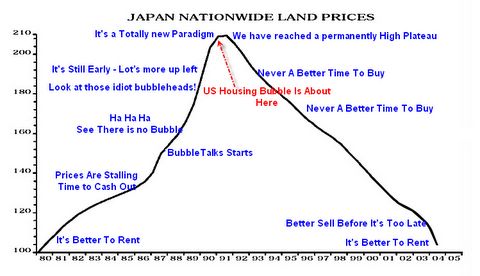

assuming the sharp increase started in 2009, assuming property boom and bust cycle is around 6 years, we might be looking at 2014.

those who have waited, you are only half way there, are you going to wait further or take the plunge ?

case study.

http://en.wikipedia.org/wiki/Irish_property_bubble

QUOTE

With the introduction of the single currency, interest rates were greatly reduced and those buying property were encouraged to borrow larger amounts of money. As prices continued upward financial institutions offered 100% loans. Newspapers carried advertising for properties urging people to get onto the property ladder as property was seen as a one way bet. In 2006 160,000 Irish people remained unemployed, 21% of all school leavers including those that completed the Leaving Certificate, were unemployed, the construction industry employed one eighth of the population, above the European average. Inflation was higher in Ireland than elsewhere.

Jun 28 2011, 01:00 PM

Jun 28 2011, 01:00 PM

Quote

Quote

0.0710sec

0.0710sec

0.97

0.97

7 queries

7 queries

GZIP Disabled

GZIP Disabled