QUOTE

The Reit myth busted

Whatever Reits pay out in dividends, they will take back a few years later in the form of rights issuesBy TEH HOOI LING, SENIOR CORRESPONDENT

THE high yields of real estate investment trusts (Reits) are tempting. And indeed, they have been touted as a relatively safe and stable instrument to own if one is looking for a steady stream of income. As such, many investors see Reits as a good asset class to have in one's retirement accounts.

But you know what? That Reits are good income-yielding instruments is but a myth. The thing is, whatever they pay out in dividends, they will take back - all and more - a few years later in the form of rights issues.

Here's what I found. Of the 17 Reits which have a listing history of at least four years on the Singapore Exchange, only three have not had any cash calls or secondary equity raising. The remaining 13 have had cash calls, and many had raised cash multiple times. One had a few rounds of private placement of new units which diluted the stake of existing unitholders somewhat.

For many of these Reits, the cash called back far exceeded the cash received. So, the myth of Reits as almost comparable to a fixed income instrument is really busted.

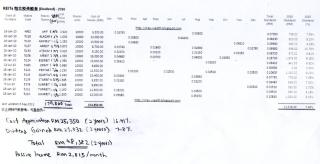

Take CapitaMall Trust (CMT) which was listed in July 2002. Assuming that Ms Retiree bought one lot or 1,000 units at the initial public offering (IPO) for a total sum of $960. For the whole of 2003, she received $57 in dividends. However in that year, CMT also had a one-for-10 rights issue. To subscribe for her entitlement, Ms Retiree would have to cough out $107.

In 2004, she would received $89 for the total number of CMT units she owned. That year, CMT had another rights issue, also one-for-10. The exercise price was higher at $1.62. To subscribe, Ms Retiree would have to fork out $178.

In 2005, CMT again had another fund raising exercise via rights issue. Ms R would pocket $124 in dividends but in that same year, had to return $282 back to the Reit.

In the next three years - 2006 to 2008 - Ms Retiree felt rich and happy. She merrily banked in her quarterly distributions which amounted to $404 for her holdings of CMT. Her one lot, after three rights issues, had grown to 1,331 units.

In the following year, another $175 was distributed. But CMT wasn't going to let Ms R be happy for long. It launched a big one - a 9-for10 rights issue. To fully subscribe for her entitlement, Ms R had to empty her bank account of a whopping $982.

And you know what, the cash call came in March 2009, when the Straits Times Index fell below 1,600 points, and many retirees were dismayed to see their investment portfolios plunge by half or more. Many fret if they would have enough left in the pot to sustain their lifestyle. Having to cough up more money for a Reit was the last thing that they wanted to do!

Negative cash flowAnd here's the final tally. Since its IPO until today, a holder of one lot of CMT would have received $1,264 in cash distributions. However, in all, he or she had to return $1,549 back to the Reit so as to subscribe to their entitlement of new issues. That's a net outflow of $284 per lot.

It's the same story with K-Reit Asia, Capitacommercial Trust, Frasers Commercial Trust, Mapletree Logistics, First Reit, Lippo Malls Indo Retail Trust, AIMS AMP CAP and Saizen REIT in that what was taken back from investors was more than what was given out.

K-Reit has been one of the most aggressive fund raising Reits. Had you started with just one lot when it was listed in April 2006, you would have to dish out $8,399 to subscribe to your rights issue. Distributions amounted to $1,110, resulting in a net outflow of $7,289.

For Reits with at least four years of track record, only Fraser Centrepoint, Parkway Life and CapitaRetail China have not had any cash calls.

Instead of a rights issue, Suntec Reit raised funds by issuing new units to some institutional investors at a slight discount. Existing unitholders don't have to cough out additional cash, but they would have their share of earnings diluted somewhat.

Misalignment of interests

Reits are managed by managers, and managers are paid based on the size of the portfolio that they manage. So the incentive is for the managers to continue to raise money and expand the portfolio size. Sometimes this is not done in the best interest of unitholders.

The most recent controversy was over K-Reit's purchase of Ocean Financial Centre (OFC) from its sponsor Keppel Land. K-Reit has launched a 17-for-20 rights issue to pay for the purchase which was deemed by the market to be expensive at a time of uncertain outlook and when office rental is expected to ease.

BT reader Bobby Jayaraman argued that rather than be compensated based on factors such as the value of assets, net property income and acquisition fees, Reit managers should be paid based on a combination of growth in distribution per unit and market valuation of the Reit.

'If Reit managers were paid on the basis of distribution per unit and market valuation growth, would K-Reit have bulldozed its way through the OFC acquisition like they have done?

'The day K-Reit announced the OFC acquisition, its stock price fell close to 10 per cent and has continued sliding. Yet, its Reit manager will take home significantly increased management fees while shareholders would have lost a good chunk of their capital even as they bear significantly more risk in the form of higher leverage and potential property devaluations given the uncertain environment,' he wrote to BT.

Misalignment of interests aside, there are also unitholders who clamour for growth.

But while Reits may not be the perfect income yielding instrument that they are made out to be, they have proven their capacity for capital appreciation. Relative to the capital ploughed in, CapitaMall Trust has rewarded its unitholders with a return of 127 per cent. Most Reits have yielded positive total returns.

Instead of buying Reits for yields, some savvy investors only buy them when they see those with good quality assets trade at sharp discounts to their book value. For example in the first half of 2009, CMT was trading at 50 per cent its book value. Today, it is not as cheap. At $1.755, CMT is now trading at 13 per cent premium to its net asset value of $1.55.

Hence, valuation metrics which apply to a typical asset heavy stock would apply to Reits as well.

Dec 5 2011, 03:29 PM

Dec 5 2011, 03:29 PM

Quote

Quote

0.0193sec

0.0193sec

0.59

0.59

6 queries

6 queries

GZIP Disabled

GZIP Disabled