QUOTE(jet2020 @ Jul 22 2011, 12:20 PM)

tough time ahead very soon in MY.....just received latest insider info that 1 major foreign bank decided to cutback property loan to only 60%-70% financing regardless of commercial, residential, etc. This also applicable to 1st property owner unless falls under RM220k residential prop. Heard other local banks are likely to follow suit .....

Seems the bank has identified some big risk is coming very soon in the horizon......

those still gangho to BBB, better check with your banker first before making any commitment......

I tthought many are already experiencing the "tough time" with all the prices of daily neccessities going up crazily since last year

but yes, i agree that tough time is ahead of MY. that's why am at a difficult stage thinking whether to buy or not to buy my first condo for own stay purpose (currently living with family) .

no offence, but how reliable is your insider info, has BNM issue any kind of guidance to banks on loans to individuals? Coz i heard that when people argue that Malaysians' debt are still not too high compared to savings, the ratio actually takes into account monies in EPF and we can't use (a large portion). This worries me.

recently i feel that the property market has cooled down abit, not as crazy as months back, anyone got the same feeling ah?

Added on July 22, 2011, 3:32 pmQUOTE(sampool @ Jul 22 2011, 02:22 PM)

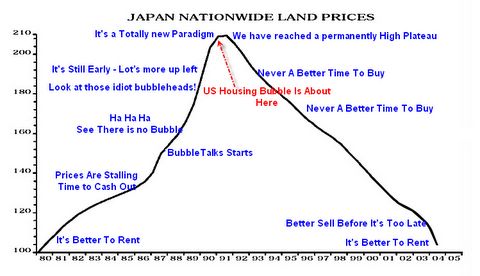

i think bacos of this

cutback property loan to only 60%-70% , ppl think difficult to get loan in future.. so they borrow now!!!... create further BBB (Bubble Bubble Bubble).

Maybe i am coming from the buying side (for own stay) and hope prices could be more reasonable, so i would think that the cutback of property loan to 60-70% will make speculators panic wanting to sell fast, coz not many buyers can afford to fork out 30-40% cash as downpayment.

Added on July 22, 2011, 3:39 pm

QUOTE(AVFAN @ Jul 22 2011, 10:30 AM)

i wouldn't put my hope on those thickheads busy lining own pockets and arresting innocent people.

read a bit more, forget sg or hk. start comparing with other cambodia and kazakhstan, so says adb:

haha, can't help but to laugh and feel sad at the same time. You are so right, we should compare apple to apple. Malaysia's financial industry is >10years behind S'pore, maybe more relevant to compare S'pore property prices 10 years back

?

This post has been edited by godutch: Jul 22 2011, 03:39 PM

Jul 22 2011, 12:45 AM

Jul 22 2011, 12:45 AM

Quote

Quote

0.0319sec

0.0319sec

0.68

0.68

6 queries

6 queries

GZIP Disabled

GZIP Disabled