Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

PseudomonasSA

|

Aug 21 2023, 05:50 PM Aug 21 2023, 05:50 PM

|

|

Any good news from RHB Singapore? QUOTE(moonsatelite @ Aug 20 2023, 05:50 AM) RHB Bank SG Account Opening Documents Required: - Malaysian NRIC - Bank Statement (dated within the last 3 months) - A photo of your signature (just sign on a piece of white blank paper, the app will have a section for you to take a photo of it and upload) You WILL NOT receive any confirmation email that your application is pending, but..... the app does give false hopes in a way that it will allow you to create a username and login PIN *False hopes, don't know why the bank allows you to create an account even though you're just in the midst of having your application processed |

|

|

|

|

|

PseudomonasSA

|

Aug 23 2023, 06:28 PM Aug 23 2023, 06:28 PM

|

|

Thanks for the update. At least you tried QUOTE(moonsatelite @ Aug 23 2023, 10:45 AM) jerantut2011 Medufsaid alright, update time. already been 3 working days that i have no updates from RHB Singapore, so i decided to give them a call. Bad news, account opening requires a valid work/ student/ dependent pass Documents required as informed by the customer care officer. - Passport - Malaysian i.c - Valid proof of address and.... (repeat again) a valid work/ student/ dependent pass You are required to bring all these physical documents to any RHB Singapore branch to be verified welp... RHB Singapore isn't opening doors to Malaysians |

|

|

|

|

|

PseudomonasSA

|

May 20 2024, 04:23 AM May 20 2024, 04:23 AM

|

|

Hi Sifus

Wish to ask for advice about first deposit of SGD $1000 to verify new OCBC Singapore bank account.

1) If we send SGD via WISE in a direct conversion, the sender name will likely be WISE or its partner. So understandably, the verification shall fail.

2) However, now WISE offers an SGD account. WISE confirmed that any outgoing payments from the WISE SGD account will have our own names as "Sender Name". If we send first deposit from the Wise SGD account to OCBC Singapore, will this be acceptable? Has anyone had any experiences?

Have personally tried to send SGD From WISE SGD account to a friend's HSBC account - the "Sender Name" is indeed the same as WISE account holder name.

Thank you

This post has been edited by PseudomonasSA: May 20 2024, 04:23 AM

|

|

|

|

|

|

PseudomonasSA

|

May 20 2024, 05:57 AM May 20 2024, 05:57 AM

|

|

QUOTE(Medufsaid @ May 19 2024, 09:58 PM) PseudomonasSA do you have Maybank MY account? you can send via Duitnow Overseas Transfer. have to do 2 transfers like Yluxion did as there's a RM3k daily limit. first you link your phone number to PayNow in OCBC app. can guarantee that it's also cheaper than Wise then you follow this step to transfer from MBB MY via DuitNow Overseas Transfer Thank you so much! Can I link MY number to Pay now? Because I don't have a SG number |

|

|

|

|

|

PseudomonasSA

|

May 21 2024, 05:47 AM May 21 2024, 05:47 AM

|

|

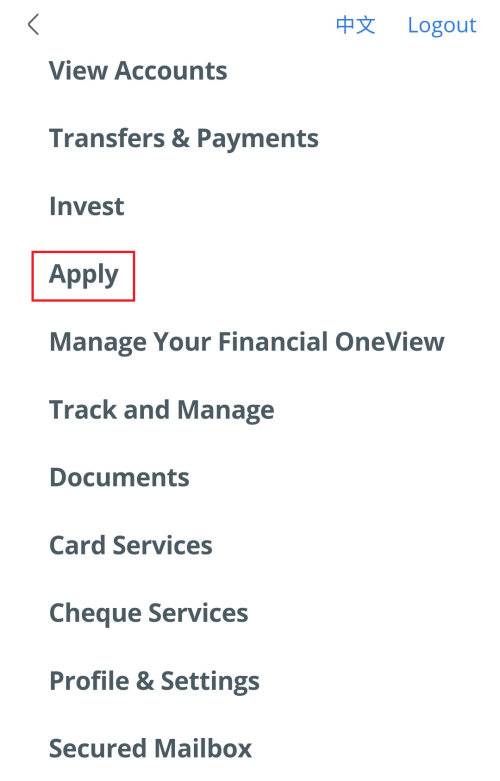

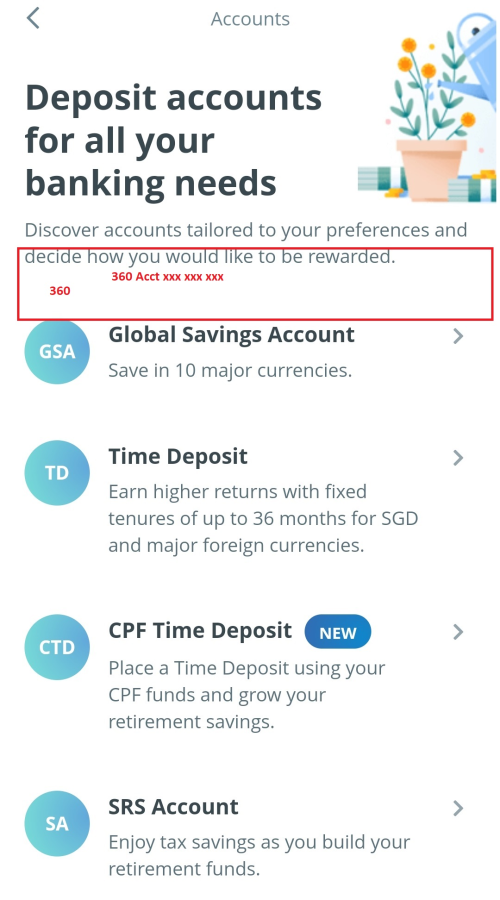

QUOTE(Medufsaid @ May 20 2024, 12:46 PM) manage to open OCBC Sg acct within hours on a Sunday. However, have to wait 12 hours after creating OCBC OneToken to add Payee. then wait 12 hours to send money to Payee. S$15 welcome gift received hours after deposit of S$1k, debit card also on the wayno way to generate on demand? How did you apply for the debit card? In the SG OCBC apps? Thank you |

|

|

|

|

|

PseudomonasSA

|

May 21 2024, 01:44 PM May 21 2024, 01:44 PM

|

|

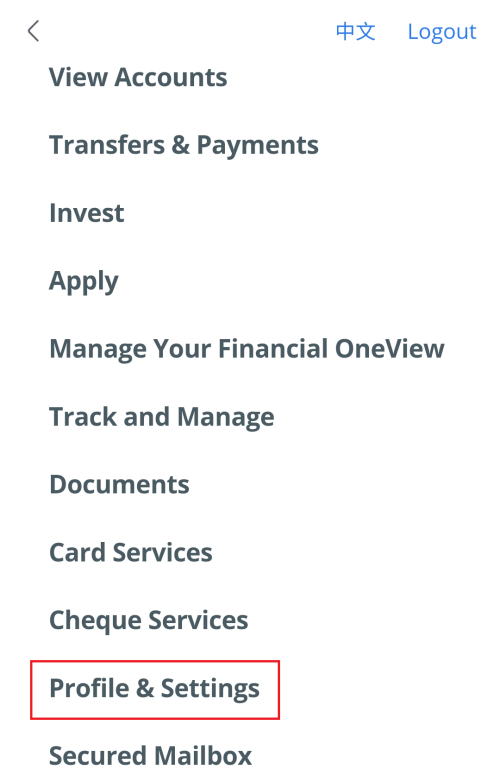

QUOTE(Medufsaid @ May 21 2024, 02:41 AM) PseudomonasSA you applied for 360 yet? after successfully applying 360 OCBC, try and probe around, there's an option to apply debit card I see. The debit card is only available for 360 account. Does the debit card have an annual fee? |

|

|

|

|

|

PseudomonasSA

|

May 26 2024, 05:02 AM May 26 2024, 05:02 AM

|

|

OCBC SG has quietly increased the monthly fee for non-residents to SGD 50 per month and minimum daily balance for waiver to SGD 25k.

These are astronomical numbers.

There is also no option to open the Monthly Savings Account in the apps for non-residents.

Looks like the OCBC SG account is only good for the first 12 months.

We can switch to the OCBC 360 which requires minimum SGD 3k but the bank can easily introduce a new fee of SGD 50 per month for non-residents.

This post has been edited by PseudomonasSA: May 26 2024, 05:03 AM

|

|

|

|

|

|

PseudomonasSA

|

Jun 10 2024, 05:41 AM Jun 10 2024, 05:41 AM

|

|

https://www.hsbc.com.sg/international/open-an-account/Looks like HSBC Singapore accepts customers residing overseas. Has anyone successfully applied for HSBC SG account from Malaysia?

|

|

|

|

|

|

PseudomonasSA

|

Jun 10 2024, 05:43 AM Jun 10 2024, 05:43 AM

|

|

QUOTE(coolguy99 @ May 19 2024, 07:45 AM) Has anyone tried to open HSBC SG account from malaysia? I'm curious too. The website suggests that it accepts applications from non residents |

|

|

|

|

|

PseudomonasSA

|

Jun 13 2024, 06:03 AM Jun 13 2024, 06:03 AM

|

|

Have an interesting question.

Are non residents able to buy life insurance policies in Singapore?

For example, Malaysians working in Malaysia.

Singaporean policies offer more protection per equivalent unit of premium paid

|

|

|

|

|

|

PseudomonasSA

|

Dec 11 2024, 02:24 PM Dec 11 2024, 02:24 PM

|

|

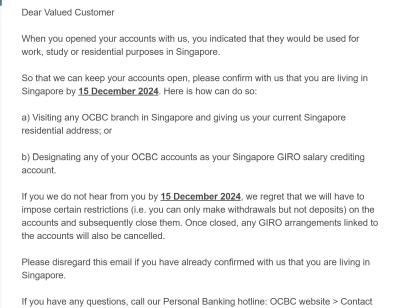

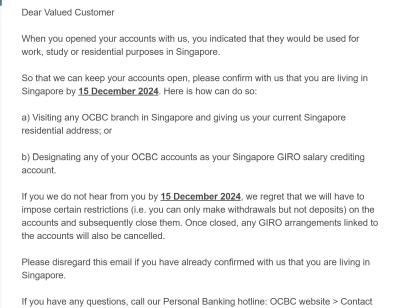

Received this email. Malaysian citizen with registered address in Malaysia. Opened OCBC SG a few months ago via the apps. Has anyone received anything similar? Attached thumbnail(s)

|

|

|

|

|

Aug 21 2023, 05:50 PM

Aug 21 2023, 05:50 PM

Quote

Quote

0.0269sec

0.0269sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled