QUOTE(katshi @ Oct 20 2024, 10:20 AM)

Hi everyone, i am looking to open an account in sg, preferrably with debit card, as I foresee frequent visit to sg. Also potentially future investment. I am currently working and staying in malaysia, without sg resident address. May I ask what are the options?

1. CIMB Fastsaver (no debit)

2. Maybank iSavvy Account

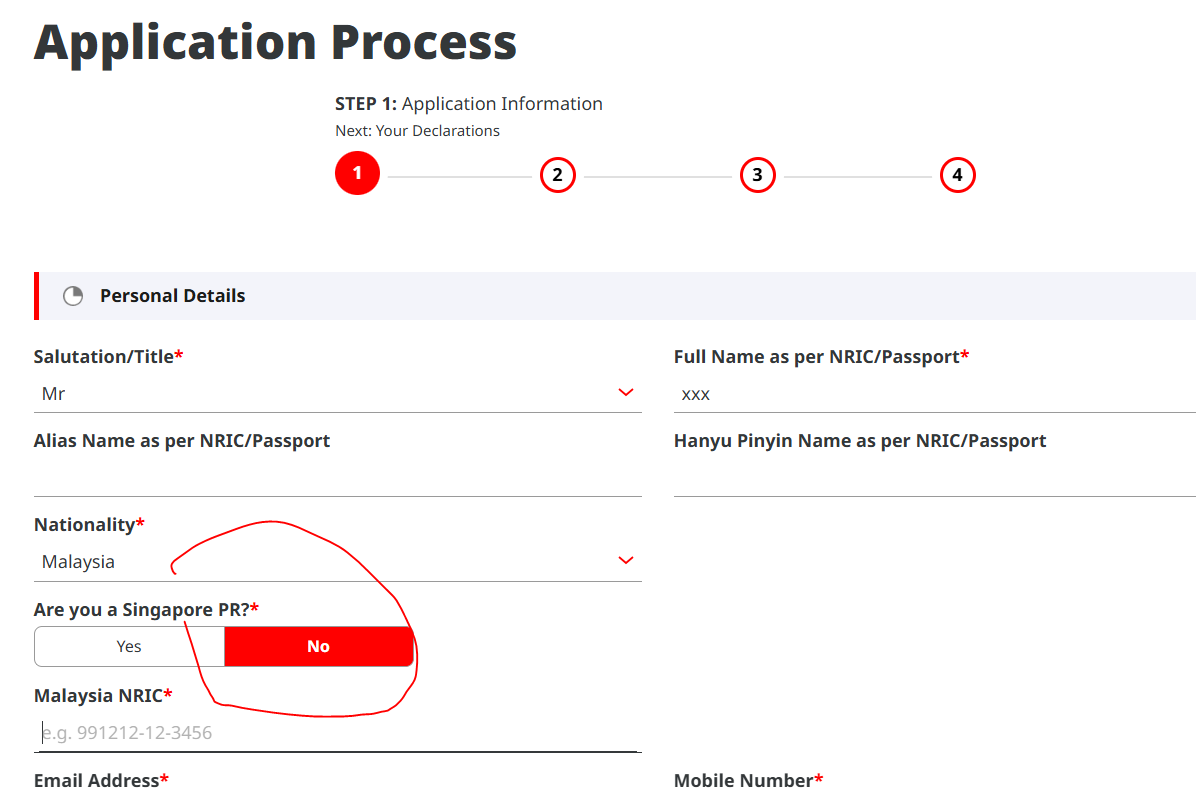

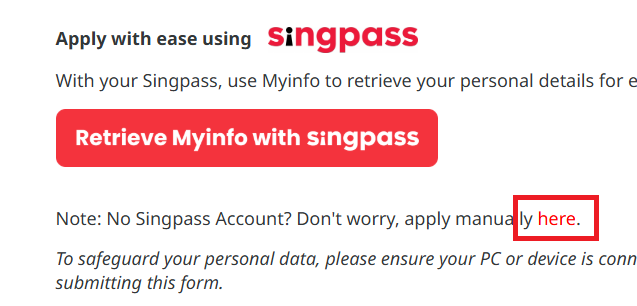

3. OCBC digital? (can?)

I am currently using wise to hold some sgd, while can use debit card for payment, i believe to withdraw money in sg got charges. May I know if these options valid or any other option? All these 3 banks I have account in Malaysia as well.

OCBC Digital currently offers lowest $1,000 minimum balance amount...

Apparently OCBC SG Recently restructured. Last time $20,000, otherwise if your account <$20k, $10 Fall Below Service Fees.

I opened a 360 Account, just for the sake of the Debit Card when I visited earlier this January. But I believe if you go to Singapore on a working weekday, the front desk don't mind to help you to get a Debit Card linked to the Statement Saving Account (STS/SSA), if you don't want to open a 360 Account.

Well, personally, I would say open another OCBC Savings Account without those "Fall Below Fees", because I feel parking $3k SGD doing nothing there, kinda defeats the purpose. Otherwise, park your money in Fullerton Money Market Fund or SG T-Bills.

This post has been edited by iSean: Nov 25 2024, 01:27 AM

Nov 23 2024, 09:26 PM

Nov 23 2024, 09:26 PM

Quote

Quote

0.0201sec

0.0201sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled