I lived in HK for 3-4 years.

I find it funny when ppl tried to compare HK prop with bolehland....2 diff worlds and like durian vs apple

Are property prices going to up further? V3

Are property prices going to up further? V3

|

|

Jul 22 2011, 12:22 AM Jul 22 2011, 12:22 AM

Return to original view | Post

#1

|

Junior Member

402 posts Joined: Jan 2011 |

I lived in HK for 3-4 years.

I find it funny when ppl tried to compare HK prop with bolehland....2 diff worlds and like durian vs apple |

|

|

|

|

|

Jul 22 2011, 12:45 AM Jul 22 2011, 12:45 AM

Return to original view | Post

#2

|

Junior Member

402 posts Joined: Jan 2011 |

QUOTE(koopa @ Jul 22 2011, 12:32 AM) I would like to recommend to Malaysia to do it like HongKong, Property above say RM3m, need to pay 40% deposit etc. Instead of 3rd property loan 70% only. Just to curb bubble. I realise its bad for investor. 40% deposit may not be fully effective to curb hot speculation....many loopholes (ie SOHOs) to go around this ruling. Developers and bankers are working closely to bypass this for common commercial objectives. The most effective is stopping DIBS scheme and introduce higher RPGT......but doubt govt will use this drastic measure as prices may drop like a rock!! |

|

|

Jul 22 2011, 01:08 AM Jul 22 2011, 01:08 AM

Return to original view | Post

#3

|

Junior Member

402 posts Joined: Jan 2011 |

QUOTE(kh8668 @ Jul 22 2011, 12:48 AM) Affordability index (HK props attracted international buyers due to its status as regional financial centre). Easy to subsale in HK (within 1 week) and not like MsiaPopulation growth (many rich mainland chinese sending children at HK schools and need accomodation), Controlled supply (HK govt has a better planning to release land banks...unlike bolehland with poor prop supply vs demand) Lower prop vacancy rate due to controlled supply as mentioned above Low cost of fund (very low BLR) plus depreciation of HK dollar make prop investment a logical choice Property transactions are fast/efficient and transacted prices are transparent in the govt website for reference many many more.......so cannot compare la.... |

|

|

Jul 22 2011, 12:20 PM Jul 22 2011, 12:20 PM

Return to original view | Post

#4

|

Junior Member

402 posts Joined: Jan 2011 |

tough time ahead very soon in MY.....just received latest insider info that 1 major foreign bank decided to cutback property loan to only 60%-70% financing regardless of commercial, residential, etc. This also applicable to 1st property owner unless falls under RM220k residential prop. Heard other local banks are likely to follow suit .....

Seems the bank has identified some big risk is coming very soon in the horizon...... those still gangho to BBB, better check with your banker first before making any commitment...... |

|

|

Jul 23 2011, 09:55 AM Jul 23 2011, 09:55 AM

Return to original view | Post

#5

|

Junior Member

402 posts Joined: Jan 2011 |

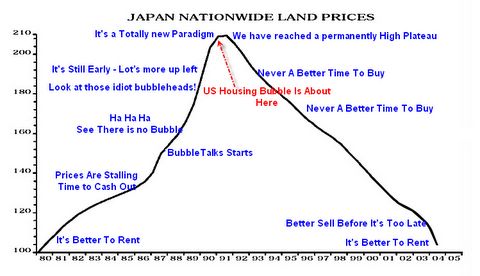

QUOTE(cranx @ Jul 23 2011, 12:03 AM) US bubble prophecy in 2005. i like this chart......i think MY prop is about to enter into the last leg of the bull run before reaching the plateau unless this is brought forward by an event eg political instability. Banks tightening credit is the beginning....keep a close watch on the coming budget announcement in Oct and next GE. |

|

|

Jul 26 2011, 08:21 PM Jul 26 2011, 08:21 PM

Return to original view | Post

#6

|

Junior Member

402 posts Joined: Jan 2011 |

QUOTE(kh8668 @ Jul 26 2011, 07:27 PM) KL property may enter uncertain patch says DTZ By Lee Wei LianJuly 26, 2011 The sun sets near the Petronas Twin Towers © and Kuala Lumpur Tower (L) in this file photo of 2009. Global real estate consultancy DTZ in a report released July 26, 2011 pointed out that some developments in the prestigious KLCC area are only 10 per cent occupied. – Reuters picKUALA LUMPUR, July 26 – Declining affordability is expected to impact the local property market with some developments in the prestigious KLCC area only 10 per cent occupied said global real estate consultancy DTZ in a report released today. The report said that a recent survey of completed projects around the KLCC area revealed that occupancy ranged from a low of about 10 per cent to a high of 80 per cent, with an average of 56 per cent and said that occupancy levels are an issue that investors should be wary of. low accupancy or high vacancy rate is a fact that new condo buyers shld not take it lightly....this phenomenon not just limited in KLCC but spreading across KV. |

|

|

|

|

|

Jul 26 2011, 08:45 PM Jul 26 2011, 08:45 PM

Return to original view | Post

#7

|

Junior Member

402 posts Joined: Jan 2011 |

QUOTE(kh8668 @ Jul 26 2011, 08:28 PM) this figure published in their report in 1Q 2011. don't you see ranging from 10% to 80%. average about 50-60% in general. Still some condos are achieving good occupancy rate. is average 50-60% a good indicator for ppl to invest their hard earned money in condo?is the condo occupancy trend going up or down...you shld know better like i said below....pls continue your salesman talk as i am benefitting from it |

|

|

Jul 26 2011, 08:52 PM Jul 26 2011, 08:52 PM

Return to original view | Post

#8

|

Junior Member

402 posts Joined: Jan 2011 |

Affordability index is a good indicator used in key mkts like HK, SG and Aust.....sadly MY mkt yet to reach that status

the absence of prop indicators eg affordability index, median price, vacancy indec, etc serve good opportunity for some vested parties to dupe newbie investors.....sedih tapi benar! |

|

|

Jul 26 2011, 09:05 PM Jul 26 2011, 09:05 PM

Return to original view | Post

#9

|

Junior Member

402 posts Joined: Jan 2011 |

QUOTE(kh8668 @ Jul 26 2011, 08:53 PM) LOL...depend on your luck. i am waiting for the right time to dispose and invest....every exit shld follow immediately with another entry....this is my investment rule.by the way, you already make a lot. as long as you do not dispose any your properties, you will make more. I am not DIRECT salesman anyway, just kepoh kepoh here coz a lot of information I can get from here. you are no diff with SAs when you keep promoting new devs.... |

|

|

Jul 26 2011, 09:11 PM Jul 26 2011, 09:11 PM

Return to original view | Post

#10

|

Junior Member

402 posts Joined: Jan 2011 |

|

|

|

Jul 26 2011, 09:16 PM Jul 26 2011, 09:16 PM

Return to original view | Post

#11

|

Junior Member

402 posts Joined: Jan 2011 |

QUOTE(kh8668 @ Jul 26 2011, 09:13 PM) ohh, you also a buyer from TMS Icon City? kekeke sadly, my pocket is not deep enuff to buy Icon City..... |

|

|

Aug 22 2011, 12:43 AM Aug 22 2011, 12:43 AM

Return to original view | Post

#12

|

Junior Member

402 posts Joined: Jan 2011 |

QUOTE(kh8668 @ Aug 21 2011, 11:27 PM) hmmm...August now and soon September is coming in. I am still seeing the price of property in Malaysia still up or at least from developer. hehehe....subsale still maintain as it is now. kh, i really tabik spring your continued optimism and bullish on prop mkt despite i am not aligned with you on this.Btw, continue to share the first hand info on prop devp....i likey |

|

Topic ClosedOptions

|

| Change to: |  0.0663sec 0.0663sec

0.70 0.70

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 10:01 PM |