QUOTE(kochin @ Jul 23 2011, 06:58 AM)

so it answers the question on the thread already, close thread? Are property prices going to up further? V3

Are property prices going to up further? V3

|

|

Jul 23 2011, 09:31 AM Jul 23 2011, 09:31 AM

|

Senior Member

1,830 posts Joined: Aug 2010 From: Kuala Lumpur |

|

|

|

|

|

|

Jul 23 2011, 09:55 AM Jul 23 2011, 09:55 AM

|

Junior Member

402 posts Joined: Jan 2011 |

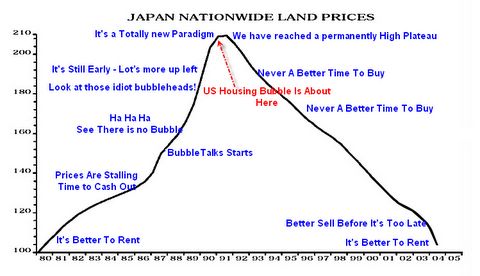

QUOTE(cranx @ Jul 23 2011, 12:03 AM) US bubble prophecy in 2005. i like this chart......i think MY prop is about to enter into the last leg of the bull run before reaching the plateau unless this is brought forward by an event eg political instability. Banks tightening credit is the beginning....keep a close watch on the coming budget announcement in Oct and next GE. |

|

|

Jul 23 2011, 09:59 AM Jul 23 2011, 09:59 AM

|

|

Elite

1,701 posts Joined: Jan 2003 From: Setia Alam |

The game is getting very excited. The point is, now I buy the property. But some able to sell w/o complete or after SP and some only after complete? You see now developer very clever, they try to sell it even before launching it. They get your money put in the bank save the interest. So their case settle, now for the buyer side. Another 2 years down road to complete, so after 2 years time the market still good or bad we don't know. Buy for own stay always no problem.

In order ppl can afford higher loan, we should have a higher and steady salary. So much depends on our govt. Inflation high, car loan, now housing loan. If the salary not competative enough for overall. Then the ppl might suffer. But maybe the time ppl are moving to new state to stay, like JB. If JB can create more jobs and attract foreigner with the iskandar. The place property still affortable but not as high as KL. Penang also not a bad place, mainland landed still look very attractive, if you can stay Sg petani also ok. So there is still much option. Travelling an hour to work is quite common. Place like Sg and HK diff, you don't have place to stay. Bcoz every here and there the price is much the same. It is the govt, banker and developer create this trend so all ppl rushing in to buy the property? Even last 3 years ago there isn't much hunger for property. So..... ppl buy property is much for gaining and sustain wealth? Some rushing for own stay bcoz seeing the price increasing. Last time ppl though is, aiway...wait and see and good houses coming out. Compare first check other places first. Now? you better prepare a cheque book on the first day to do the booking. The time I bought my house in SA, it was about nearly 1 month I ding dong here and there before confirmed my booking. My last question, should I go for some property for rental (subsale) now or go for upgrade? |

|

|

Jul 23 2011, 11:18 AM Jul 23 2011, 11:18 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

Please do a favour for all benefit.

Do not copy and paste entire article. Please highlight certain points that one wants to highlight or willing to discuss upon, the rest please use spoiler. Thank you for the cooperation |

|

|

Jul 23 2011, 11:23 AM Jul 23 2011, 11:23 AM

|

Senior Member

5,488 posts Joined: Jun 2008 |

QUOTE(cherroy @ Jul 23 2011, 11:18 AM) Please do a favour for all benefit. Do not copy and paste entire article. Please highlight certain points that one wants to highlight or willing to discuss upon, the rest please use spoiler. Thank you for the cooperation will learn how to use the spoiler..kekekeke by the way, these articles will cost a bomb in future |

|

|

Jul 23 2011, 12:55 PM Jul 23 2011, 12:55 PM

|

Senior Member

1,135 posts Joined: Oct 2007 |

QUOTE(jet2020 @ Jul 22 2011, 12:20 PM) tough time ahead very soon in MY.....just received latest insider info that 1 major foreign bank decided to cutback property loan to only 60%-70% financing regardless of commercial, residential, etc. This also applicable to 1st property owner unless falls under RM220k residential prop. Heard other local banks are likely to follow suit ..... I've heard from bankers and have the same feeling.Seems the bank has identified some big risk is coming very soon in the horizon...... those still gangho to BBB, better check with your banker first before making any commitment...... Its a good time to sell props that appreciated 100% |

|

|

|

|

|

Jul 23 2011, 01:05 PM Jul 23 2011, 01:05 PM

|

Senior Member

2,114 posts Joined: Aug 2010 From: Edge Of D. World |

BNM will got no choice but to increase interest rate. The leverage by using currency appreciation to contain inflation has already reached its limit. Further appreciation without other countries following suit will only hurt exporters.

http://biz.thestar.com.my/news/story.asp?f...46&sec=business |

|

|

Jul 23 2011, 02:05 PM Jul 23 2011, 02:05 PM

|

Senior Member

1,080 posts Joined: Jun 2010 |

QUOTE(jet2020 @ Jul 22 2011, 02:08 AM) Affordability index (HK props attracted international buyers due to its status as regional financial centre). Easy to subsale in HK (within 1 week) and not like Msia Population growth (many rich mainland chinese sending children at HK schools and need accomodation), Controlled supply (HK govt has a better planning to release land banks...unlike bolehland with poor prop supply vs demand) Lower prop vacancy rate due to controlled supply as mentioned above Low cost of fund (very low BLR) plus depreciation of HK dollar make prop investment a logical choice Property transactions are fast/efficient and transacted prices are transparent in the govt website for reference many many more.......so cannot compare la.... Added on July 23, 2011, 2:11 pm QUOTE(jet2020 @ Jul 22 2011, 01:20 PM) tough time ahead very soon in MY.....just received latest insider info that 1 major foreign bank decided to cutback property loan to only 60%-70% financing regardless of commercial, residential, etc. This also applicable to 1st property owner unless falls under RM220k residential prop. Heard other local banks are likely to follow suit ..... Credit Crunching!!Seems the bank has identified some big risk is coming very soon in the horizon...... those still gangho to BBB, better check with your banker first before making any commitment...... Added on July 23, 2011, 2:50 pm QUOTE(kh8668 @ Jul 23 2011, 01:47 AM) iProperty.com Malaysia Property Trends Survey 2011 (Malaysia) I have yet to see any of the political figure saying that bad time is coming and that we should prepare ourselves. Everything is only good. **IF** the finance ministry knows anything coming, e.g. credit crunching, he should warn us and not give us false hope that property price will increase further.Welcome to the iProperty.com Asia Property Trends Survey 2011! 20% According to Deputy Finance Minister Datuk Donald Lim Siang Chai, in light of rising inflation and increase in demand for local properties from foreigners, the property prices in Malaysia are expected to increase at an average of between 10% - 20% this year. This post has been edited by GangHo: Jul 23 2011, 02:50 PM |

|

|

Jul 23 2011, 03:24 PM Jul 23 2011, 03:24 PM

|

Senior Member

1,549 posts Joined: Nov 2010 |

|

|

|

Jul 23 2011, 06:26 PM Jul 23 2011, 06:26 PM

|

Junior Member

413 posts Joined: Jun 2008 From: Bromborough, United Kingdom & Penang, Malaysia |

QUOTE(jet2020 @ Jul 22 2011, 12:20 PM) tough time ahead very soon in MY.....just received latest insider info that 1 major foreign bank decided to cutback property loan to only 60%-70% financing regardless of commercial, residential, etc. This also applicable to 1st property owner unless falls under RM220k residential prop. Heard other local banks are likely to follow suit ..... Does that reflect that property price might be dropping when the majority can not afford to pay 30 - 40% of downpayment ? Seems the bank has identified some big risk is coming very soon in the horizon...... those still gangho to BBB, better check with your banker first before making any commitment...... Hi guys, a newbie to learn about this field |

|

|

Jul 23 2011, 07:17 PM Jul 23 2011, 07:17 PM

|

Senior Member

1,080 posts Joined: Jun 2010 |

QUOTE(SunofaBeach @ Jul 23 2011, 07:26 PM) Does that reflect that property price might be dropping when the majority can not afford to pay 30 - 40% of downpayment ? IF majority(depending on your definition) REALLY cannot afford to pay 30% to 40% of down payment and it is the regulation set, it mean only minority(Depending on your definition) is buying houses. Hi guys, a newbie to learn about this field Under the above situation, price will definitely drop because the property sector could not be supported only by minority. |

|

|

Jul 23 2011, 07:29 PM Jul 23 2011, 07:29 PM

|

Senior Member

1,764 posts Joined: Sep 2008 |

this is my conversation with a property agent just now for her post of a semi-d selling for RM 450k at KL

QUOTE me: i heard about your property listing for a semiD going for RM450k where is that? Go higher while you still can ! I'm also waiting...agent: oh that one, you cannot live in it without major renovation, maybe another RM200k for that at least me: oh, too bad agent: ya, nowadays very hard to get property in KL at reasonable price. New condos are launching at least RM500k. The agents and buyers are waiting for the market to crash. me: agent also waiting for market to crash? agent: ya, married couple with combine income of RM 10k-15k can't afford houses nowadays and the market has been very slow lately. We hope it crashed so at least it keeps the prices at reasonable price and hopefully ppl start buying. me: oh, i see. Thanks ! This post has been edited by Vincent Pang: Jul 23 2011, 07:30 PM |

|

|

Jul 23 2011, 07:29 PM Jul 23 2011, 07:29 PM

|

Junior Member

413 posts Joined: Jun 2008 From: Bromborough, United Kingdom & Penang, Malaysia |

QUOTE(GangHo @ Jul 23 2011, 07:17 PM) IF majority(depending on your definition) REALLY cannot afford to pay 30% to 40% of down payment and it is the regulation set, it mean only minority(Depending on your definition) is buying houses. Myself still has got long way to go before being able to afford a property but the dramatic increase of property's price in recent years have always made me wonder how tough for coming generations to afford a property, and also looks like for those who is planning to invest in properties should hold the thoughts?Under the above situation, price will definitely drop because the property sector could not be supported only by minority. |

|

|

|

|

|

Jul 23 2011, 09:01 PM Jul 23 2011, 09:01 PM

|

Senior Member

869 posts Joined: Dec 2009 |

QUOTE(SunofaBeach @ Jul 23 2011, 07:29 PM) Myself still has got long way to go before being able to afford a property but the dramatic increase of property's price in recent years have always made me wonder how tough for coming generations to afford a property, and also looks like for those who is planning to invest in properties should hold the thoughts? The younger generation will still afford ......just not close to prime area. And can forget about city center. Rawang may be part of Greater Greater KV in the next 30 yrs |

|

|

Jul 23 2011, 09:15 PM Jul 23 2011, 09:15 PM

|

All Stars

24,471 posts Joined: Nov 2010 |

QUOTE(dlyw1103 @ Jul 23 2011, 09:01 PM) The younger generation will still afford ......just not close to prime area. right, younger, next-next generation can still afford and buy. just dun complain cannot buy in prime-prime areas, cannot buy when 20-25 yrs old!! |

|

|

Jul 23 2011, 09:25 PM Jul 23 2011, 09:25 PM

|

Senior Member

1,360 posts Joined: Mar 2010 |

QUOTE(Vincent Pang @ Jul 23 2011, 07:29 PM) this is my conversation with a property agent just now for her post of a semi-d selling for RM 450k at KL no doubt subsale is slowing down tremendously. lots of properties just paper gain.Go higher while you still can ! I'm also waiting... the BBB scenario is only applicable for new launch properties. |

|

|

Jul 23 2011, 09:36 PM Jul 23 2011, 09:36 PM

|

Junior Member

413 posts Joined: Jun 2008 From: Bromborough, United Kingdom & Penang, Malaysia |

|

|

|

Jul 23 2011, 10:14 PM Jul 23 2011, 10:14 PM

|

Senior Member

2,294 posts Joined: Mar 2009 |

if everyone expect the prop down.. it will not going to down, but up.

if everyone expect the prop up.. it will not going to up, but down. |

|

|

Jul 23 2011, 11:08 PM Jul 23 2011, 11:08 PM

|

Senior Member

869 posts Joined: Dec 2009 |

why dont someone start a poll to survey number(%) of forumer in LYN thinks whether property will continue rising / fall / stagnant in 2012 onwards? Ppl will be able to plan the next move using the figures

|

|

|

Jul 24 2011, 10:55 AM Jul 24 2011, 10:55 AM

|

Senior Member

7,923 posts Joined: Feb 2007 From: 1 Malaysia |

|

|

Topic ClosedOptions

|

| Change to: |  0.0407sec 0.0407sec

1.23 1.23

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 03:21 AM |