» Click to show Spoiler - click again to hide... «

Update by 27-AUG-2011

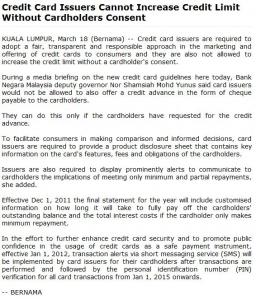

BNM is expected to take new measures to further control the use of credit, including a requirement for a second or more credit card must be presented two months of payroll!

It is understood, the National Bank and commercial banks who have been meeting to discuss the new measures; expected that the new regulations will be included in published October 7, 2012 Budget.

Credit card sales agents and Effective Synergy Sdn Bhd managing director Chen Hanguo that in the past, the National Bank first credit card application is only required to produce those two months of payroll, for a second or third time just goes to identity cards certified copies.

Income customers are willing to open

"Unless the customer a great need for a second or third credit card, otherwise the new measures will certainly affect the credit of the source, because many customers are reluctant to open their own income."

Chenhan Guo said that since the beginning of the year, deteriorating credit card business agency staff; BNM Strict new measures will give them the credit card business worse.

4,000 salesman forced to change jobs

"The government announced in RM3, 000 the following year, the national income can not hold more than two cards of the measures has resulted in 60% of the credit card agency closed down, there are 4,000 salesman forced to change jobs.

"In the 2008 peak of about 80 credit agency, but only about 12."

"The industry has more than 80% of sales are ethnic Chinese, most are not well educated, looking to switch to a monthly income of 3,000 to 4,000 ringgit is not easy."

Chen Hanguo also pointed out that since the government credit card services from the tax levy last year, Credit Card Holders from the 2009 peak of 960 million people in 2010 fell to 7.5 million as of June 2011, further reduced to 7.4 million .

In this year announced the following income limits RM3, 000 people who can not hold more than two cards of the measures, resulting in this period, 60% of credit card sales company closed down, there are 4,000 salesman forced to change jobs.

Translate from Google

http://www.sinchew.com.my/node/217455?tid=1

This post has been edited by bingozero: Feb 18 2012, 10:10 PM

Mar 18 2011, 02:39 PM, updated 13y ago

Mar 18 2011, 02:39 PM, updated 13y ago

Quote

Quote

0.1408sec

0.1408sec

0.26

0.26

6 queries

6 queries

GZIP Disabled

GZIP Disabled