QUOTE(kart @ Sep 17 2017, 10:43 PM)

Really? Sigh.  Are you saying that I have to change to OCBC debit card and pay RM 8.48 annually, just to retain the ability to perform fund transfer (IBG and IBFT) via OCBC Online Banking?

Are you saying that I have to change to OCBC debit card and pay RM 8.48 annually, just to retain the ability to perform fund transfer (IBG and IBFT) via OCBC Online Banking?

Well, I have a saving account with Standard Chartered Bank. Even though I terminated my Standard Chartered debit card, I can still perform fund transfer (IBG and IBFT) via Standard Chartered online banking website.

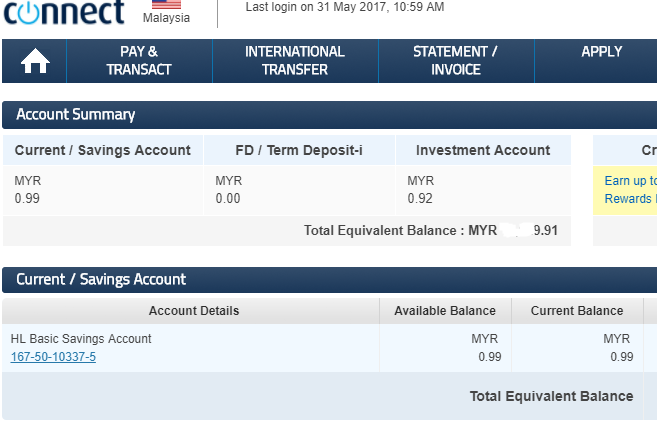

In the Fixed Deposit thread (https://forum.lowyat.net/topic/4154481/), some people open basic saving account, without a debit card. For sure, they have access to the internet banking website, in which they can transfer the principal and interest to their saving account in other bank, upon the maturity of the fixed deposit.

Is it possible that the linkage between online banking website and debit card is different for each bank in Malaysia?

from my understanding, the online banking does require a card to be linked, be it credit, debit or ATM card.Well, I have a saving account with Standard Chartered Bank. Even though I terminated my Standard Chartered debit card, I can still perform fund transfer (IBG and IBFT) via Standard Chartered online banking website.

In the Fixed Deposit thread (https://forum.lowyat.net/topic/4154481/), some people open basic saving account, without a debit card. For sure, they have access to the internet banking website, in which they can transfer the principal and interest to their saving account in other bank, upon the maturity of the fixed deposit.

Is it possible that the linkage between online banking website and debit card is different for each bank in Malaysia?

if you cancel it afterward, the access would still work, just that you won't be able to unlock your account without using a card in the future if you accidentally lock your account.

and yes, the ocbc staff also told me that the staff is also required to pay RM8.48 for the debit card.

Sep 18 2017, 08:02 AM

Sep 18 2017, 08:02 AM

Quote

Quote

0.0258sec

0.0258sec

1.08

1.08

6 queries

6 queries

GZIP Disabled

GZIP Disabled