23 PM

Show posts by this member only | IPv6 | Post

#4615

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(proJay @ Dec 4 2020, 04:21 PM) Thanks for the replied. You're right as long as you have FSM account.you mean im first time buyer for the PRS Provider and with FSMONE. I still manage to buy via FSM MOBILE WEB without need to submit any form? proJay liked this post

|

|

|

Dec 4 2020, 04:27 PM Dec 4 2020, 04:27 PM

|

Junior Member

50 posts Joined: Jan 2012 |

|

|

|

Dec 4 2020, 07:59 PM Dec 4 2020, 07:59 PM

|

Junior Member

25 posts Joined: Apr 2009 |

QUOTE(memorylane @ Dec 3 2020, 09:49 AM) 1) Is it better to invest via PPA website or FSM? Any difference? Thanks for the feedback!i'm using FSM, 0% sale charges, for certain fund house, you don't need to mail the paper form to open account. Can manage/invest multiple fund house at the same time PPA website , never tried.. not sure. 2) What are the recommended funds for high growth long term? i'm taking Principal PRS Plus Asia Pacific Ex Japan Equity which invest in asia pacific region... For others, most of the PRS fund are malaysia equity based, it depends on personal preferences on region and fund house... 3) Can non-bumis invest in Islamic funds? can of cos. Regarding sales charge, is it only chargeable when we deposit money into the PRS fund? |

|

|

Dec 4 2020, 08:00 PM Dec 4 2020, 08:00 PM

Show posts by this member only | IPv6 | Post

#4618

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(xgen123 @ Dec 4 2020, 07:59 PM) Thanks for the feedback! Yes, aka buying units into the PRS fund.Regarding sales charge, is it only chargeable when we deposit money into the PRS fund? xgen123 liked this post

|

|

|

Dec 4 2020, 08:09 PM Dec 4 2020, 08:09 PM

|

Junior Member

25 posts Joined: Apr 2009 |

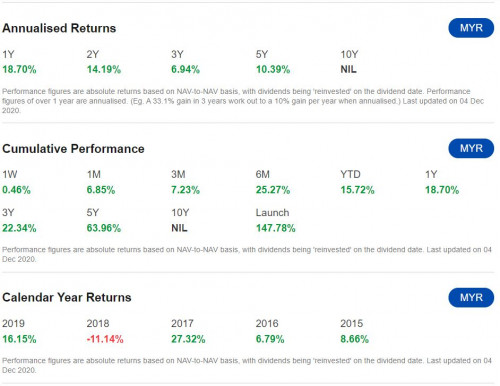

Just wondering why are most people invested into "Principal PRS Plus Asia Pacific Ex Japan Equity" ? Is it because it has more consistent returns over many years?

Because I noticed that for example, "Public Mutual PRS Islamic Strategic Equity Fund" seems to have higher returns based on recent data. |

|

|

Dec 4 2020, 08:14 PM Dec 4 2020, 08:14 PM

Show posts by this member only | IPv6 | Post

#4620

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(xgen123 @ Dec 4 2020, 08:09 PM) Just wondering why are most people invested into "Principal PRS Plus Asia Pacific Ex Japan Equity" ? Is it because it has more consistent returns over many years? Consistent or not? Because I noticed that for example, "Public Mutual PRS Islamic Strategic Equity Fund" seems to have higher returns based on recent data. Here're the indicators that you can refer for your reference:  Fund link: https://www.fsmone.com.my/funds/tools/facts...c=global-search |

| Change to: |  0.0270sec 0.0270sec

0.75 0.75

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 12:17 AM |