Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

iSean

|

Dec 10 2024, 06:17 PM Dec 10 2024, 06:17 PM

|

|

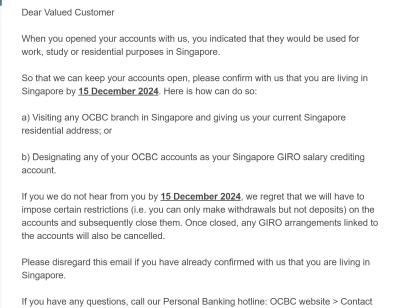

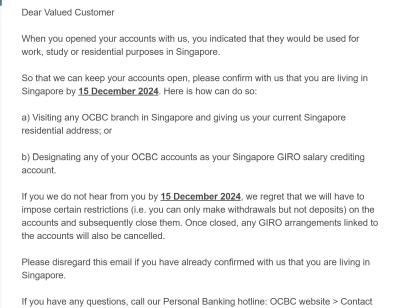

QUOTE(Xakiox @ Dec 10 2024, 04:35 PM) Managed to open ocbc account via app early this year but recently I got an email saying I need to provide sg address or the account will be closed. After reading your link, turns out this special convenience is for those foreigners planning to relocate to sg Dang it, guess I need to switch to maybank sg? Or any another option that doesn't require sg residential address?  I guess so. I also received this email today to my surprised. |

|

|

|

|

|

Medufsaid

|

Dec 11 2024, 10:08 AM Dec 11 2024, 10:08 AM

|

|

QUOTE (google translate) On December 10, it was revealed online that OCBC Bank of Singapore had begun cleaning up users living outside Singapore.

Some users reported receiving emails from the bank, which required them to go to the bank offline before December 15 to provide their Singapore address, or to use an OCBC Bank account to designate the account as the one for depositing their Singapore GIRO salary. QUOTE (google translate) Now everyone is talking about OCBC Singapore's withdrawal of Chinese users. They asked everyone to open an account before, but now they are withdrawing everyone 😅, which is very unethical.

This time OCBC Singapore's OCBC withdraws Chinese users. The first batch will end on December 15, and then on December 31. Very few users can delay until the end of January; what about the funds in the account?

He looked at the second picture and provided a temporary solution.

(Shared by Xiaohongshu users) https://youtu.be/X3KcEJonQ7gcan search by this keyword 新加坡华侨银行 This post has been edited by Medufsaid: Dec 11 2024, 10:23 AM |

|

|

|

|

|

privatequity

|

Dec 11 2024, 10:58 AM Dec 11 2024, 10:58 AM

|

|

QUOTE(iSean @ Dec 10 2024, 06:17 PM)  I guess so. I also received this email today to my surprised. how come i didn't receive? any other sg bank we can apply? |

|

|

|

|

|

john123x

|

Dec 11 2024, 12:01 PM Dec 11 2024, 12:01 PM

|

|

QUOTE(iSean @ Dec 10 2024, 06:17 PM)  I guess so. I also received this email today to my surprised. same, i got the email today |

|

|

|

|

|

Eugenet

|

Dec 11 2024, 12:34 PM Dec 11 2024, 12:34 PM

|

Getting Started

|

QUOTE(iSean @ Dec 10 2024, 06:17 PM)  I guess so. I also received this email today to my surprised. Are you mainland Chinese? The youtube video posted by Medufsaid seems to indicate it affect them only. I've not received any email yet. But it will bad because I still hold SG stocks and mutual funds invested via OCBC SG. |

|

|

|

|

|

john123x

|

Dec 11 2024, 01:21 PM Dec 11 2024, 01:21 PM

|

|

Hopefully, this isnt a MAS directive.

|

|

|

|

|

|

Medufsaid

|

Dec 11 2024, 01:28 PM Dec 11 2024, 01:28 PM

|

|

QUOTE(Eugenet @ Dec 11 2024, 12:34 PM) Are you mainland Chinese? malaysians also kena QUOTE(Eugenet @ Dec 11 2024, 12:34 PM) I still hold SG stocks and mutual funds invested via OCBC SG. nonetheless, can u ask OCBC sg if your account is also affected? perhaps investing something via OCBC sg will allow one to be exempted |

|

|

|

|

|

PseudomonasSA

|

Dec 11 2024, 02:24 PM Dec 11 2024, 02:24 PM

|

|

Received this email. Malaysian citizen with registered address in Malaysia. Opened OCBC SG a few months ago via the apps. Has anyone received anything similar? Attached thumbnail(s)

|

|

|

|

|

|

Mr Gray

|

Dec 11 2024, 05:59 PM Dec 11 2024, 05:59 PM

|

|

QUOTE(PseudomonasSA @ Dec 11 2024, 02:24 PM) Received this email. Malaysian citizen with registered address in Malaysia. Opened OCBC SG a few months ago via the apps. Has anyone received anything similar? Same. I've moved all my money to Maybank SG and CIMB SG |

|

|

|

|

|

Medufsaid

|

Dec 11 2024, 06:08 PM Dec 11 2024, 06:08 PM

|

|

QUOTE(Medufsaid @ May 26 2024, 01:41 PM) does MBB sg allow you to empty out to another bank acct? S$0 balance in MBB does MBB sg allow you to empty out everything to another bank acct? |

|

|

|

|

|

Mr Gray

|

Dec 11 2024, 06:20 PM Dec 11 2024, 06:20 PM

|

|

QUOTE(Medufsaid @ Dec 11 2024, 06:08 PM) Mr Gray does MBB sg allow you to empty out everything to another bank acct? No idea |

|

|

|

|

|

Gabriel03

|

Dec 11 2024, 07:52 PM Dec 11 2024, 07:52 PM

|

|

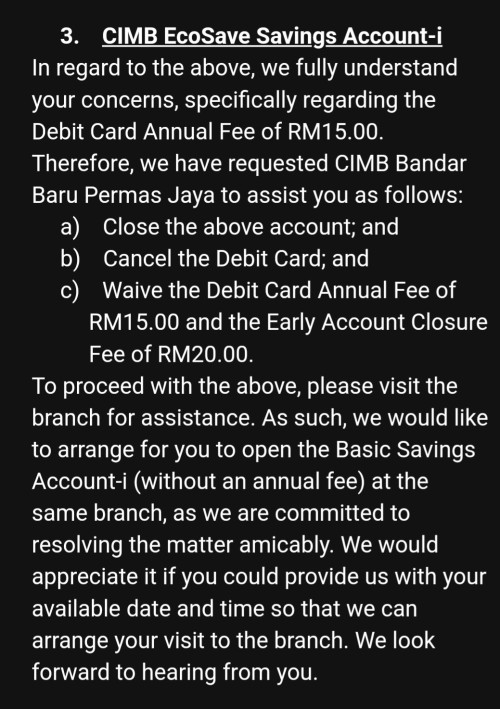

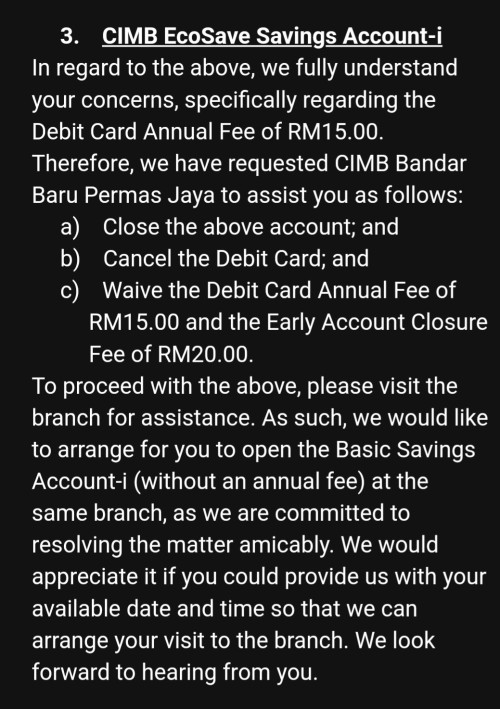

QUOTE(Gabriel03 @ Nov 18 2024, 11:36 PM) i didn't disclose my plans and didn't have CIMB SG account at the time of application at CIMB MY. Nowadays, opening bank account is not simple and they tend to ask about your employment. I said that I work in SG. That's all. She guessed my intention and used it as an excuse when I conforted her when my account was called Ecosave-i instead Basic Savings Account without Annual Fee. Even if I don't disclose my employment, I suspect that they will find another excuse. Anyway, what's done is done. I'll wait for CIMB MY's official response before submiting a complaint to BNM. At least, the others are aware and will be more alert when dealing with CIMB staffs. Finally, after one month, the problem is resolved. Initially, CqIMB CS didn't entertain me. I had to bring in BNM. At first, they were talking crap to hide things under the carpet with BNM in CCq. When I asked for written bank policy, then only they relented and tell the truth.   This post has been edited by Gabriel03: Dec 11 2024, 07:58 PM This post has been edited by Gabriel03: Dec 11 2024, 07:58 PM |

|

|

|

|

|

!@#$%^

|

Dec 11 2024, 07:58 PM Dec 11 2024, 07:58 PM

|

|

QUOTE(Gabriel03 @ Dec 11 2024, 07:52 PM) Finally, after one month, the problem is resolved. Initially, CqIMB CS didn't entertain me. I had to bring in BNM. At first, they were talking crap to hide things under the carpet with BNM in CCq. When I asked for written bank policy, then only they relented and tell the truth. what's the truth? |

|

|

|

|

|

Gabriel03

|

Dec 11 2024, 08:05 PM Dec 11 2024, 08:05 PM

|

|

QUOTE(!@#$%^ @ Dec 11 2024, 07:58 PM) CIMB Basic Savings Account without Annual Fee can be linked to CIMB Fastsaver SG. A month ago, I went to complete my online application for CIMB BSA without AF as it required me to present documents. The bank officer go and change the type of account to Ecosave without my knowledge. When I ask why she did it, she lied to me that BSA without AF cannot be linked to CIMB SG account. Probably, she has some quota to get people to sign up to that account as it comes with an annual fee of RM 15. This post has been edited by Gabriel03: Dec 11 2024, 08:25 PM |

|

|

|

|

|

poooky

|

Dec 12 2024, 07:20 AM Dec 12 2024, 07:20 AM

|

|

QUOTE(Gabriel03 @ Dec 11 2024, 08:05 PM) CIMB Basic Savings Account without Annual Fee can be linked to CIMB Fastsaver SG. A month ago, I went to complete my online application for CIMB BSA without AF as it required me to present documents. The bank officer go and change the type of account to Ecosave without my knowledge. When I ask why she did it, she lied to me that BSA without AF cannot be linked to CIMB SG account. Probably, she has some quota to get people to sign up to that account as it comes with an annual fee of RM 15. Wow, rm15 fee. The normal account is only rm8 a year. I also got konned decades ago when I opened my MBB and Cimb SA. Every year take rm8 each. Is it possible to open a BSA even though we already SA? Most likely will need to cancel all cards to relink it to BSA. |

|

|

|

|

|

Medufsaid

|

Dec 12 2024, 08:11 AM Dec 12 2024, 08:11 AM

|

|

poooky this is what i remember (might be wrong) - MBB Malaysia, you can ask them to change the account type of your savings account. not sure of any fees

- CIMB Malaysia, you cannot change any existing savings account to no-fees type. have to create a new BSA w/o fee

there's a reason why i never want to deal with CIMB unless i have to --update-- looks like 1 month ago, OCBC sg already revamped their opening account. you need proof of eventually staying in SG to open (passport alone is not enough anymore). not going to translate sorry https://youtu.be/kbuk9EAOugk so they were indeed planning this crackdown for some time This post has been edited by Medufsaid: Dec 12 2024, 09:47 AM

|

|

|

|

|

|

poooky

|

Dec 12 2024, 09:19 AM Dec 12 2024, 09:19 AM

|

|

QUOTE(Medufsaid @ Dec 12 2024, 08:11 AM) poooky this is what i remember (might be wrong)

- MBB Malaysia, you can ask them to change the account type of your savings account. not sure of any fees

- CIMB Malaysia, you cannot change any existing savings account to no-fees type. have to create a new BSA w/o fee

there's a reason why i never want to deal with CIMB unless i have to Thanks, going to try convert to BSA. If cannot, I'll try opening new BSA then closing SA. |

|

|

|

|

|

coolguy99

|

Dec 12 2024, 01:31 PM Dec 12 2024, 01:31 PM

|

|

QUOTE(Medufsaid @ Dec 12 2024, 08:11 AM) poooky this is what i remember (might be wrong)

- MBB Malaysia, you can ask them to change the account type of your savings account. not sure of any fees

- CIMB Malaysia, you cannot change any existing savings account to no-fees type. have to create a new BSA w/o fee

there's a reason why i never want to deal with CIMB unless i have to --update-- looks like 1 month ago, OCBC sg already revamped their opening account. you need proof of eventually staying in SG to open (passport alone is not enough anymore). not going to translate sorry https://youtu.be/kbuk9EAOugk so they were indeed planning this crackdown for some time Any idea if this is a directive from MAS? If so it is only time till other banks follow suit as well. |

|

|

|

|

|

Medufsaid

|

Dec 12 2024, 01:47 PM Dec 12 2024, 01:47 PM

|

|

looks like it didn't come from MAS QUOTE » Click to show Spoiler - click again to hide... « (Bloomberg) – Oversea-Chinese Banking Corp, Singapore’s second-largest lender, told some international clients to show proof of residence in the city state to avoid having their accounts shut, a signal of heightened scrutiny in the wake of a spate of money-laundering cases.

OCBC gave clients a deadline to confirm they are Singapore residents with verified addresses, or face service restrictions that could lead to account closures, according to notices sent by consumer financial services. A spokesperson for the bank verified the authenticity of the documents.

“For customers outside Singapore who are coming here to live, work or study, they can open their Singapore accounts remotely,” the spokesperson said. “Documentary proof of this residential status is therefore required.”

OCBC is among several banks caught in Singapore’s largest money-laundering case where some S$3 billion ($2.2 billion) in assets were seized from more than two dozens of Chinese people who resided in the city-state for years. Local authorities are bolstering measures to combat illicit flows that also include non-bank players from property agents to traders of precious stones and metals.

Two copies of the letter seen by Bloomberg News are in simplified Chinese characters – typically used in mainland China. One of the letters indicated a deadline of Dec. 15, while the other showed Dec. 31. Another copy is in English. The documents addressed customers who had previously told the bank the accounts would be used for their work, study or residential purposes in Singapore.

“Once the account is closed, any financial arrangement related to the this account will also be cancelled,” OCBC told clients in the Chinese version.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P. CIMB MBB still ok (and hopefully in the future) since they're limited to Malaysians only worse case scenario, i'll transfer stocks from IBKR back to Moomoo Malaysia (they currently have transfer-in promo) This post has been edited by Medufsaid: Dec 12 2024, 01:56 PM |

|

|

|

|

|

Medufsaid

|

Dec 12 2024, 01:47 PM Dec 12 2024, 01:47 PM

|

|

This post has been edited by Medufsaid: Dec 12 2024, 05:50 PM

|

|

|

|

|

Dec 10 2024, 06:17 PM

Dec 10 2024, 06:17 PM

Quote

Quote

0.0214sec

0.0214sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled