QUOTE(almeizer @ Sep 1 2010, 11:48 AM)

I think the guaranteed renewal is meant that insurance company will renew the policy regardless of the health condition of policy holder. Let's say the policy holder did not make any claim and the policy cover until 65, if guaranteed renewal until 65, meaning the company cannot terminate the policy until 65. Guaranteed renewal does not mean after you made claim but still can renew.

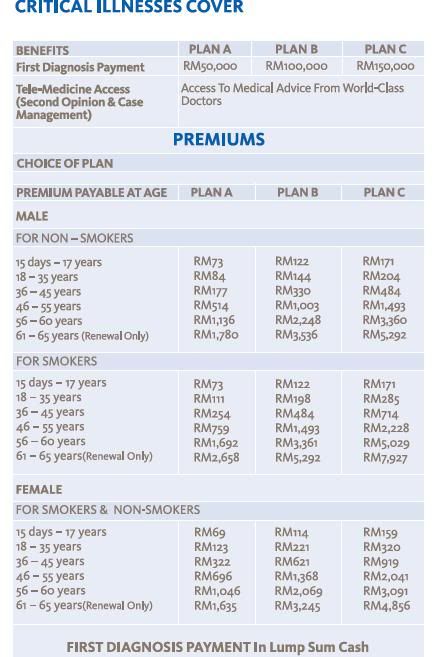

This is a pure C.I plan unlike health insurance plan i.e. medical card where its guaranteed renewable or conditional renewable. A lump sum is paid at first diagnosis when diagnosed with any one of the said illness, and when this sum is paid, the whole policy will be terminated and when terminated, there is no point to renew.

Added on September 1, 2010, 2:50 pmQUOTE(happy_gal @ Sep 1 2010, 12:07 PM)

btw, for those ING, Prudential, can u guys send me a quotation on only the critical illness and female illness only?..

coverage till about 80-90 lah... bt then i want to pay less then 200 per month..

hehehe... im doing a lot of comparison here

Frankly, as I see ur case, you shouldn't have compare anymore. Just apply to all insurance companies out the be it ING, Pru, Hong Leong, Allianz, AIA, Manulife or any u can name off at RM 200/mth (ur budget) because of ur health condition that is excluded by GE during ur 1st application. See which company can provide u with the less exclusion. Now u compare this and that, and if u can find a best policy, that insurance company might impose alot of exclusion or loading to u especially when u buy women illness and Critical illness because u had a surgery as u mentioned before.

I am not trying to be harsh here, but i'm just speaking the true fact. THanks

This post has been edited by chew_ronnie: Sep 1 2010, 02:50 PM

Aug 25 2010, 06:03 PM

Aug 25 2010, 06:03 PM

Quote

Quote

0.0251sec

0.0251sec

0.50

0.50

6 queries

6 queries

GZIP Disabled

GZIP Disabled